Winnipeg. Manitoba--(Newsfile Corp. - December 20, 2023) - Snow Lake Resources Ltd., d/b/a Snow Lake Lithium™ (NASDAQ: LITM) ("Snow Lake" or the "Company") is pleased to announce that it has entered into a binding letter of intent ("LOI") with ACME Lithium Ltd. ("ACME Lithium") to acquire a 90% undivided interest in a group of mineral claims 100% owned by ACME that adjoin the Tanco lithium mine in Southern Manitoba (the "Project").

Highlights

CEO Remarks

"We are extremely pleased to have entered into this letter of intent with ACME Lithium Ltd. for a large, highly prospective land position immediately adjacent to the Tanco Mine," commented Frank Wheatley, CEO of Snow Lake. He continued: "This agreement with Acme Lithium reflects our disciplined approach to expanding our portfolio of Manitoba lithium projects to complement our Snow Lake Lithium™ project."

Agreement to Acquire Mineral Claims Adjacent to Tanco Mine

Snow Lake and ACME Lithium have entered into a binding letter of intent (the "LOI") with respect to 37 mineral claims 100% owned by ACME Lithium with 31 that adjoin the southern boundary of the Tanco lithium mine in Southern Manitoba.

The project (the "Shatford Lithium Project") consists of the following mineral claims:

Key terms of the LOI are included in Appendix A.

Shatford lake Project

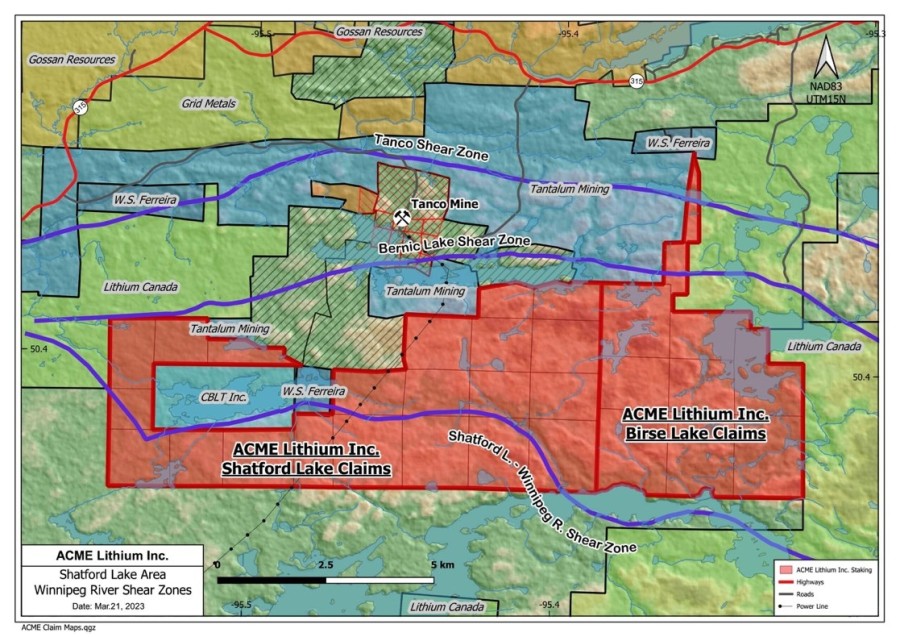

The Shatford Lake and Brise Lake mineral claims are set forth on the map below:

The Cat Lake / Euclid Lake mineral claims are set forth on the map below:

Geological Setting of Shatford Lithium Project

The Shatford Lithium Project straddles a 15 kilometers long structural trend of the Greer-Shatford Shear Zone with numerous pegmatite dykes and favorable host rocks. It is situated in the southern limb of the Bird River greenstone belt in southeastern Manitoba. The region hosts hundreds of individual pegmatite bodies, many of which are classified as complex rare-element Lithium-Cesium-Tantalum (LCT) pegmatites — known to account for a quarter of the world's lithium production.

The northeast corner of the Shatford Lithium Project borders the mineral lease of the Tanco mine, with the Buck, Pelgi, and Dibs pegmatites nearby.

Proposed Work Program

Snow Lake intends to build upon the prior work undertaken by ACME Lithium on the Project, and its immediate focus will be to undertake a detailed review of all data, samples, assays and reports prepared by ACME Lithium. Upon completion of that review, Snow Lake will design an exploration program to both build upon ACME Lithium's work, and to undertake a regional exploration program over the balance of the Project to identify potential drill targets.

Snow Lake also intends to use the services of Critical Discoveries to assist in reviewing ACME Lithium's exploration data, as well as to provide input to the development of the 2024 exploration program on the Shatford Lithium Project.

Tanco Mine

Tantalum Mining Corporation of Canada Ltd. ("Tanco") is 100% owned and operated by Sinomine (Hong Kong) Rare Metals Resource Co., and operates the Tanco mine located on the northwest shore of Bernic Lake, Lac du Bonnet, Manitoba. The Tanco mine pegmatite orebody was discovered in the late 1920's and the Tanco mine has been in commercial operation producing lithium in Manitoba for more than 50 years. In addition to lithium concentrate for the lithium battery market, the Tanco mine produces cesium-based products for the North American market.

More Information

For more information on ACME Lithium, refer to their website at www.acmelithium.com.

For more information on Tanco, refer to their website at www.tancomine.com.

About Snow Lake Resources Ltd.

Snow Lake is a Canadian lithium development company listed on NASDAQ: LTIM with 2 hard rock lithium projects, the Thompson Brothers project and the Grass River project (together the "Snow Lake Lithium™ Project"), in the Snow Lake region of Northern Manitoba. Snow Lake is focused on advancing the Snow Lake Lithium™ Project through subsequent phases of development and into production in order to supply the North American electric vehicle and energy storage markets.

The wholly owned Snow Lake Lithium™ Project now covers a 59,587 acre site that has only been 1% explored and contains an identified-to-date 8.2 million metric tonnes measured, indicated and inferred resource at between 0.99% and 1.13% Li2O.

Forward-Looking Statement

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the "safe harbor" provisions under the Private Securities Litigation Reform Act of 1995. that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements, including without limitation statements with regard to Snow Lake Lithium™. We base these forward-looking statements on our expectations and projections about future events, which we derive from the information currently available to us. Forward-looking statements contained in this press release may be identified by the use of words such as "anticipate," "believe," "contemplate," "could," "estimate," "expect," "intend," "seek," "may," "might," "plan," "potential," "predict," "project," "target," "aim," "should," "will," "would," or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward- looking statements are based on Snow Lake Resources Ltd.'s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Some of these risks and uncertainties are described more fully in the section titled "Risk Factors" in our registration statements and annual reports filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Snow Lake Resources Ltd. undertakes no duty to update such information except as required under applicable law.

For more information, please contact:

Investors: This email address is being protected from spambots. You need JavaScript enabled to view it.

Media: This email address is being protected from spambots. You need JavaScript enabled to view it.

Twitter: @SnowLakeLithium

www.SnowLakeLithium.com

Schedule A — Key Terms of the Agreement

Snow Lake and ACME Lithium have entered into a binding letter of intent ("LOI") on the following key terms and conditions.

1. Project: The Shatford Lithium Project, located in Southern Manitoba, consists of 37 mineral claims 100% owned by ACME Lithium and described in Schedule B.

2. Letter of Intent: Snow Lake and ACME Lithium have entered into the LOI, which provides:

3. Option

ACME Lithium will grant Snow Lake the option (the "Option") to earn up to a 90% undivided interest in the Shatford Lithium Project upon the following terms and conditions:

a) First Stage Option

Snow Lake will have the option (the "First Stage Option") to earn a 51% undivided interest in the Shatford Lithium Project upon:

b) Second Stage Option

After exercise of the First Stage Option, Snow Lake will have the option (the "Second Stage Option") to earn an additional 39% undivided interest in the Shatford Lithium Project upon:

Any expenditures incurred by Snow Lake in excess of the minimum expenditures required to exercise the First Stage Option will be credited or carried forward against the expenditure commitment for the Second Stage Option.

4. Formation of Joint Venture

Once Snow Lake has earned a 90% undivided interest in the Shatford Lithium Project, and completed a positive feasibility study on the Shatford Lithium Project, a joint venture (the "Joint Venture") between Snow Lake and ACME Lithium will be formed for the further development of the Shatford Lithium Project, the detailed market standard terms and conditions of which will be agreed at the time of formation of the joint venture.

