Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

HIVE Digital Technologies Announces Quarterly Revenue of $31.3 Million with a Gross Operating Margin of $11.3 Million and Production of 830 Bitcoin

Vancouver, British Columbia--(Newsfile Corp. - February 13, 2024) - HIVE Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0) (the "Company" or "HIVE"), a leading digital asset miner and "green" focused data center builder and operator, announced today its earnings report for the third quarter ended December 31, 2023 (all amounts in US dollars, unless otherwise indicated).

HIVE achieved revenue of $30.1 million this quarter by mining 830 Bitcoin with a 38% Gross Operating Margin representing $11.3 million of income from digital currency mining operations. This also represents a 146% increase in Gross Operating Margin from the previous quarter of $4.6 million. This quarter, Bitcoin mining economics were stronger due to the rally in Bitcoin, possibly as a result of the news surrounding the Bitcoin ETFs in the United States and subsequent SEC approval on January 10, 2024. Additionally, the Company realized $0.9 million of revenue this quarter from the GPU powered High Performance Computing ("HPC") business unit, where the Company's GPUs are utilized for AI computations, including inference and fine-tuning of large language models (LLMs).

The Company notes that HIVE's production of 830 Bitcoin this quarter represents an increase of 5% year-over-year, having mined 787 Bitcoin in the same period last year. This is a result of increasing HIVE's global hashrate to over 4 Exahash per second ("EH/s"), while there was an increase in Bitcoin mining network difficulty of approximately 82%, which suggests more miners are competing with more efficient equipment than in the past for the same daily opportunity of 900 Bitcoin. Accordingly, earning 9 Bitcoin per day equates to having 1% of the hashrate of the entire Bitcoin mining network. On average this quarter HIVE mined 9.0 Bitcoin per day. HIVE had an average operating hashrate of 4.01 EH/s for this quarter, representing a 10% increase over the average hashrate from the previous quarter of 3.66 EH/s.

"At this stage in the four-year Halving cycle which is embedded in the bitcoin algorithm to slow the supply and eventually cap the total supply at 21 million Bitcoin, we are focused on being prepared for the upcoming Halving in April 2024 while building our HPC AI revenue strategy with our Nvidia chips. We have experienced the last Halving and know it is key to have additional sources of revenue growth and a very strong balance sheet with a current HODL position of over 2,000 Bitcoin," says Frank Holmes, HIVE's Executive Chairman.

Aydin Kilic, President & CEO of HIVE, added, "This was a very strong quarter for HIVE, as we were well positioned with our global operations, earning approximately 9 Bitcoin per day, and exceeding the growth of the Bitcoin mining network hashrate in the process. We mined 830 Bitcoin this quarter, a 2.5% increase over the previous quarter of 810 Bitcoin. This is a commendable feat considering Bitcoin mining difficulty increased by 26% this quarter, ending with a then all-time high of 72 trillion as at December 31, 2024. Also, I am pleased with our growing GPU powered AI business unit realizing over $5 million of revenues on an annualized run rate basis as of December 31, 2023, effectively representing 5x growth during the 2023 calendar year. Our team has done a phenomenal job learning and advancing our position in the HPC and AI industry, being aligned with technology leaders such as Nvidia and Dell. We are currently using our GPUs to allow our contest winner to perform research on advanced LLMs, at the vanguard of AI advancement."

HIVE's average cost of production per Bitcoin was $22,607 (including cost of goods sold, not including SG&A) for the quarter ending December 31, 2023, a 2.37% increase in cost from the previous quarter ending September 30, 2023. The Company notes that with Bitcoin mining hashrates and difficulty at all-time highs, it is expected that the cost of production for Bitcoin will increase for the industry at large, as less Bitcoin per Terahash is being rewarded at these difficulty levels. The cost of production per Bitcoin is driven primarily by the cost of electricity to mine, and also the efficiency, in Joules per TeraHash ("J/TH") of the ASIC miners. HIVE has made strides to lower its cost of Bitcoin production with a substantive fleet upgrade of ASICs. Our target global fleet efficiency is 25 J/TH once all of our Bitmain S21 Antminers are delivered and installed, as the Company previously announced the purchase of 1.4 EH/s of machines, being delivered from January through June 2024. We remain focused on acquiring new ASIC machines in an opportunistic way from cash flow and managing our balance sheet. We are busy preparing for the Halving as we did in 2020.

Notably, the average hashprice for the Bitcoin mining network (a measure of the USD daily revenue earned per operating Petahash of Bitcoin hashrate online) was $81/PH per day for the period end December 31, 2023. The average hashprice for the Bitcoin mining network for the previous quarter end September 30, 2023, was $68/PH per day. Therefore, the average Bitcoin mining network hashprice was 20% higher on a quarter over quarter basis. What this means is, for all Bitcoin miners, they would earn on average 20% more revenue for the same quantity of hashrate online for the period end December 31, 2023, compared on a quarter over quarter basis to the period end September 30, 2023.

Q3 Quarterly Summary - December 31, 2023

- Generated digital currency mining revenue of $30.1 million, with a gross operating margin1 of $11.3 million

- Mined 830 Bitcoin during the three-month period ended December 31, 2023

- Adjusted EBITDA1 income of $17.3 million for the three-month period

- Working capital increased by $36.4 million during the three-month period ended December 31, 2023

- Digital currency assets of $71.9 million, as at December 31, 2023

- Average cost of production per Bitcoin was $22,607, where the average Bitcoin price was $36,119, during the three-month period ended December 31, 2023. This also represents a 2.37% increase in production costs of Bitcoin from the previous quarter of $22,084 for the three months ended September 30, 2023 (average price of Bitcoin was $28,045 during this period)

- Net loss from continuing operations of $6.95 million for the three-month period, due greatly to the accelerated depreciation of ASIC equipment, and a provision on sales tax receivables

Q3 F2024 Financial Review

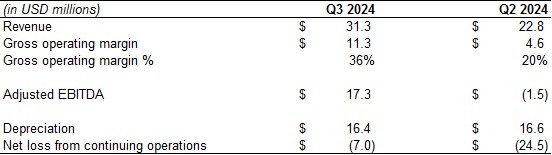

For the three months ended December 31, 2023, revenue was $31.3 million, an increase of approximately 118% from the prior comparative period primarily due to the increase in Bitcoin price, and $1.1 million of revenue from our HPC business segment.

Gross operating margin1 during the three-month period was $11.3 million, or 36% of revenues, compared to $3.6 million, or 25% of revenues, in the same period in the prior year. The Company's gross operating margin1 is partially dependent on external network factors including mining difficulty, the amount of digital currency rewards and fees it receives for mining, as well as the market price of digital currencies.

The Company notes that, adjusted EBITDA1 this quarter was $17.3 million, because of higher operating costs and a provision on sales tax receivables, net loss from continuing operations during the quarter ended December 31, 2023, was $6.95 million, or a loss of $0.08 per share, compared to a net loss of $93.5 million, or a loss of $1.13 per share, in the same period last year. The improvement from the prior comparative period was driven primarily by lower non-cash charges such as depreciation, unrealized valuation losses on digital currencies and investments, and impairment charges on equipment. Adjusted EBITDA is a non-IFRS financial measurement and should be read in conjunction with and should not be viewed as an alternative to or replacement of measures of operating results and liquidity presented in accordance with IFRS.

Mr. Holmes noted, "At HIVE we strive to maintain a high-performance culture, which means that we always adapt to unexpected headwinds, and maintain operational excellence in the process."

Table 1

EBITDA and Adjusted EBITDA

The Company uses EBITDA and Adjusted EBITDA as a metric that is useful for assessing its operating performance on a cash basis before the impact of non-cash items and acquisition related activities.

EBITDA is net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization.

Adjusted EBITDA is EBITDA adjusted for removing other non-cash items, including share-based compensation, non-cash effect of the revaluation of digital currencies and one-time transactions.

Table 2

The Company emphasizes that "Adjusted EBITDA" is not a GAAP or IFRS measurement and is included only for comparative purposes.

Non-Cash Charges

A non-cash charge is a write-down or accounting expense that does not involve a cash payment. Depreciation, amortization, depletion, stock-based compensation, and asset impairments are common non-cash charges that reduce earnings but not cash flows.

Financial Statements and MD&A

The Company's Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three and nine months ended December 31, 2023 will be accessible on SEDAR+ at www.sedarplus.ca under HIVE's profile and on the Company's website at www.HIVEdigitaltechnologies.com.

At-the-Market Offering

On May 10, 2023, the Company entered into an equity distribution agreement ("May 2023 Equity Distribution Agreement") with Stifel GMP and Canaccord Genuity Corp. Under the May 2023 Equity Distribution Agreement, the Company may, from time to time, sell up to $100 million of common shares in the capital of the Company (the "May 2023 ATM Equity Program"). The May 2023 Equity Distribution Agreement was terminated as of August 16, 2023, in order to proceed with the August 2023 Equity Distribution Agreement (as defined below).

For the period ended December 31, 2023, the Company issued 1,374,700 common shares (the "May 2023 ATM Shares") pursuant to the May 2023 ATM Equity Program for gross proceeds of C$9.0 million ($6.8 million). The May 2023 ATM Shares were sold at prevailing market prices, for an average price per May 2023 ATM Share of C$6.55. Pursuant to the May 2023 Equity Distribution Agreement, a cash commission of $0.2 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the May 2023 Equity Distribution Agreement. In addition, the Company incurred $162 in fees related to its May 2023 ATM Equity Program.

On August 17, 2023, the Company entered into an equity distribution agreement ("August 2023 Equity Distribution Agreement") with Stifel GMP and Canaccord Genuity Corp. Under the August 2023 Equity Distribution Agreement, the Company may, from time to time, sell up to $90 million of common shares in the capital of the Company (the "August 2023 ATM Equity Program").

For the period ended December 31, 2023, the Company issued 6,175,140 common shares (the "August 2023 ATM Shares") pursuant to the August 2023 ATM Equity Program for gross proceeds of C$32.9 million ($24.4 million). The August 2023 ATM Shares were sold at prevailing market prices, for an average price per August 2023 ATM Share of C$5.33. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $0.7 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement. In addition, the Company incurred $246 in fees related to its August 2023 ATM Equity Program.

The Company is using the net proceeds from the May 2023 Equity Distribution Agreement and the August 2023 Equity Distribution Agreement for the purchase of data center equipment, strategic investments including building BTC assets on our balance sheet and general working capital.

About HIVE Digital Technologies Ltd.

HIVE Digital Technologies Ltd. went public in 2017 as the first cryptocurrency mining company listed for trading on the TSX Venture Exchange with a sustainable green energy focus.

HIVE is a growth-oriented technology stock in the emergent blockchain and high-performance computing industry. As a company whose shares trade on major stock exchanges, we are building a bridge between the digital currency and blockchain sectors and traditional capital markets. HIVE owns green energy-powered data center facilities in Canada, Sweden, and Iceland, where we endeavour to source geothermal and hydroelectric energy to mine digital assets such as Bitcoin on the cloud. Since the beginning of 2021, HIVE has held in secure storage the majority of its treasury of BTC derived from mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of Bitcoin. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency and high-performance computing space.

We encourage you to visit HIVE's YouTube channel here to learn more about HIVE.

For more information and to register to HIVE's mailing list, please visit https://hivedigitaltechnologies.com/. Follow @HIVEDigitalTech on X and subscribe to HIVE's YouTube channel.

On Behalf of HIVE Digital Technologies Ltd.

"Frank Holmes"

Executive Chairman

For further information please contact:

Frank Holmes

This email address is being protected from spambots. You need JavaScript enabled to view it.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes information about: business goals and objectives of the Company; the results of operations for the three months ended December 31, 2023; the HODL strategy adopted by the Company; the acquisition, deployment and optimization of the mining fleet and equipment; the continued viability of its existing Bitcoin mining operations; the Company's program to build a high-performance computing business offering cloud computing services; the Company's operations and sustainable future profitability; potential further improvements to the profitability and efficiency across mining operations by optimizing cryptocurrency mining output, continuing to lower direct mining operations cost structure, and maximizing existing electrical and infrastructure capacity including with new mining equipment in existing facilities; continued adoption of Bitcoin globally; the potential for the Company's long term growth; the business goals and objectives of the Company, and other forward-looking information includes but is not limited to information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward looking information include, but are not limited to, the volatility of the digital currency market; the Company's ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company's operations; the Company's ability to compete successfully with other cloud computing service providers; the regulatory environment for cryptocurrency in Canada, the United States and the countries where our mining facilities are located; economic dependence on regulated terms of service and electricity rates; the speculative and competitive nature of the technology sector; dependency on continued growth in blockchain and cryptocurrency usage; lawsuits and other legal proceedings and challenges; government regulations; the global economic climate; dilution; future capital needs and uncertainty of additional financing, including the Company's ability to utilize the Company's at-the-market equity offering program (the "ATM Program") and the prices at which the Company may sell Common Shares in the ATM Program, as well as capital market conditions in general; risks relating to the strategy of maintaining and increasing Bitcoin holdings and the impact of depreciating Bitcoin prices on working capital; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; the ability to maintain reliable and economical sources of power to run its cryptocurrency mining assets; the impact of energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; share dilution resulting from the ATM Program and from other equity issuances; the construction and operation of facilities may not occur as currently planned, or at all; expansion may not materialize as currently anticipated, or at all; the digital currency market; the ability to successfully mine digital currency; revenue may not increase as currently anticipated, or at all; it may not be possible to profitably liquidate the current digital currency inventory, or at all; a decline in digital currency prices may have a significant negative impact on operations; an increase in network difficulty may have a significant negative impact on operations; the volatility of digital currency prices; the anticipated growth and sustainability of electricity for the purposes of cryptocurrency mining in the applicable jurisdictions; the inability to maintain reliable and economical sources of power for the Company to operate cryptocurrency mining assets; the risks of an increase in the Company's electricity costs, cost of natural gas, changes in currency exchange rates, energy curtailment or regulatory changes in the energy regimes in the jurisdictions in which the Company operates and the adverse impact on the Company's profitability; the ability to complete current and future financings, any regulations or laws that will prevent the Company from operating its business; historical prices of digital currencies and the ability to mine digital currencies that will be consistent with historical prices; an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to the effects of COVID-19 on the price of digital currencies, capital market conditions, restriction on labour and international travel and supply chains; and, the adoption or expansion of any regulation or law that will prevent the Company from operating its business, or make it more costly to do so; and other related risks as more fully set out in the Company's disclosure documents under the Company's filings at www.sec.gov/EDGAR and www.sedarplus.ca.

This news release also contains "financial outlook" in the form of gross operating margins, which is intended to provide additional information only and may not be an appropriate or accurate prediction of future performance and should not be used as such. The gross operating margins disclosed in this news release are based on the assumptions disclosed in this news release and the Company's Management Discussion and Analysis for the fiscal year ended March 31, 2023, which assumptions are based upon management's best estimates but are inherently speculative and there is no guarantee that such assumptions and estimates will prove to be correct.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's ability to realize operational efficiencies going forward into profitability; profitable use of the Company's assets going forward; the Company's ability to profitably liquidate its digital currency inventory as required; historical prices of digital currencies and the ability of the Company to mine digital currencies will be consistent with historical prices; and there will be no regulation or law that will prevent the Company from operating its business. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

1 Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" below.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$3.44 |

| Daily Change: | 0.005 0.15 |

| Daily Volume: | 3,750,480 |

| Market Cap: | US$817.430M |

January 13, 2026 November 03, 2025 October 27, 2025 | |