Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Mawson Infrastructure Reports Full Year 2022 Financial Results; Select Financial Highlights for FY 2022 compared to FY 2021

- Record revenue of $84.3 Million, up 92%

- Record gross profit of $36.6 Million, up 8%

- Record non-GAAP EBITDA of $30.4 Million, up 70%

- Record hosting revenue of $13.3 Million, up 1464%

- New revenue stream from energy markets of $13.7 Million

- Record 1343, Self-mined Bitcoin produced in FY 2022 up 66%

SHARON, Pa. / Mar 23, 2023 / Business Wire / Mawson Infrastructure Group Inc. (NASDAQ: MIGI) (“Mawson”), a digital infrastructure provider, reports financial results and highlights for the fourth quarter and full year ended December 31, 2022.

Q4 2022 Financial and Business Highlights

- Revenue of $16.8 million

- Gross profit of $10.1 million

- Non-GAAP EBITDA of $7.5 million

- Sold Georgia facility for $40.0 million1 (“Georgia Sale”)

Full Year 2022 Financial and Business Highlights

- Record revenue of $84.3 million compared to $43.8 million in 2021, up 92%

- Record gross profit of $36.6 million, compared to $33.9 million in 2021, up 8%

- Record non-GAAP EBITDA of $30.4 million, compared to $17.9 million in 2021, up 70%

- Reduction of Selling, General and Administrative (SGA) expenses by 37% from first half to second half of FY22 ($15.9m to $10m)

- Continued the 100 MW Bitcoin mining facility expansion in Midland, Pennsylvania.

- Started construction on 120 MW Bitcoin mining facility in Sharon, Pennsylvania

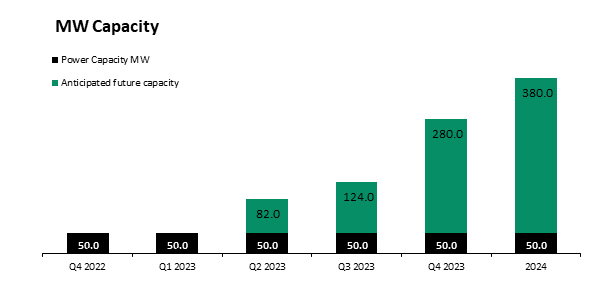

- Total infrastructure capacity of available energy at Bitcoin mining facilities reaches 220 megawatts in 2022

- Co-location hosting business generated $13.3 million revenue in 2022, up 1464%

- Energy Markets Revenue of $13.7 million revenue, gross profit of 91%

Corporate Developments Subsequent to Year End

- Expanded the Midland facility with an additional 20 MW to a 120 MW capacity, for a total combined capacity of 240 MW in Pennsylvania capable of operating up to 8 EH.

- Commenced construction of the new 120 MW Sharon, PA facility, with 12 MW onsite ready for energisation in Q2, 2023.

- Transferred all Australian miners to USA to continue Mawson’s new focus in the PA region. Completed operational exit from Australia.

- Mawson received all CleanSpark, Inc (“CLSK”) common shares payable to it from the Georgia Sale and has liquidated approximately 90% of that stock to cash.

- Entered a contract for the sale of Mawson’s Texas facility and assets, with deposit received.

- Entered an exclusivity arrangement for 24 MW Ohio facility on long term lease.

- Submitted a Letter of Intent (LOI) for purchase of an 18 MW Ohio facility.

2023 Strategic Focus

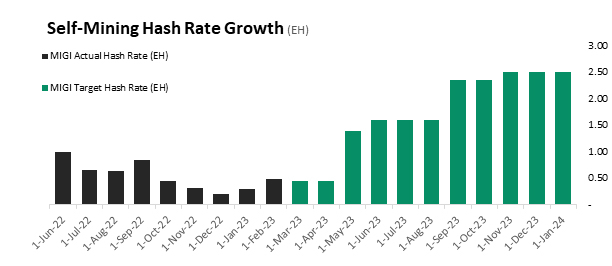

- Expansion of Bitcoin Self-Mining and Hosting Co-location operations to 4.5 Exahash by early Q2, 2023 and to our projected 8.0 Exahash by Q4, 2023.2

- Continue the expansion of its 240-megawatt Pennsylvania facilities where the company has strategic relationships, favorable energy contracts and expansion opportunities.

- Continue with its market leading Energy Markets Program, which creates additional high margin revenue and reduces overall costs of production.

- Continue to secure a portfolio of sites in preferred geographies and jurisdictions for long term digital infrastructure capacity.

- Develop strategic partnerships and relationships with suppliers, customers and communities.

- Continue to offer quality hosting services to miners in addition to increasing self-mining capacity.

James Manning, CEO and Founder of Mawson Infrastructure, said, “2022 was a pivotal year for the Mawson team. We simultaneously expanded our large scale and low cost Pennsylvania facilities - which today stand at 240MW of capacity or approximately 8 Exahash of computing power - and also completed the sale of one of our non-core facilities to CleanSpark for $40M. We intend to expand our Pennsylvanian facilities with a mixture of self-mining and hosting throughout 2023 and into 2024. Our infrastructure first approach to the industry has proven itself in real time. We and look forward to sharing more information on our further expansions in Q2.“

About Mawson Infrastructure

Mawson Infrastructure Group Inc (NASDAQ: MIGI) is a digital infrastructure provider, with multiple operations throughout the USA and Australia. Mawson’s vertically integrated model is based on a long-term strategy to promote the global transition to the new digital economy. Mawson matches sustainable energy infrastructure with next-generation Mobile Data Center (MDC) solutions, enabling low-cost Bitcoin production and on-demand deployment of infrastructure assets. With a strong focus on shareholder returns and an aligned board and management, Mawson Infrastructure Group Inc is emerging as a global leader in ESG focused Bitcoin mining and digital infrastructure.

For more information, visit: www.mawsoninc.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Mawson cautions that statements in this press release that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon Mawson’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility that Mawson’s need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility in the value and prices of cryptocurrencies and further or new regulation of digital assets. More detailed information about the risks and uncertainties affecting Mawson is contained under the heading “Risk Factors” included in Mawson’s Annual Report on Form 10-K filed with the SEC on March 23, 2023, and Mawson’s Quarterly Report on Form 10-Q filed with the SEC on August 22, 2022, November 14, 2022 and in other filings Mawson has made and may make with the SEC in the future. One should not place undue reliance on these forward-looking statements, which speak only as of the date on which they were made. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Mawson undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as may be required by law.

1 Assumes maximum earn outs are achieved, no adjustments are made to the purchase price, and uses the CleanSpark, Inc. stock price as at October 7, 2022, and rounding. The actual proceeds from the transaction in the 10k may differ due to actual stock sale proceeds and stock revaluation.

2 Based on the continued development of the Midland and Sharon facilities to their maximum capacity.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$4.49 |

| Daily Change: | 0.09 2.05 |

| Daily Volume: | 44,108 |

| Market Cap: | US$5.120M |

November 14, 2025 October 17, 2025 September 17, 2025 | |