5. Interests in Joint Venture

Upon formation of the Joint Venture:

6. Right of First Refusal

Once the Option Agreement is signed, Snow Lake will have a right of first refusal (the "ROFR") to acquire ACME Lithium's 10% free carried interest in the Shatford Lithium Project if ACME Lithium decides to dispose of its interest in the Shatford Lithium Project pursuant to an unsolicited bona fide third-party offer.

7. Royalty

The Euclid-Cat Lake and Shatford Lake mineral claims are subject to a 2% gross overriding royalty on lithium or other metals in favour of Lithium Royalty Corporation.

Schedule B — Mineral Claims

| CLAIM NAME | NUMBER | DATE | HECTARES | EVENT # |

| ACME 1 | MB13931 | SEPT16/21 | 256 | 522669 |

| ACME 2 | MB13932 | SEPT16/21 | 247 | 522658 |

| ACME 3 | MB13933 | SEPT17/21 | 168 | 522667 |

| ACME 4 | MB13934 | SEPT18/21 | 152 | 522671 |

| ACME 5 | MB13935 | SEPT18/21 | 139 | 522668 |

| ACME 6 | MB13936 | SEPT17/21 | 220 | 522672 |

| ACME 7 | MB13937 | SEPT22/21 | 180 | 522830 |

| ACME 8 | MB13938 | SEPT22/21 | 132 | 522840 |

| ACME9 | MB13939 | SEPT21/21 | 92 | 522841 |

| ACME 10 | MB13940 | SEPT21/21 | 120 | 522831 |

| ACME 11 | MB13941 | SEPT23/21 | 182 | 522832 |

| ACME 12 | MB13942 | SEPT23/21 | 156 | 522842 |

| ACME 13 | MB13943 | SEPT24/21 | 208 | 522843 |

| ACME 14 | MB13944 | SEPT24/21 | 140 | 522833 |

| ACME 15 | MB13945 | SEPT25/21 | 248 | 522834 |

| ACME 16 | MB13946 | SEPT25/21 | 192 | 522844 |

| ACME17 | MB13947 | SEPT26/21 | 163 | 522845 |

| ACME 18 | MB13928 | OCT 1/21 | 210 | 522846 |

| ACME 19 | MB13949 | SEPT29/21 | 192 | 522847 |

| ACME 20 | MB13950 | SEPT30/21 | 240 | 522848 |

| ACME 21 | MB13951 | SEPT29/21 | 192 | 522835 |

| ACME 22 | MB13952 | SEPT30/21 | 240 | 522836 |

| ACME 23 | MB13953 | SEPT26/21 | 142 | 522837 |

| ACME 24 | MB13954 | SEPT28/21 | 160 | 522849 |

| ACME 25 | MB13955 | SEPT28/21 | 160 | 522838 |

| ACME 26 | MB13926 | SEPT27/21 | 111 | 522850 |

| ACME 27 | MB13927 | SEPT27/21 | 135 | 522839 |

| ACME 27 | MB13927 | SEPT27/21 | 135 | 522839 |

| ACME 28 | MB14707 | MAR14/23 | 256 | 549435 |

| ACME 29 | MB14708 | MAR14/23 | 182 | 549436 |

| ACME 30 | MB14709 | MAR14/23 | 64 | 549437 |

| ACME 31 | MB14704 | FEB06/23 | 224 | 546505 |

| ACME 32 | MB14705 | FEB10/23 | 234 | 547020 |

| ACME 33 | MB14706 | MAR14/23 | 245 | 549430 |

| ACME 34 | MB14701 | MAR14/23 | 239 | 549431 |

| ACME 35 | MB14702 | MAR14/23 | 247 | 549434 |

| ACME 36 | MB14703 | FEB06/23 | 256 | 546503 |

| ACME 37 | MB14710 | MAR14/23 | 140 | 549438 |

| Last Trade: | US$3.51 |

| Daily Change: | -0.06 -1.74 |

| Daily Volume: | 874,760 |

| Market Cap: | US$63.250M |

December 23, 2025 December 22, 2025 December 15, 2025 December 08, 2025 October 21, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS