Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Largo Announces Results of an Updated Life of Mine Plan and Pre-Feasibility Study for its Vanadium-Titanium Operation in Brazil: 67% Increase in Mineral Reserves, 64% Increase in Mineral Resources, 31-Year Mine Life with US$1.1 Billion NPV7% Estimate

- All amounts expressed are in U.S. dollars, denominated by “$”.

TORONTO / Oct 28, 2024 / Business Wire / Largo Inc. ("Largo" or the "Company") (TSX: LGO) (NASDAQ: LGO) is pleased to report a significant increase in Mineral Reserves, Mineral Resources and mine life as part of results from an updated Life of Mine Plan (“LOMP”) and Pre-Feasibility Study completed on the Company’s vanadium-titanium Maracás Menchen operation (the “Project”) located in Bahia State, Brazil. An independent technical report (the "2024 Technical Report") is being prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") for the Company by GE21 Consultoria Mineral Ltda. (“GE21”) and will be filed on SEDAR+ within 45 days of this news release.

2024 Life of Mine Plan and Pre-Feasibility Study Highlights

- Large Scale Vanadium/Titanium Project – Increased Mine Life to 2054: Total operating mine life for the Project of 31 years, representing an increase of 13 years in mine life as compared to the parameters set forth in the Company’s 2021 technical report, titled An Updated Life of Mine Plan for Campbell Pit and Pre-Feasibility Study for GAN and NAN Deposits, dated December 16, 2021 (the “2021 Technical Report”)

- Strong Economics Outlined over Project Life Including Additional TiO2 Pigment Production Upside Opportunity: Post-tax NPV7% of $1.1 billion, post-tax life-of-mine (“LOM”) cash flow of $3.8 billion, reflecting the weighted average long-term forecast prices of $9.00/lb vanadium pentoxide (“V2O5”) (inclusive of high purity premium), $222.05/tonne ilmenite concentrate, $4040.05/tonne titanium dioxide (“TiO2”) pigment and $5.10 USD/BRL exchange rate

- Robust and Reliable Supply of Critical Materials through Outlined Operational Scenarios: Total LOM V2O5 equivalent production of 346.6 kt, ilmenite concentrate production of 7,766.6 kt and TiO2 pigment production opportunity of 2,499 kt

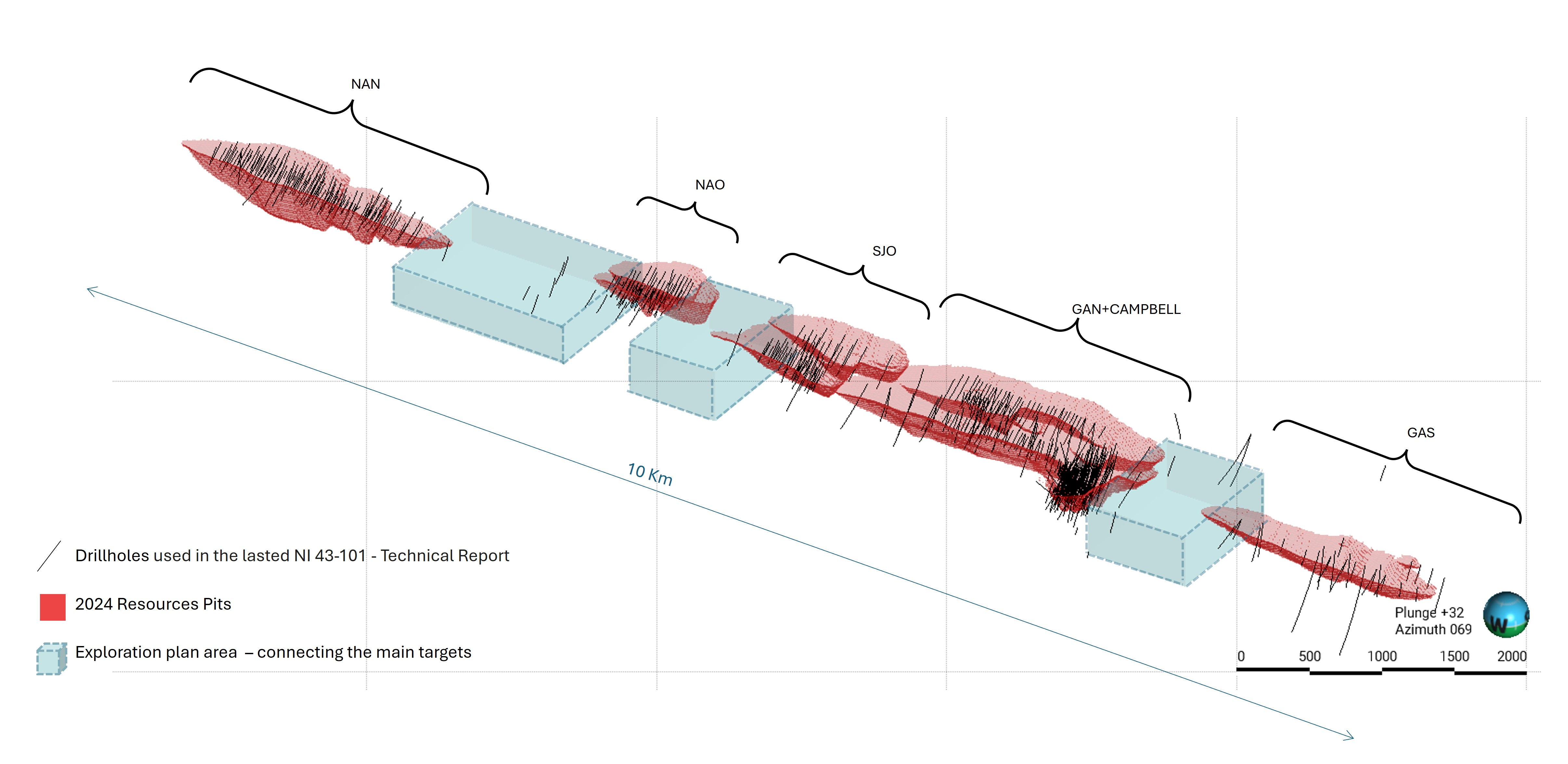

- Supported by a Significant Increase in Mineral Reserves over 2021 Technical Report Results Following Inclusion of the Novo Amparo Oeste (“NAO”) and São Jose (“SJO”) Deposits: Total Proven and Probable Reserves of 101.03 mt grading 0.56% V2O5, yielding 2.16% V2O5 in magnetic concentrate for 435.31 kt of contained V2O5 in magnetic concentrate and head grade of 7.52% TiO2 for 6,890.99 kt of contained TiO2` in non-magnetic concentrate; representing a 67% increase in total Mineral Reserves, 16% increase in V2O5 contained metal, 54% increase in TiO2 contained metal, 29% decrease in V2O5 head grade, 15% decrease in V2O5 in magnetic concentrate, 9% decrease in TiO2 head grade

- Substantial Increase Mineral Resources over 2021 Technical Report – Upgrade of Measured and Indicated Resources from Campbell, Gulçari A Norte (“GAN”) and Novo Amparo Norte (“NAN”), and Indicated Resources from SJO, NAO Deposits: The total 2024 Measured and Indicated Resources of 104.78 mt grading 0.62% V2O5 and 8.31% TiO2 for 653.54 kt of contained V2O5 in situ and 8707.50 kt of contained TiO2` in situ, 64% increase in total Mineral Resources, 29% increase in V2O5 contained metal, 66% increase in TiO2 contained metal, 22% decrease in V2O5 head grade, 1% increase in TiO2 head grade

- Future Growth Opportunities: The 2024 Technical Report outlines several additional studies in progress meant to improve future results of the Company, including new resource base and exploration potential of the Campbell Pit-Gulcari A South (“GAS”) connection, located approximately 800 meters from the Campbell Pit, the evaluation and exploration of precious group metals (“PGMs”) at the Project, the improvement of magnetite quality in its operations and the increase of the Company’s TiO2 grade in its flotation feed

Daniel Tellechea, Interim CEO and Director of Largo, stated: “The results of our 2024 Technical Report clearly showcase the long-term potential of the Maracás Menchen vanadium and titanium operation and reaffirm Largo’s position as a secure and reliable supplier of critical materials for the future in the Americas. Over the past three years, our geology and operations teams have made significant progress in advancing the Company’s exploration and project planning, expanding both Mineral Reserves and Resources, which has extended mine life by an additional 13 years over Largo’s previous 2021 Technical Report. While head grades have decreased following the addition of new ore deposits and further understanding and interpretation of the Company’s ore bodies, this knowledge will allow us to better optimize our production plan going forward and maximize long-term resource planning and extraction. Additionally, the economic scenarios presented in the 2024 Technical Report, including a post-tax NPV7% of $1.1 billion and undiscounted accumulated cash flows of $3.8 billion over the life of the Project, demonstrate the Project’s ability to generate sustainable value subject to the outlined CAPEX and cost scenarios."

He continued: "In the long-term, we see growing demand for our products, particularly Largo’s high-quality vanadium, as industries and governments increasingly prioritize energy storage and the development of advanced technologies, particularly in the aerospace sector. Largo is well-positioned to meet this demand, with a significant resource base to support future production scenarios. Additional growth projects such as implementing a TiO2 pigment production in Camaçari, along with ongoing exploration at the Campbell-GAS connection and platinum-palladium exploration opportunities are expected to enhance overall results at the Company. These initiatives, combined with the outlined expansion scenarios, present a solid plan to strengthen Largo’s role as a key player in the vanadium and titanium markets, meeting the critical material needs of a transitioning global economy.”

Updated Vanadium/Titanium Project Overview and Timelines

The Company’s 2024 Technical Report outlines a comprehensive plan for the proposed development of its Project, highlighting key milestones across the 31-year project lifecycle. The proposed timeline for the Project is designed to seek ways to optimize the extraction of vanadium and titanium Resources, to ensure consistent production rates while progressively developing multiple pits. Contingent on securing the necessary financing and approvals, the potential strategic expansion of the Project’s various processing facilities aims to meet future production goals, particularly in enhancing TiO2 pigment production. Potential ramp-ups and expansions would align with the Company's long-term objectives to maximize Resource utilization and market presence with high-quality vanadium and titanium products.

Outlined Project and Mining Development Phases:

- 2023 – 2032: Continued Mining at Campbell Pit: Mining operations will focus on the Campbell Pit, extracting vanadium-rich ore to meet the production target of 2.6 million tonnes per annum (“mtpa”) for the next nine years;

- 2032 – 2054: Sequential Mining from NAN, SJO, NAO, and GAN Pits: Following the Campbell Pit, mining would transition sequentially to the NAN, SJO, NAO, and GAN pits, ensuring a continuous feed of 3.4 mtpa to the vanadium and titanium processing plants.

Proposed Production Timeline:

- Vanadium Processing

- 2027: The installation of a second kiln, designed for a 20-tonne-per-hour feed rate to increase the capacity of the vanadium operations

- Ilmenite Concentration Plant:

- 2023: Production capacity of 100 kilotonnes per year (“ktpy”)

- 2025: Increased capacity to 122 ktpy

- 2026: Capacity reaches 196 ktpy

- 2029: Full ramp-up to 265 ktpy to meet the Company’s expected TiO2 pigment plant demand

- TiO2 Pigment Plant:

- 2029: Construction in Camaçari, Bahia begins, with an initial production capacity of 30 ktpy

- 2030: Capacity increases to 60 ktpy

- 2031: Full production of 100 ktpy achieved

The outlined phased approach presents scenarios for maintaining stable production over the long term, supporting the Company’s growth objectives and its ambitions to remain a reliable and secure supplier in the vanadium and TiO2 markets. The proposed mining plan, along with potential expansions of processing capabilities—including the Ilmenite and TiO2 pigment plant—are expected to position the Company for sustained market leadership and resource optimization.

2024 Pre-Feasibility Study Summary

Production | |||

LOM | 31 years | ||

Run-of-mine plant feed | 101.0 Mt | ||

LOM average strip ratio | 5 : 1 | ||

Metal production | V2O5 equivalent | Ilmenite | TiO2 |

LOM | 343,600 | 7,766.6 | 2,490.0 |

Proven & Probable Reserves | 101.03 mt grading 0.56% V2O5, yielding 2.16% V2O5 in magnetic concentrate for metal contained of 435.31 kt V2O5 in magnetic concentrate and 7.52% TiO2 head grade for 6,890.99 kt TiO2` in non-magnetic concentrate | ||

Cost | |||

Ilmenite plant expansion CAPEX | $22.0 million | ||

TiO2 pigment plant CAPEX | $480.1 million | ||

Total sustaining CAPEX | $440.4 million | ||

Total CAPEX | $575.4 million | ||

Project Economicsi | |||

Post-tax NPV7% | $1.1 billion | ||

Modified internal rate-of-return | 18.5% | ||

Post-tax LOM cash flow | $3.8 billion | ||

i Weighted average long-term forecast prices of $9.00/lb V2O5 (inclusive of high purity premium), $222.05/tonne ilmenite concentrate, 4040.05/tonne TiO2 and $5.10 USD/BRL exchange rate | |||

Significant Increase In Largo’s Mineral Resource and Reserves

The Company’s updated 2024 Mineral Resource and Reserve estimates demonstrate considerable advancements in exploration and development efforts at Largo over the last three years. Based on an extensive exploration program comprising 650 diamond drill holes, totaling over 114,000 meters (“m”) and incorporating more than 47,000 samples (45,814.24 m), the new geological models provide a strong foundation to support future production scenarios outlined in the 2024 Technical Report. This update includes newly reported Indicated and Inferred Resources at SJO and NAO, with additional Inferred Resources delineated at Jacaré (“JAC”), GAS, and Rio de Contas (“RIOCON”).

The Company has significantly increased both its Mineral Reserves and Resources through these exploration efforts, driven by a deeper understanding and improved interpretation of the ore bodies. While this additional knowledge has contributed to a substantial increase in the Company’s overall resource base, it has also led to a reduction in head grades, as the knowledge and understanding of more complex ore zones, including lower-grade pegmatite bodies, have been incorporated into the models. This is expected to enable the Company to optimize future mining and processing activities, balancing anticipated resource growth with long-term operational efficiency.

Table 1: Maracás Menchen Project – Mineral Reserves Estimate (Effective Date – January 30th, 2024)

Category | Tonnage | %Magnetics | Head | Magnetic Concentrate | Metal Contained | ||||

%V2O5 | %TiO2 | Mag | %V2O5 | %TiO2 | V2O5 in Magnetic | TiO2 in Non-Magnetic | |||

Campbell Pit I | |||||||||

Proven | 16.16 | 22.42 | 0.86 | 6.35 | 3.62 | 3.15 | 5.05 | 114.23 | 842.94 |

Probable | 5.47 | 18.75 | 0.76 | 5.60 | 1.03 | 3.23 | 4.60 | 33.14 | 259.09 |

Total Campbell | 21.63 | 21.49 | 0.83 | 6.16 | 4.65 | 3.17 | 4.95 | 147.37 | 1,102.03 |

GAN II | |||||||||

Proven | 12.96 | 18.44 | 0.45 | 7.66 | 2.39 | 1.80 | 2.93 | 43.94 | 922.31 |

Probable | 11.34 | 16.88 | 0.42 | 7.16 | 1.91 | 1.79 | 2.53 | 34.23 | 763.94 |

Total GAN | 24.29 | 17.71 | 0.44 | 7.42 | 4.30 | 1.79 | 2.75 | 77.17 | 1,685.25 |

NAN III | |||||||||

Proven | 19.55 | 21.02 | 0.58 | 8.25 | 4.11 | 2.05 | 3.33 | 84.22 | 1,474.91 |

Probable | 6.40 | 21.14 | 0.56 | 8.63 | 1.35 | 1.98 | 3.04 | 27.84 | 511.05 |

Total NAN | 25.95 | 21.05 | 0.58 | 8.34 | 5.46 | 2.03 | 3.26 | 111.06 | 1,985.96 |

SJO IV |

|

|

|

|

|

|

|

|

|

Proven | - | - | - | - | - | - | - | - | - |

Probable | 22.41 | 18.12 | 0.44 | 7.48 | 4.06 | 1.76 | 2.99 | 71.32 | 1,555.47 |

Total SJO | 22.41 | 18.12 | 0.44 | 7.48 | 4.06 | 1.76 | 2.99 | 71.32 | 1,555.47 |

NAO V |

|

|

|

|

|

|

|

|

|

Proven | - | - | - | - | - | - | - | - | - |

Probable | 6.74 | 24.98 | 0.53 | 9.17 | 1.68 | 1.69 | 3.33 | 28.39 | 562.27 |

Total NAO Reserve | 6.74 | 24.98 | 0.53 | 9.17 | 1.68 | 1.69 | 3.33 | 28.39 | 562.27 |

Total Maracás Menchen Mine Proven and Probable Reserves | |||||||||

Proven | 48.67 | 20.80 | 0.64 | 7.46 | 10.12 | 2.38 | 3.85 | 241.39 | 3,240.16 |

Probable | 52.36 | 19.17 | 0.50 | 7.57 | 10.03 | 1.93 | 3.13 | 193.92 | 3,650.82 |

Total | 101.03 | 19.95 | 0.56 | 7.52 | 20.15 | 2.16 | 3.49 | 435.31 | 6,890.99 |

Notes: | |||||||||

1. Mineral Reserves estimates were prepared under the CIM Standards. | |||||||||

2. Mineral Reserves are the economic portion of the Measured and Indicated Mineral Resources. | |||||||||

3. Mineral Reserves were estimated by Guilherme Gomides Ferreira, BSc. (MEng), MAIG, a GE21 associate, who meets the requirements of a “Qualified Person” as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM Standards). | |||||||||

4. Mineral Reserves are reported effective date January 30th, 2024. | |||||||||

5. The reference point at which the Mineral Reserves are defined is the point where the ore is delivered from the open pit to the crushing plant. | |||||||||

6. Vanadium product comes from magnetic concentrate, while TiO2 product comes from the non-magnetic portion. | |||||||||

7. Mineral Reserves were estimated using the Geovia Whittle 4.3 software and following the geometric and economic parameters. | |||||||||

8. Geometric and economic parameters include: | |||||||||

• Mine Recovery of 97% and dilution of 10%. | |||||||||

• V2O5 selling price (standard purity >98%) of $8.50/lb, with an additional premium of $1.00/lb for high purity (>99.5%) product. | |||||||||

• TiO2 pigment selling price (purity >94%) of $3,528.00 per tonne. | |||||||||

• Mining costs of $2.93 per tonne for mineralization and waste. | |||||||||

• Vanadium processing costs of $34.60 per tonne of ore feed. | |||||||||

• Ilmenite concentrate costs $5.74 per tonne processed. | |||||||||

• TiO2 pigment costs of $1,733.00 per tonne of pigment produced. | |||||||||

• General and Administrative (G&A) costs of $0.27 per lb of V2O5. | |||||||||

9. Exchange rate: $1.00 = R$5.10. | |||||||||

10. Specific values for each Deposit: | |||||||||

I. Campbell Pit: Pit slope angles ranging from 37.5° to 64°. V2O5 concentrate recovery of 78.86%. TiO2 overall recovery of 43.44%. Strip Ratio 3.25 (tonnes per tonne). | |||||||||

II. GAN: Pit slope angles ranging from 40° to 64. V2O5 concentrate recovery of 70.50%. TiO2 overall recovery of 32.78%. Strip Ratio 6.17 (tonnes per tonne). | |||||||||

III. NAN: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 45.90%. Strip Ratio 5.75 (tonnes per tonne). | |||||||||

IV. SJO: Pit slope angles ranging from 40° to 56°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 32.78%. Strip Ratio 4.23 (tonnes per tonne). | |||||||||

V. NAO: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 32.78%. Strip Ratio 6.98 (tonnes per tonne). | |||||||||

Source: GE21, 2024. | |||||||||

Table 2: Maracás Menchen Project – Non-Magnetic Reserves in Ponds (Effective Date – January 30th, 2024)

Pond | Classification | Mass (kt) | Grade TiO2 (%) | Metal Content (kt) |

BNM 02 | Probable | 1,131.77 | 10.69 | 120.99 |

BNM 03 | Probable | 1,051.72 | 11.87 | 124.84 |

BNM 04 | Probable | 3,034.94 | 10.03 | 304.42 |

Total in Ponds Reserves | Probable | 5,218.43 | 10.54 | 550.25 |

Notes: | ||||

1. Stock of “Non-Magnetic concentrate” available in the tailing’s ponds. | ||||

2. Effective Date–January 30th, 2024. | ||||

3. Mineral Reserves in ponds were estimated based on monthly processing and validated with topographic surveys (primitive data and current data) and reconciliation data. | ||||

4. Recovery is 100% and no dilution was applied to these Reserves | ||||

Source: GE21, 2024. | ||||

Table 3: Mineral Resource of Maracás Menchen Project (Effective Date – January 30th, 2024)

Target | Classification | Mass | Head | Magnetic Concentrate | Material Content | ||||

V2O5 | TiO2 | DT | V2O5 | TiO2 | V2O5 | TiO2 | |||

(Mt) | (%) | (kt) | |||||||

Campbell Pit + GAN | Measured | 30.28 | 0.71 | 7.64 | 22.21 | 2.40 | 3.48 | 215.73 | 2,313.22 |

Indicated | 21.09 | 0.54 | 7.28 | 18.51 | 2.14 | 2.73 | 114.50 | 1,536.38 | |

Measured + Indicated | 51.37 | 0.64 | 7.49 | 20.69 | 2.30 | 3.17 | 330.23 | 3,849.60 | |

Inferred | 29.94 | 0.54 | 7.46 | 18.52 | 2.00 | 2.31 | 162.2 | 2,232.6 | |

SJO | Indicated | 17.92 | 0.58 | 8.77 | 22.78 | 1.90 | 2.86 | 104.4 | 1,571.6 |

Measured + Indicated | 17.92 | 0.58 | 8.77 | 22.78 | 1.90 | 2.86 | 104.39 | 1,571.57 | |

Inferred | 15.19 | 0.52 | 7.43 | 19.02 | 1.89 | 2.53 | 78.9 | 1,127.9 | |

NAO | Indicated | 7.13 | 0.58 | 10.06 | 27.29 | 1.72 | 3.06 | 41.4 | 717.2 |

Measured + Indicated | 7.13 | 0.58 | 10.06 | 27.29 | 1.72 | 3.06 | 41.38 | 717.16 | |

Inferred | 4.09 | 0.59 | 8.61 | 23.34 | 1.83 | 3.03 | 24.0 | 351.8 | |

NAN | Measured | 19.44 | 0.64 | 9.02 | 22.88 | 2.14 | 2.83 | 123.7 | 1,753.6 |

Indicated | 8.93 | 0.60 | 9.14 | 21.90 | 2.14 | 2.63 | 53.9 | 815.6 | |

Measured + Indicated | 28.37 | 0.63 | 9.06 | 22.57 | 2.14 | 2.77 | 177.54 | 2,569.17 | |

Inferred | 6.88 | 0.66 | 9.16 | 22.69 | 2.28 | 2.68 | 45.7 | 630.0 | |

GAS | Inferred | 11.30 | 0.58 | 8.48 | 18.36 | 2.31 | 2.22 | 66.0 | 958.7 |

JAC | Inferred | 21.16 | 0.47 | 7.78 | 18.57 | 1.74 | 4.65 | 98.9 | 1,645.3 |

RIOCON | Inferred | 13.27 | 0.41 | 7.23 | 16.15 | 1.63 | 3.86 | 55.0 | 959.3 |

Total | Measured | 49.72 | 0.68 | 8.18 | 22.47 | 2.30 | 3.22 | 339.39 | 4,066.84 |

Indicated | 55.06 | 0.57 | 8.43 | 21.58 | 2.01 | 2.80 | 314.15 | 4,640.66 | |

Measured + Indicated | 104.78 | 0.62 | 8.31 | 22.01 | 2.15 | 3.00 | 653.54 | 8,707.50 | |

Inferred | 101.82 | 0.52 | 7.76 | 18.75 | 1.93 | 3.08 | 530.79 | 7,905.60 | |

Notes: | |||||||||

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. | |||||||||

2. Mineral Resources were estimated by Fábio Xavier, BSc. (Geo), MAIG, a GE21 Associate, who meets the requirements of a “Qualified Person” as established by the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014) (CIM Standards). | |||||||||

3. The Mineral Resource estimates were prepared under the CIM Standards and the CIM Guidelines, using geostatistical, economic, and mining parameters appropriate to the deposits. | |||||||||

4. Presented Mineral Resources are inclusive of Mineral Reserves. All figures have been rounded to the relative accuracy of the estimates. Summed amounts may not add due to rounding. | |||||||||

5. The Mineral Resource is reported on an effective date of January 30th, 2024. | |||||||||

6. A cut-off grade of 0.3% V2O5 head is applied in V2O5 Mineral Resource. | |||||||||

7. A cut-off grade of 1% TiO2 head, derived from an economic function, is associated to TiO2 Mineral Resource. | |||||||||

8. Geometric and economic parameters include: | |||||||||

• Mine Recovery of 100% and dilution 0%. | |||||||||

• V2O5 selling price of $16 per lb. | |||||||||

• TiO2 pigment selling price of $4,000.00 per tonne. | |||||||||

• Mining costs of $2.93 per tonne for mineralization and waste. | |||||||||

• Vanadium processing costs of $34.60 per tonne of ore feed. | |||||||||

• Ilmenite concentrate costs $5.74 per tonne processed. | |||||||||

• TiO2 pigment costs of $1,733.00 per tonne of pigment produced. | |||||||||

• General and Administrative (G&A) costs of $0.27 per lb of V2O5. | |||||||||

9. Exchange rate: $1.00 = R$5.10. | |||||||||

10. Specific values for each Deposit: | |||||||||

• Campbell Pit + GAN: Pit slope angles ranging from 37.5° to 64°. V2O5 concentrate recovery of 70.50% to 78.86%. TiO2 overall recovery of 32.78% to 43.44%. | |||||||||

• NAN: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 45.90%. | |||||||||

• SJO: Pit slope angles ranging from 40° to 56°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 32.78%. | |||||||||

• NAO: Pit slope angles ranging from 40° to 68°. V2O5 concentrate recovery of 70.00%. TiO2 overall recovery of 32.78%. | |||||||||

Source: GE21, 2024. | |||||||||

Table 4: Non-Magnetic Ponds Resource Estimate (Effective Date – January 30th, 2024)

Pond | Classification | Mass (kt) | Grade TiO2 (%) | Metal content (kt) |

BNM 02 | Indicated | 1,131.77 | 10.69 | 120.99 |

BNM 03 | Indicated | 1,051.72 | 11.87 | 124.84 |

BNM 04 | Indicated | 3,034.94 | 10.03 | 304.42 |

Total in Ponds Resources | Indicated | 5,218.43 | 10.54 | 550.25 |

Notes: | ||||

1. Stock of “Non-Magnetic concentrate” available in the tailing’s ponds. | ||||

2. Effective Date–January 30th, 2024. | ||||

3. Mineral Resources in ponds were estimated based on monthly processing and validated with topographic surveys (primitive data and current data) and reconciliation data. | ||||

4. Recovery is 100% and no dilution was applied to these Resources. | ||||

Source: GE21, 2024. | ||||

Future Growth Opportunities at the Project

The Company is actively advancing several long-term growth initiatives, designed to enhance resource potential and production capabilities at the Project. These initiatives will focus on both expanding the Company's resource base and leveraging new technologies to optimize future operations.

- Additional Exploration and the Campbell-GAS Deposit Connection: The Company is undertaking an exploration program to confirm mineralization between the Campbell Pit and the GAS deposit. Previous drilling at the GAS target identified 11.3 mt of Inferred Resources, grading 0.58% V2O5 and 8.48% TiO2, with concentrate grades of 2.31% V2O5 and 2.22% TiO2. The relatively short distance of approximately 800 m between the Campbell Pit and the GAS deposit presents a strong opportunity to enhance the Company’s resource base by connecting these deposits. If successful, this would increase the overall ROM material close to the Company’s existing processing facilities as compared to other more northerly deposits.

- PGM Opportunities: At the end of 2023, the Company resumed studies to further explore the existence of PGMs within its non-magnetic tailings ponds. Auger samples from the non-magnetic tailings ponds revealed promising results, with notable platinum and palladium grades, including 3.0 meters grading 0.410 g/t Pt and 0.209 g/t Pd. This follows historical data from past exploration efforts at the Company, which also demonstrated significant PGM mineralization (see press release dated March 5, 2024). By further reviewing and analyzing historical drill data, the Company aims to develop a comprehensive PGM resource model that could further enhance the potential of future mining operations and provide a potential new revenue opportunities alongside its vanadium and ilmenite operations. PGMs are highly valuable due to their applications in catalytic converters and the automotive industry, presenting a major growth opportunity if these studies yield positive results.

Technical Report Consultants

GE21 is a specialized and independent mineral consulting firm based on a multi-disciplinary technical team, which offers services covering most project development stages in the mining sector. The senior staff and Board of Directors have extensive technical and operational experience, based on collaboration with relevant companies in the fields of exploration and mineral consulting in Brazil going back to the 1980's. GE21's services cover the entire mining cycle, from business strategies and target generation and investments to mine closure. GE21 routinely provides services for mineral exploration, project development, geological valuations, and resource and reserve estimation and certification according to international standards, including JORC and NI 43- 101. In addition, GE21 also serves the mining industry by working with operators in connection with mine planning and mine optimization, technical and economic studies as well as technical audits and the application of best market practices advocated by various international codes.

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 for the Project will be filed on SEDAR+ (www.sedarplus.com) on or before December 12, 2024. Readers are encouraged to read the Technical Report in its entirety, including all qualifications, assumptions and exclusions that relate to the Mineral Reserve and Mineral Resource declaration. The 2024 Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context. The Mineral Reserve and Mineral Resource statements for the Project included in this press release were prepared under the supervision of Porfírio Cabaleiro Rodriguez, Mining Engineer, BSc (Mine Eng), FAIG, GE21 director. Mr. Rodriguez is a “qualified persons” as defined in NI 43-101 and have reviewed and approved disclosure of the scientific and technical information and data in this press release that relate to the mineral operations which are the subject of the 2024 Technical Report.

About Largo

Largo is a globally recognized vanadium company known for its high-quality VPURE® and VPURE+® products, sourced from its Maracás Menchen Mine in Brazil. The Company is currently focused on ramping up production of its ilmenite concentrate plant and is undertaking a strategic evaluation of its U.S.-based clean energy business, including its advanced VCHARGE vanadium battery technology to maximize the value of the organization. Largo's strategic business plan centers on maintaining its position as a leading vanadium supplier with a growth strategy to support a low-carbon future.

Largo’s common shares trade on the Nasdaq Stock Market and on the Toronto Stock Exchange under the symbol "LGO". For more information on the Company, please visit www.largoinc.com.

Cautionary Statement Regarding Forward-looking Information:

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation. Forward‐looking information in this press release includes, but is not limited to, statements with respect to management’s expectations and the potential of Project; the estimation of Mineral Reserves and Mineral Resources and the realization of any such estimates; operational and financial performance including the Company’s guidance for and actual results of production; the updated life of mine plan; expected benefits from the updated life of mine plan and updated Mineral Reserves and Mineral Resources; the Company’s plans, targets and proposals in relation to the Project; economic and social factors regarding the importance of vanadium; future potential growth opportunities for the Project and the Company; and expected Project timelines.

Forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. All information contained in this news release, other than statements of current and historical fact, is forward looking information. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Largo to be materially different from those expressed or implied by such forward-looking statements, including but not limited: to those risks described in the annual information form of Largo and in its public documents filed on www.sedarplus.ca and available on www.sec.gov from time to time. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made. Although management of Largo has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Largo does not undertake to update any forward-looking statements, except in accordance with applicable securities laws. Readers should also review the risks and uncertainties sections of Largo’s annual and interim MD&A which also apply.

Trademarks are owned by Largo Inc.

Information Concerning Estimates of Mineral Reserves and Measured, Indicated and Inferred Resources

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). These definitions differ significantly from the definitions in the disclosure requirements promulgated by the Securities and Exchange Commission (the “SEC”) applicable to domestic reporting companies. Investors are cautioned that information contained in this press release may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations of the SEC thereunder.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$1.34 |

| Daily Change: | -0.02 -1.11 |

| Daily Volume: | 1,239,969 |

| Market Cap: | US$111.700M |

January 12, 2026 January 08, 2026 January 05, 2026 November 12, 2025 October 22, 2025 | |