Marathon Digital Holdings, Inc. (NASDAQ:MARA) ("Marathon" or "Company"), one of the largest enterprise Bitcoin self-mining companies in North America, today published unaudited bitcoin (“BTC”) production and miner installation updates for June 2021.

Corporate Highlights as of July 1, 2021

Bitcoin Production Update

As of July 1, 2021, Marathon’s mining fleet has produced approximately 846 newly minted bitcoins during 2021. By month, the Company’s bitcoin production was as follows:

As a result, Marathon currently holds approximately 5,784 BTC, including the 4,812.66 BTC the Company purchased in January 2021 for an average price of $31,168 per BTC. On July 1, 2021, the fair market value of one bitcoin was approximately $34,855, implying that the approximate fair market value of Marathon’s current bitcoin holdings is approximately $201.6 million.

Miner Installations and Hashrate Growth

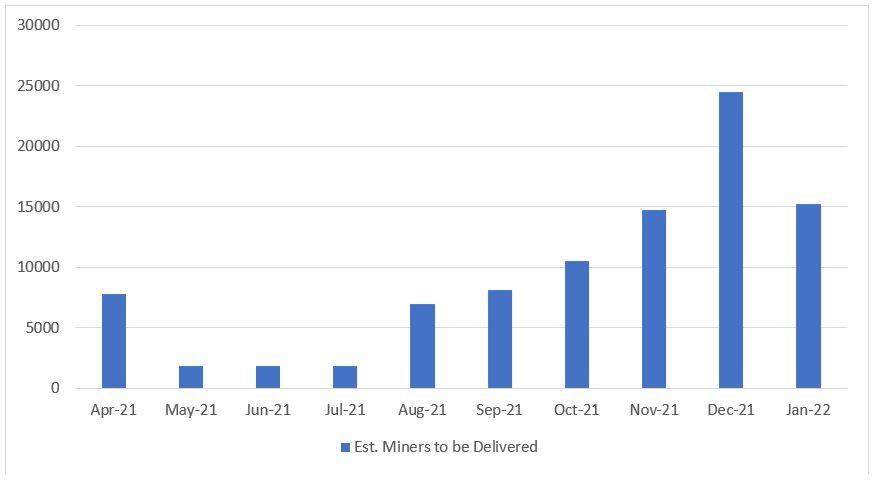

During June, Marathon completed construction of the remaining containers which will house approximately two-thirds the Company’s mining rigs at its facility at Hardin, MT. The balance of the miners will be housed in a new structure currently under construction. All containers at Hardin have been built out and are ready to receive new miners according to previously released delivery schedules of 1,800 in July, 7,000 in August and the final tranche of approximately 3,200 in September, after which, the Company will commence installing its remaining 73,000 miners at a new 300-megawatt facility in Texas, hosted by Compute North.

As of July 1, 2021, Bitmain has delivered approximately 18,702 S-19 Pro ASIC miners to the Company’s mining facility in Hardin, MT, all of which were delivered on time and as scheduled. During the month of June, Marathon installed 1,740 new miners, increasing the Company’s active mining fleet to approximately 19,395 miners, generating approximately 2.09 EH/s.

New miners continue to be installed on a daily basis. Based on current delivery and installation schedules, Marathon continues to expect all previously purchased miners to be fully installed by the end of the first quarter of 2022, at which point, the Company’s mining fleet will consist of approximately 103,120 miners, generating approximately 10.37 EH/s.

As of June 30, 2021, 1,056 miners have been received or are in transit, with the balance expected in July due to global logistics delays. Future deliveries are expected as originally scheduled.

Management Commentary

“In June, we produced 265.6 bitcoins, which is a 17% increase from the 226.6 bitcoins we produced in May, and we increased our hashrate to 2.09 EH/s after installing another 1,740 miners,” said Fred Thiel, Marathon’s CEO. “We also completed building and preparing the remaining containers which will house our mining rigs in Hardin, MT. As a result, we are well positioned to receive and install the remaining miners at Hardin before turning our attention to the new facility in Texas, which will house the majority of our miners and which will be 100% carbon neutral.

“May, June, and July are slower delivery months as the majority of our miners are expected to be delivered this fall. We are therefore taking advantage of this opportunity to proactively perform maintenance and upgrades on a portion of our existing containers and systems before delivery schedules accelerate and to prepare for the expected decrease in global hashrate. These preparatory actions resulted in some of our miners being offline during June, temporarily decreasing our hashrate. However, we still increased our bitcoin production month over month, and we are now better prepared to receive the large upcoming shipments and take advantage of expected favorable mining conditions.

“Given our current delivery schedule and the macro events affecting the global network hashrate, Marathon remains particularly well positioned to scale and thrive in the current mining environment.”

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described under "Risk Factors" in Item 1A of our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2020. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network-wide mining difficulty rate or Bitcoin hashrate may also materially affect the future performance of Marathon's production of Bitcoin. Additionally, all discussions of financial metrics assume mining difficulty rates as of July 2021. See "Safe Harbor" below.

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company's Annual Reports on Form 10-K, as may be supplemented or amended by the Company's Quarterly Reports on Form 10-Q. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

About Marathon Digital Holdings

Marathon is a digital asset technology company that mines cryptocurrencies with a focus on the blockchain ecosystem and the generation of digital assets.

Marathon Digital Holdings Company Contact:

Jason Assad

Telephone: 678-570-6791

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | US$10.79 |

| Daily Change: | 0.09 0.84 |

| Daily Volume: | 11,749,526 |

| Market Cap: | US$4.080B |

November 04, 2025 October 03, 2025 August 25, 2025 August 11, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS