HIGHLIGHTS

HOUSTON, May 11, 2023 (GLOBE NEWSWIRE) -- 5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E” or the “Company”), a boron and lithium company with U.S. government Critical Infrastructure designation for its 5E Boron Americas (Fort Cady) Complex ("Project"), is pleased to announced it has updated its Technical Report Summary for the Project and released its financial results for the quarter ended March 31, 2023.

BUSINESS UPDATE

Technical Report Update and Larger Scale Facility

During the quarter, the 5E team spent significant time updating the Company’s initial assessment Technical Report Summary, which has been filed with the Securities and Exchange Commission ("SEC") and prepared in accordance with the SEC S-K Regulations (Title 17, Part 229, Items 601 and 1300 until 1305). A dedicated internal and external team pooled their professional and technical expertise to publish a report that the Company believes highlights a world-class resource, management's firm understanding and direction for the business, and a phased approach to scale production, which can position the company to achieve profitability, generate cash flow, and reduce risk. The updated initial assessment includes a revised mineral resource estimate for boric acid and lithium carbonate, estimates for capital costs and operating expenses, and a bottoms-up economic analysis based on a phased approach to scaling production. The financial model for the economic analysis includes preliminary market studies and independent pricing forecasts for boric acid and lithium carbonate. As part of the updated technical report, the Company engaged two external EPC firms to assist management with the capital cost estimate, which the Company expects to use as the basis to stage a formal process to request proposals for detail design of the large-scale facility.

The updated Technical Report Summary outlines three phases for the larger-scale facility:

The initial capital cost estimate outlined in the technical report for Phase 1 is $288 million before contingency and owner's costs. With the owner’s cost and a 25% contingency, Phase 1 capital is estimated at $373 million. First year full-production cash costs are targeted at $686 per short ton and the table below includes targeted financial metrics for each phase's first full-year of operation:

| FY 2027 (Phase 1) | FY 2030 (Phase 2) | FY 2032 (Phase 3) | ||||||||||

| ($ in millions) | ||||||||||||

| Revenue - US$ | $ | 162.9 | $ | 575.1 | $ | 1,069.3 | ||||||

| Operating margin - US$ | 64.4 | 264.3 | 431.4 | |||||||||

| EBITDA - US$ | 101.2 | 360.9 | 621.9 | |||||||||

| EBITDA margin - % | 62.10 | % | 62.80 | % | 58.20 | % | ||||||

Market Study Results

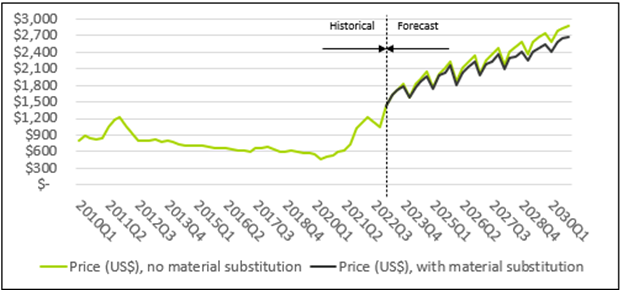

The Company commissioned an independent third-party research firm to perform a boron market study and forward pricing forecast. The market study indicates that overall demand for boric acid is expected to increase at a CAGR of 5.4% from 2022 through 2031 while capacity increases for the same period are projected at a 5.1% CAGR. Given that the market is already nearly balanced and existing suppliers have not demonstrated an ability to immediately ramp up capacity, a systematic market deficit is expected through the next decade, driving prices higher as projected in Figure 1 below. Figure 2 below outlines the supply and demand deficit.

Figure 1: Boric Acid Pricing per Kline and Company, Inc.

Figure 2: Projected market capacity versus demand, in thousands of tonnes per Kline and Company, Inc.

As the world focuses on decarbonization, food security and security of strategic and critical minerals, the forecasted pull-side demand for boron enabling future-facing applications is expected to pressure boric acid pricing higher. Further reinforcing the market study and pricing forecast is the lack of near-term supply. As 80% of the market is controlled by two producers, 5E is one of the only permitted boron resources with a proven commercially viable mineralization (calcium-based) that is likely to add meaningful supply in the next five to seven years.

Small-Scale Facility

During the quarter ended March 31, 2023, the Company substantially completed construction of the Small-Scale Facility and progressed commissioning activities. Initial production of boric acid will commence upon final clearance from the U.S. Environmental Protection Agency (EPA) under the Company’s Underground Injection Control Permit as well as successful completion of commissioning activities. Key required reports and documentation were submitted to the EPA for their approval in 2022 and the Company believes it is in full compliance with the terms of the permit. Upon final review of required documentation by the EPA, the Company expects to receive authorization to commence mining operations. Data gathered from the construction and future operation of the Small-Scale Facility will be used to optimize and improve accuracy of capital and operating estimates for the larger-scale operations, provide customer samples for qualification and future off-take agreements, and offset future operating expenses.

CEO Appointment

During the quarter, the Company announced the appointment of Ms. Susan Seilheimer Brennan as its new Chief Executive Officer. Ms. Brennan started on April 24, 2023, and has an extensive global leadership background, particularly in the battery technology and electric vehicle industries. During Ms. Brennan's first two weeks, she has implemented general, administrative and fixed cost cutting measures and will relocate the Company's headquarters to California in an effort to focus on production of boric acid and lithium carbonate.

Third Quarter 2023 Results:

As of quarter-end, the Company maintained a cash balance of $36.2 million. Construction in progress was $61.5 million, compared to $46.9 million in the prior fiscal quarter ended December 31, 2022, as the Company neared mechanical completion of the Small-Scale Facility.

| 5E ADVANCED MATERIALS, INC. CONDENSED CONSOLIDATED BALANCE SHEET (Unaudited) (In thousands, except share data) 5E ADVANCED MATERIALS, INC. | ||||||||

| March 31, | June 30, | |||||||

| 2023 | 2022 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 36,170 | $ | 31,057 | ||||

| Prepaid expenses and other current assets | 1,892 | 1,506 | ||||||

| Total current assets | 38,062 | 32,563 | ||||||

| Mineral rights and properties, net | 7,612 | 8,364 | ||||||

| Construction in progress | 61,533 | 25,625 | ||||||

| Properties, plant and equipment, net | 3,084 | 2,871 | ||||||

| Reclamation bond deposit | 1,086 | 1,086 | ||||||

| Right of use asset | 247 | 371 | ||||||

| Other assets | 6 | 6 | ||||||

| Total assets | $ | 111,630 | $ | 70,886 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 11,314 | $ | 7,212 | ||||

| Lease liabilities, current | 158 | 164 | ||||||

| Total current liabilities | 11,472 | 7,376 | ||||||

| Long-term debt, net | 36,228 | 148 | ||||||

| Lease liabilities | 94 | 211 | ||||||

| Accrued reclamation liabilities | 676 | 489 | ||||||

| Total liabilities | 48,470 | 8,224 | ||||||

| Commitments and contingencies (Note 12) | ||||||||

| Stockholders’ Equity: | ||||||||

| Common stock, $0.01 par value; 180,000 shares authorized; 44,149 and 43,305 shares outstanding March 31 and June 30, respectively | 441 | 433 | ||||||

| Additional paid-in capital | 190,455 | 169,593 | ||||||

| Retained earnings (accumulated deficit) | (127,736 | ) | (107,364 | ) | ||||

| Total stockholders’ equity | 63,160 | 62,662 | ||||||

| Total liabilities and stockholders’ equity | $ | 111,630 | $ | 70,886 | ||||

| CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) (Unaudited) (In thousands, except per share amounts) | |||||||||||||||

| Three months ended March 31, | Nine Months Ended March 31, | ||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||

| Operating expenses: | |||||||||||||||

| Project expenses | $ | 1,268 | $ | 2,039 | $ | 8,267 | $ | 9,816 | |||||||

| General and administrative | 6,004 | 30,832 | 18,591 | 44,497 | |||||||||||

| Research and development | 45 | 88 | 123 | 88 | |||||||||||

| Impairment | 908 | — | 908 | — | |||||||||||

| Depreciation and amortization expense | 53 | 36 | 132 | 76 | |||||||||||

| Total operating expenses | 8,278 | 32,995 | 28,021 | 54,477 | |||||||||||

| Income (loss) from operations | (8,278 | ) | (32,995 | ) | (28,021 | ) | (54,477 | ) | |||||||

| Non-operating income (expense): | |||||||||||||||

| Other income | 13 | 29 | 49 | 39 | |||||||||||

| Interest income | 388 | 1 | 914 | 2 | |||||||||||

| Derivative gain (loss) | — | — | 11,743 | — | |||||||||||

| Interest expense | (2,237 | ) | (1 | ) | (5,043 | ) | (2 | ) | |||||||

| Other income (expense) | (1 | ) | (3 | ) | (14 | ) | 961 | ||||||||

| Total non-operating income (expense) | (1,837 | ) | 26 | 7,649 | 1,000 | ||||||||||

| Income (loss) before income taxes | (10,115 | ) | (32,969 | ) | (20,372 | ) | (53,477 | ) | |||||||

| Income tax provision (benefit) | — | — | — | — | |||||||||||

| Net income (loss) | $ | (10,115 | ) | $ | (32,969 | ) | $ | (20,372 | ) | $ | (53,477 | ) | |||

| Net income (loss) per common share — basic and diluted | $ | (0.23 | ) | $ | (0.79 | ) | $ | (0.47 | ) | $ | (1.33 | ) | |||

| Weighted average common shares outstanding — basic and diluted | 44,104 | 41,895 | 43,737 | 40,148 | |||||||||||

| Comprehensive income (loss): | |||||||||||||||

| Net income (loss) | $ | (10,115 | ) | $ | (32,969 | ) | $ | (20,372 | ) | $ | (53,477 | ) | |||

| Reporting currency translation gain (loss) | — | (339 | ) | — | (1,169 | ) | |||||||||

| Comprehensive income (loss) | $ | (10,115 | ) | $ | (33,308 | ) | $ | (20,372 | ) | $ | (54,646 | ) | |||

| 5E ADVANCED MATERIALS, INC. CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS (Unaudited) (In thousands) | |||||||

| For the nine months ended March 31, | |||||||

| 2023 | 2022 | ||||||

| Cash Flows From Operating Activities: | |||||||

| Net income (loss) | $ | (20,372 | ) | $ | (53,477 | ) | |

| Adjustments to reconcile net income (loss) to net cash used by operating activities: | |||||||

| Depreciation and amortization | 132 | 76 | |||||

| Share based compensation | 4,251 | 4,428 | |||||

| Common stock issued for consulting fees | — | 27,172 | |||||

| Unrealized (gain) loss on convertible note derivative instrument | (11,743 | ) | — | ||||

| Impairment | 908 | — | |||||

| Accretion of reclamation liability | 20 | 6 | |||||

| Amortization of debt issuance costs and discount — convertible note | 3,454 | — | |||||

| Amortization of right of use asset | 124 | — | |||||

| Interest earned on reclamation bond | — | (1 | ) | ||||

| Net foreign exchange (gain) loss | — | (965 | ) | ||||

| Change in: | |||||||

| Prepaid expenses and other current assets | (386 | ) | (3,050 | ) | |||

| Accounts payable and accrued liabilities | (514 | ) | 2,421 | ||||

| Net cash used in operating activities | (24,126 | ) | (23,390 | ) | |||

| Cash Flows From Investing Activities: | |||||||

| Construction in progress | (29,705 | ) | (3,301 | ) | |||

| Mineral rights and properties additions | — | (87 | ) | ||||

| Properties, plant and equipment additions | (333 | ) | (1,222 | ) | |||

| Net cash used in investing activities | (30,038 | ) | (4,610 | ) | |||

| Cash Flows From Financing Activities: | |||||||

| Proceeds from issuance of convertible note | 55,840 | — | |||||

| Payments on note payable | (29 | ) | (104 | ) | |||

| Proceeds from issuance of common stock | — | 26,309 | |||||

| Share offering costs | — | (797 | ) | ||||

| Proceeds from exercise of stock options | 3,466 | 3,124 | |||||

| Net cash provided by financing activities | 59,277 | 28,532 | |||||

| Net increase (decrease) in cash and cash equivalents | 5,113 | 532 | |||||

| Effect of exchange rate fluctuation on cash | — | (203 | ) | ||||

| Cash and cash equivalents at beginning of period | 31,057 | 40,811 | |||||

| Cash and cash equivalents at end of period | $ | 36,170 | $ | 41,140 | |||

| Supplemental Disclosure of Cash Flow Information: | |||||||

| Cash paid for interest | $ | 5 | $ | — | |||

| Noncash Investing and Financing Activities: | |||||||

| Accounts payable and accrued liabilities change related to construction in progress | $ | 6,203 | $ | 2,022 | |||

| Interest paid through issuance of additional convertible notes | 1,710 | — | |||||

| Equipment acquired with notes payable | — | 227 | |||||

| Recognition of operating lease liability and right of use asset | — | 137 | |||||

| Increase (decrease) in asset retirement costs | 167 | — | |||||

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) is focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on our large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward Looking Statements and Disclosures

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this press release, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “estimate,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on 5E’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small-Scale Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; and other risks. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K filed on September 28, 2022. Additional risks are also disclosed by 5E in its filings with the U.S. Securities and Exchange Commission, throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

| J.T. Starzecki Chief Marketing Officer This email address is being protected from spambots. You need JavaScript enabled to view it. Ph: +1 (612) 719-5076 | Chris Sullivan Media This email address is being protected from spambots. You need JavaScript enabled to view it. Ph: +1 (917) 902-0617 |

| Last Trade: | US$3.71 |

| Daily Change: | -0.07 -1.85 |

| Daily Volume: | 217,994 |

| Market Cap: | US$87.220M |

January 08, 2026 December 17, 2025 December 09, 2025 November 19, 2025 November 14, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS