TEL AVIV, Israel, Aug. 07, 2024 (GLOBE NEWSWIRE) -- Enlight Renewable Energy Ltd. (NASDAQ: ENLT, TASE: ENLT) today reported financial results for the second quarter ending June 30, 2024. The Company’s earnings conference call and webcast will be held today at 8:00 AM ET. Registration links to both the call and the webcast can be found at the end of this earnings release.

| The entire suite of the Company’s 2Q24 financial results can be found on our IR website at https://enlightenergy.co.il/data/financial-reports/ |

Financial Highlights

6 months ending June 30, 2024

3 months ending June 30, 2024

Raising full year guidance range

The results of Enlight’s operations during the second quarter and first half of 2024 have been excellent. Revenues and EBITDA have been higher than our expectations after achieving sound operational performance as well as O&M and G&A cost savings. As a result, we are raising our full year guidance ranges for 2024. We now expect 2024 revenues in the range of $345-$360m from $335-$360m previously, and adjusted EBITDA1 in the range of $245-$260m from $235-$255m previously. This represents an increase of $5m and $7.5m from previous midpoints respectively, and further demonstrates our confidence in the positive trends and strong growth in all areas of our business.

Second Quarter Business Developments

“I’m pleased with Enlight’s excellent financial performance this quarter, exceeding our own expectations. The Company’s investment in the US has begun to bear fruit with the completion of construction at our flagship Atrisco project, which will begin to contribute a substantial amount of income to our operations in the coming months,” said Gilad Yavetz, CEO of Enlight Renewable Energy.

“The financial close of Atrisco Energy Storage, involving eight of the largest and most prestigious banks in the US and the world, highlights Enlight’s differentiated sources of financing. We believe that in the near future many opportunities will arise in the market, and Enlight’s advantage in access to finance will become significant.”

“The markets in Europe and Israel continue to grow in parallel with the increasing activity in the USA. We believe that thanks to the core infrastructure that we have created, together with differentiation in financing and ability to execute in all market conditions, we will continue to show rapid growth with high margins in the coming periods as well.”

Overview of Financial and Operating Results: Revenue

| ($ thousands) | For the six months period ended | For the three months ended | ||

| Segment | June 30, 2024 | June 30, 2023 | June 30, 2024 | June 30, 2023 |

| MENA | 66,041 | 29,757 | 37,567 | 15,919 |

| Europe | 101,123 | 89,530 | 41,963 | 34,507 |

| USA | 3,431 | - | 2,200 | - |

| Management and Construction | 4,500 | 4,270 | 2,968 | 2,137 |

| Total Revenues | 175,095 | 123,557 | 84,698 | 52,563 |

In the second quarter of 2024, the Company’s revenues increased to $85m, up from $53m last year, a growth rate of 61% year over year. The Company benefited from the revenue contribution of new operational projects, as well as higher production and inflation indexation embedded in our PPAs for already operational projects.

Since the second quarter of 2023, 592 MW and 434 MWh of projects were connected to the grid and began selling electricity, including Apex Solar in the U.S.; ACDC in Hungary; and Genesis Wind in Israel; and nine of the Solar & Storage Cluster units in Israel. The Company also benefited from the full ramp up of project Björnberget in Sweden which was partially operational in the second quarter of last year. In total, these new projects contributed $24m in 2Q24 and $46m in the first half of the year.

Prices at projects where electricity is sold under a merchant model were firm during the second quarter following volatility at the start of the year. Gecama revenues increased 37% year over year to $13m, as the project benefited from positive pricing and production trends. We sold electricity at an average of EUR 71 per MWh versus EUR 58 per MWh for the same period this year, while production was up 14% from the same period last year.

Financial performance was well-balanced between Europe and MENA, with 51% of revenues in the second quarter of 2024 denominated in Euros, 3% in US Dollars, and 46% denominated in Israeli Shekel. In contrast, the United States received the largest amount of investment capex during the quarter; as a result of this capex spending, approximately 15% of sales are expected to come the U.S. in 2025, adding more balance and diversification to Enlight’s revenues.

Net Income

In the second quarter, the Company’s net income amounted to $9m compared to $22m last year, a decline of 58% year over year. This change can be ascribed to following factors. The impact of new projects added $6m to the net income. In addition, we recorded the revaluation of our inflation-linked Shekel denominated debt, which resulted in a non-cash financial expense of $5m. The increase was driven by rising Israeli CPI values being applied to the higher amount of indexed senior debt on our balance sheet as compared to the same period last year. While rising inflation causes an increase in non-cash financial expense, it also results in higher revenues generated from index-linked electricity prices in Israel, which will be reflected in our financial results starting from 2025 and onwards. Overall, this represents a net benefit to the Company. Finally, 2Q23 financial income was boosted by $10m benefit recorded in other income stemming from the recalculation of the earnout payments linked to the acquisition of Clenera and from the recognition of LDs from Siemens Gamesa due to the delay in reaching full production at project Björnberget.

Adjusted EBITDA2

In the second quarter of 2024, the Company’s Adjusted EBITDA grew by 39% to $58m compared to $42m for the same period in 2023. The increase was driven by the same factors which affected our revenue increase, which contributed $32m, though offset by an additional $7m in higher operating expenses linked to new projects. We also recorded profit of approximately $1m from the sale of a U.S. project from within our advanced development portfolio. Company overhead rose by $2m year-on-year. Note that adjusted EBITDA for 2Q23 was boosted by $8m from the recognition of compensation received from Siemens linked to inadequate performance of turbines at the Björnberget project in Sweden.

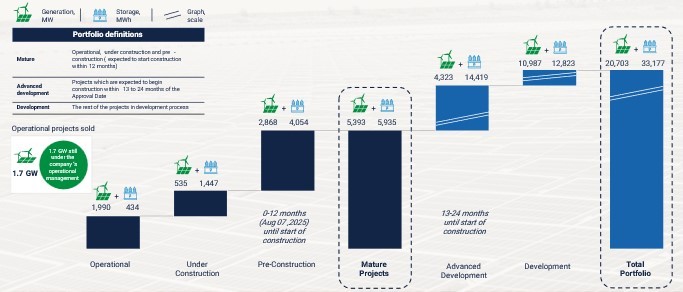

Portfolio Overview3

Key changes to the Company’s project portfolio during the second quarter of 2024:

United States

Enlight continues to increase its investment in the U.S., which will become an even more significant region for us in the coming years. Following project Apex which reached COD in 2023, we have completed the construction of our flagship Atrisco Solar and Energy Storage project, comprising 364 MW of solar and 1.2 GWh of battery located in New Mexico. Atrisco is now in the midst of the commissioning process, and is fast approaching COD. Mechanical works on both the Solar and the Energy Storage portions of the project have been completed. Gradual commencement of the Solar portion is expected to occur in the coming weeks, with full COD expected to be achieved during the rest of this year. The Energy Storage portion of the project reached financial close at the end of July, raising more than $400m in term loans and tax equity from HSBC and U.S. Bank. Additional information on the financial close appears in the Financing Arrangements section below.

Expansion plans in the United States

Quail Ranch, Roadrunner, and Country Acres projects, which together total 810 MW of generation and over 2 GWh of energy storage capacity, are all in advanced stages and progressing towards construction. We expect to begin with initial construction capex spending on all three sites during 2024. The business environment remains very supportive. Equipment costs have fallen, boosting our project returns in the U.S. during 2024 and beyond. Finally, we have been able to adapt to the new AD/CVD framework. Our panel supplier has shifted cell sourcing to non-affected Southeast Asian countries, maintaining a steady source of PV supply for the coming years.

Europe

Tapolca, a 60 MW solar plant and our fifth project in Hungary, began selling electricity on merchant markets at the end of July, on schedule. Construction of the 94 MW Pupin wind farm in Serbia is advancing as planned, and should reach COD during 2H25 as expected. Finally, project Björnberget in Sweden has reached full capacity, with all 60 turbines functioning.

Moving to our operational portfolio, the Gecama Wind project in Spain sold electricity at an average price of EUR 71 per MWh during 2Q24 compared to EUR 58 per MWh last year. During the quarter, 30% of production was sold at merchant price of EUR 35 per MWh, while 70% of production was secured under a financial hedge at EUR 85 per MWh. Spanish power prices risen significantly, and are now in the EUR 60-70 per MWh range. Gecama continues to excel on an operational level, with generation volumes up 14% and 17% for 2Q24 and 1H24 respectively when compared to the same periods last year.

Enlight’s hedging strategy provided significant downside protection against the volatility in prices, and will continue to do so for the rest of the year. Our EUR 100 per MWh hedge will cover 65% of Gecama’s anticipated generation for the rest of 2024 on an average basis. Enlight has already begun preparing a hedging strategy for 2025, and has entered into futures contracts covering 45% of our estimated generation output for next year at an approximate price of EUR 64 per MWh.

The Company expects development of the Gecama Hybrid project to reach completion soon. This project will add 225 MW solar generation and 220 MWh storage capacity to the existing wind farm, and is expected to begin construction in the coming months.

MENA

The build out of the Israel Solar + Storage clusters continued with the COD of Yesha and Re’im, adding 15 MW and 94 MWh to the project’s operational capacity. These are the eighth and ninth units within the cluster, which will ultimately comprise of 12 sites in the north and center of Israel, with a total capacity of 248 MW and 593 MWh. We expect COD for the remaining three sites during 2024. We also received approval for 200 MW of additional interconnect to Israel’s national grid, which will be used to expand the offtake of existing projects as well as support the launching of new ones.

We continue to expand our reach into Israel’s newly deregulated power sector with more commercial agreements. Our joint venture with Electra Power to supply electricity to the country’s household sector was formally launched in July, and we signed five additional corporate PPAs with industrial customers in the communications and real estate sectors.

Financing Arrangements

At the end of July, Enlight achieved the financial closing for the Atrisco Energy Storage project, a component of the Atrisco Solar and Energy Storage project with capacity of 364 MW and 1.2 GWh.

Sell downs of assets, whether operating, under construction, or still in development, remains an important strategic objective for Enlight. The Company estimates it will generate capital gains of $15m from sell-downs, likely to be realized towards the end of this year. This figure is included in the Adjusted EBITDA portion of our 2024 Financial Outlook.

Balance Sheet

The Company maintains $320m of revolving credit facilities, of which $170m have been drawn as of the date of this report. In addition, we expect the imminent receipt of $234m in equity recycled from the financial close of Atrisco Energy Storage, as mentioned above, and use part of the proceeds to repay a portion of our revolving credit facilities. These resources enhance our financial strength and provide additional flexibility to the Company as it delivers on its Mature Projects portfolio.

| ($ thousands) | June 30, 2024 | Pro Forma* |

| Cash and Cash Equivalents: | ||

| Enlight Renewable Energy Ltd, Enlight EU Energies Kft and Enlight Renewable LLC excluding subsidiaries (“Topco”) | 45,620 | 234,620 |

| Subsidiaries | 163,171 | 163,171 |

| Deposits: | ||

| Short term deposits | - | - |

| Restricted Cash: | ||

| Projects under construction | 161,120 | 161,120 |

| Reserves, including debt service, performance obligations and others | 35,097 | 35,097 |

| Total Cash | 405,008 | 594,008 |

| * Pro Forma after the recycling of Atrisco Energy Storage equity post financial close. The company expects to imminently receive $234m, and use part of the proceeds to repay revolving credit facility debt. The net cash expected to be recycled back to the company in the coming days is $189m. | ||

2024 Financial Outlook

Commenting on the outlook, Enlight Chief Financial Officer Nir Yehuda noted, “our financial performance has been very strong over the second quarter and first half of 2024. As a result, we are raising our guidance ranges of our Financial Outlook for the full year.”

Conference Call Information

Enlight plans to hold its Second Quarter 2024 Conference Call and Webcast on Wednesday, August 7, 2024 at 8:00 a.m. ET to review its financial results and business outlook. Management will deliver prepared remarks followed by a question-and-answer session. Participants can join by dial-in or webcast:

The press release with the financial results as well as the investor presentation materials will be accessible from the Company’s website prior to the conference call. Approximately one hour after completion of the live call, an archived version of the webcast will be available on the Company’s investor relations website at https://enlightenergy.co.il/info/investors/.

Supplemental Financial and Other Information

We intend to announce material information to the public through the Enlight investor relations website at https://enlightenergy.co.il/info/investors, SEC filings, press releases, public conference calls, and public webcasts. We use these channels to communicate with our investors, customers, and the public about our company, our offerings, and other issues. As such, we encourage investors, the media, and others to follow the channels listed above, and to review the information disclosed through such channels. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page of our website.

Non-IFRS Financial Measures

This release presents Adjusted EBITDA, a financial metric, which is provided as a complement to the results provided in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). A reconciliation of the non-IFRS financial information to the most directly comparable IFRS financial measure is provided in the accompanying tables found at the end of this release.

We define Adjusted EBITDA as net income (loss) plus depreciation and amortization, share based compensation, finance expenses, taxes on income and share in losses of equity accounted investees and minus finance income and non-recurring other income. Non-recurring other income for the second quarter of 2024 included income recognized in relation to the reduction of earnout we expect to pay as part of the Clenera Acquisition and other income recognized in relation to tax credits for projects in the United States. With respect to other expense (income), as part of Enlight’s strategy to accelerate growth and reduce the need for equity financing, the Company sells parts of, or entire, developed assets from time to time, and therefore includes realized gains and losses from these asset dispositions in Adjusted EBITDA. Our management believes Adjusted EBITDA is indicative of operational performance and ongoing profitability and uses Adjusted EBITDA to evaluate the operating performance and for planning and forecasting purposes.

Non-IFRS financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for financial information presented under IFRS. There are a number of limitations related to the use of non-IFRS financial measures versus comparable financial measures determined under IFRS. For example, other companies in our industry may calculate the non-IFRS financial measures that we use differently or may use other measures to evaluate their performance. All of these limitations could reduce the usefulness of our non-IFRS financial measures as analytical tools. Investors are encouraged to review the related IFRS financial measure, Net Income, and the reconciliations of Adjusted EBITDA provided below to Net Income and to not rely on any single financial measure to evaluate our business.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding the Company’s business strategy and plans, capabilities of the Company’s project portfolio and achievement of operational objectives, market opportunity, utility demand and potential growth, discussions with commercial counterparties and financing sources, pricing trends for materials, progress of Company projects, including anticipated timing of related approvals and project completion and anticipated production delays, the Company’s future financial results, expected impact from various regulatory developments and anticipated trade sanctions, expectations regarding wind production, electricity prices and windfall taxes, and Revenue and Adjusted EBITDA guidance, the expected timing of completion of our ongoing projects, and the Company’s anticipated cash requirements and financing plans , are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “target,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” “forecasts,” “aims” or the negative of these terms and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to site suitable land for, and otherwise source, renewable energy projects and to successfully develop and convert them into Operational Projects; availability of, and access to, interconnection facilities and transmission systems; our ability to obtain and maintain governmental and other regulatory approvals and permits, including environmental approvals and permits; construction delays, operational delays and supply chain disruptions leading to increased cost of materials required for the construction of our projects, as well as cost overruns and delays related to disputes with contractors; disruptions in trade caused by political, social or economic instability in regions where our components and materials are made; our suppliers’ ability and willingness to perform both existing and future obligations; competition from traditional and renewable energy companies in developing renewable energy projects; potential slowed demand for renewable energy projects and our ability to enter into new offtake contracts on acceptable terms and prices as current offtake contracts expire; offtakers’ ability to terminate contracts or seek other remedies resulting from failure of our projects to meet development, operational or performance benchmarks; exposure to market prices in some of our offtake contracts; various technical and operational challenges leading to unplanned outages, reduced output, interconnection or termination issues; the dependence of our production and revenue on suitable meteorological and environmental conditions, and our ability to accurately predict such conditions; our ability to enforce warranties provided by our counterparties in the event that our projects do not perform as expected; government curtailment, energy price caps and other government actions that restrict or reduce the profitability of renewable energy production; electricity price volatility, unusual weather conditions (including the effects of climate change, could adversely affect wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission system constraints and the possibility that we may not have adequate insurance to cover losses as a result of such hazards; our dependence on certain operational projects for a substantial portion of our cash flows; our ability to continue to grow our portfolio of projects through successful acquisitions; changes and advances in technology that impair or eliminate the competitive advantage of our projects or upsets the expectations underlying investments in our technologies; our ability to effectively anticipate and manage cost inflation, interest rate risk, currency exchange fluctuations and other macroeconomic conditions that impact our business; our ability to retain and attract key personnel; our ability to manage legal and regulatory compliance and litigation risk across our global corporate structure; our ability to protect our business from, and manage the impact of, cyber-attacks, disruptions and security incidents, as well as acts of terrorism or war; changes to existing renewable energy industry policies and regulations that present technical, regulatory and economic barriers to renewable energy projects; the reduction, elimination or expiration of government incentives for, or regulations mandating the use of, renewable energy; our ability to effectively manage the global expansion of the scale of our business operations; our ability to perform to expectations in our new line of business involving the construction of PV systems for municipalities in Israel; our ability to effectively manage our supply chain and comply with applicable regulations with respect to international trade relations, tariffs, sanctions, export controls and anti-bribery and anti-corruption laws; our ability to effectively comply with Environmental Health and Safety and other laws and regulations and receive and maintain all necessary licenses, permits and authorizations; our performance of various obligations under the terms of our indebtedness (and the indebtedness of our subsidiaries that we guarantee) and our ability to continue to secure project financing on attractive terms for our projects; limitations on our management rights and operational flexibility due to our use of tax equity arrangements; potential claims and disagreements with partners, investors and other counterparties that could reduce our right to cash flows generated by our projects; our ability to comply with increasingly complex tax laws of various jurisdictions in which we currently operate as well as the tax laws in jurisdictions in which we intend to operate in the future; the unknown effect of the dual listing of our ordinary shares on the price of our ordinary shares; various risks related to our incorporation and location in Israel, including the ongoing war in Israel, where our headquarters and some of our wind energy and solar energy projects are located; the costs and requirements of being a public company, including the diversion of management’s attention with respect to such requirements; certain provisions in our Articles of Association and certain applicable regulations that may delay or prevent a change of control; and other risk factors set forth in the section titled “Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”), as may be updated in our other documents filed with or furnished to the SEC.

These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this press release. You should not put undue reliance on any forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by applicable law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

About Enlight

Founded in 2008, Enlight develops, finances, constructs, owns, and operates utility-scale renewable energy projects. Enlight operates across the three largest renewable segments today: solar, wind and energy storage. A global platform, Enlight operates in the United States, Israel and 9 European countries. Enlight has been traded on the Tel Aviv Stock Exchange since 2010 (TASE: ENLT) and completed its U.S. IPO (Nasdaq: ENLT) in 2023.

Company Contacts

Yonah Weisz

Director IR

This email address is being protected from spambots. You need JavaScript enabled to view it.

Erica Mannion or Mike Funari

Sapphire Investor Relations, LLC

+1 617 542 6180

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Appendix 1 – Financial information | |||||||

| Consolidated Statements of Income | |||||||

| For the six months ended June 30 | For the three months ended June 30 | ||||||

| 2024 USD in thousands | 2023 USD in thousands | 2024 USD in thousands | 2023 USD in thousands | ||||

Revenues | 175,095 | 123,557 | 84,698 | 52,563 | |||

| Cost of sales | (32,421) | (20,413) | (16,985) | (10,160) | |||

| Depreciation and amortization | (49,557) | (25,961) | (24,825) | (13,211) | |||

| Gross profit | 93,117 | 77,183 | 42,888 | 29,192 | |||

| General and administrative expenses | (19,471) | (16,491) | (9,740) | (8,418) | |||

| Development expenses | (4,542) | (2,888) | (2,124) | (1,513) | |||

| Other income | 8,665 | 14,734 | 3,857 | 14,229 | |||

| (15,348) | (4,645) | (8,007) | 4,298 | ||||

| Operating profit | 77,769 | 72,538 | 34,881 | 33,490 | |||

| Finance income | 15,065 | 32,262 | 7,000 | 11,885 | |||

| Finance expenses | (49,311) | (33,431) | (29,818) | (17,068) | |||

| Total finance expenses, net | (34,246) | (1,169) | (22,818) | (5,183) | |||

| Profit before tax and equity loss | 43,523 | 71,369 | 12,063 | 28,307 | |||

| Share of loss of equity accounted investees | (449) | (368) | (305) | (163) | |||

| Profit before income taxes | 43,074 | 71,001 | 11,758 | 28,144 | |||

| Taxes on income | (9,130) | (15,294) | (2,299) | (5,713) | |||

| Profit for the period | 33,944 | 55,707 | 9,459 | 22,431 | |||

| Profit for the period attributed to: | |||||||

| Owners of the Company | 24,806 | 38,541 | 8,043 | 14,547 | |||

| Non-controlling interests | 9,138 | 17,166 | 1,416 | 7,884 | |||

| 33,944 | 55,707 | 9,459 | 22,431 | ||||

| Earnings per ordinary share (in USD) | |||||||

| with a par value of NIS 0.1, attributable to | |||||||

| owners of the parent Company: | |||||||

| Basic earnings per share | 0.21 | 0.34 | 0.07 | 0.12 | |||

| Diluted earnings per share | 0.20 | 0.32 | 0.06 | 0.12 | |||

| Weighted average of share capital used in the | |||||||

| calculation of earnings: | |||||||

| Basic per share | 118,104,228 | 113,564,373 | 117,825,464 | 117,638,008 | |||

| Diluted per share | 123,092,306 | 121,823,868 | 125,866,004 | 125,873,060 | |||

| Consolidated Statements of Financial Position as of | ||||

| June 30 | December 31 | |||

| 2024 | 2023 | |||

| USD in | USD in | |||

| Thousands | Thousands | |||

| Assets | ||||

| Current assets | ||||

| Cash and cash equivalents | 208,791 | 403,805 | ||

| Deposits in banks | - | 5,308 | ||

| Restricted cash | 161,120 | 142,695 | ||

| Trade receivables | 38,375 | 43,100 | ||

| Other receivables | 41,059 | 60,691 | ||

| Current maturities of contract assets | - | 8,070 | ||

| Other financial assets | 2,601 | 976 | ||

| Total current assets | 451,946 | 664,645 | ||

| Non-current assets | ||||

| Restricted cash | 35,097 | 38,891 | ||

| Other long-term receivables | 72,111 | 32,540 | ||

| Deferred costs in respect of projects | 283,890 | 271,424 | ||

| Deferred borrowing costs | 891 | 493 | ||

| Loans to investee entities | 47,960 | 35,878 | ||

| Contract assets | - | 91,346 | ||

| Fixed assets, net | 3,349,973 | 2,947,369 | ||

| Intangible assets, net | 286,076 | 287,961 | ||

| Deferred taxes assets | 9,068 | 9,134 | ||

| Right-of-use asset, net | 124,016 | 121,348 | ||

| Financial assets at fair value through profit or loss | 67,031 | 53,466 | ||

| Other financial assets | 72,568 | 79,426 | ||

| Total non-current assets | 4,348,681 | 3,969,276 | ||

| Total assets | 4,800,627 | 4,633,921 | ||

| Consolidated Statements of Financial Position as of (Cont.) | ||||

| June 30 | December 31 | |||

| 2024 | 2023 | |||

| USD in | USD in | |||

| Thousands | Thousands | |||

| Liabilities and equity | ||||

| Current liabilities | ||||

| Credit and current maturities of loans from | 521,810 | 324,666 | ||

| banks and other financial institutions | ||||

| Trade payables | 90,279 | 105,574 | ||

| Other payables | 83,429 | 103,622 | ||

| Current maturities of debentures | 44,885 | 26,233 | ||

| Current maturities of lease liability | 9,961 | 8,113 | ||

| Financial liabilities through profit or loss | 11,389 | 13,860 | ||

| Other financial liabilities | 1,308 | 1,224 | ||

| Total current liabilities | 763,061 | 583,292 | ||

| Non-current liabilities | ||||

| Debentures | 264,150 | 293,751 | ||

| Other financial liabilities | 55,522 | 62,020 | ||

| Convertible debentures | 127,517 | 130,566 | ||

| Loans from banks and other financial institutions | 1,723,627 | 1,702,925 | ||

| Loans from non-controlling interests | 79,149 | 92,750 | ||

| Financial liabilities through profit or loss | 34,529 | 34,524 | ||

| Deferred taxes liabilities | 49,400 | 44,941 | ||

| Employee benefits | 5,017 | 4,784 | ||

| Lease liability | 120,332 | 119,484 | ||

| Other payables | 54,355 | 60,880 | ||

| Asset retirement obligation | 66,212 | 68,047 | ||

| Total non-current liabilities | 2,579,810 | 2,614,672 | ||

| Total liabilities | 3,342,871 | 3,197,964 | ||

| Equity | ||||

| Ordinary share capital | 3,307 | 3,293 | ||

| Share premium | 1,028,532 | 1,028,532 | ||

| Capital reserves | 46,461 | 57,730 | ||

| Proceeds on account of convertible options | 15,494 | 15,494 | ||

| Accumulated profit | 88,516 | 63,710 | ||

| Equity attributable to shareholders of the Company | 1,182,310 | 1,168,759 | ||

| Non-controlling interests | 275,446 | 267,198 | ||

| Total equity | 1,457,756 | 1,435,957 | ||

| Total liabilities and equity | 4,800,627 | 4,633,921 | ||

| Consolidated Statements of Cash Flows | ||||

| For the six months period ended June 30 | For the three months period ended June 30 | |||

| 2024 | 2023 | 2024 | 2023 | |

| USD in | USD in | USD in | USD in | |

| Thousands | Thousands | Thousands | Thousands | |

| Cash flows for operating activities | ||||

| Profit for the period | 33,944 | 55,707 | 9,459 | 22,431 |

| Income and expenses not associated with cash flows: | ||||

| Depreciation and amortization | 50,886 | 26,777 | 25,282 | 13,637 |

| Finance expenses, net | 33,766 | 14,182 | 22,280 | 7,836 |

| Share-based compensation | 4,085 | 2,850 | 968 | 1,461 |

| Taxes on income | 9,130 | 15,294 | 2,299 | 5,713 |

| Other income, net | (6,705) | (6,303) | (3,280) | (5,798) |

| Company’s share in losses of investee partnerships | 449 | 368 | 305 | 163 |

| 91,611 | 53,168 | 47,854 | 23,012 | |

| Changes in assets and liabilities items: | ||||

| Change in other receivables | (4,352) | (13,331) | (2,210) | (15,653) |

| Change in trade receivables | 3,072 | 10,837 | 19,981 | 13,221 |

| Change in other payables | 860 | (1,100) | 1,399 | 2,313 |

| Change in trade payables | (856) | (169) | (927) | (976) |

| (1,276) | (3,763) | 18,243 | (1,095) | |

| Interest receipts | 5,366 | 7,791 | 2,438 | 3,240 |

| Interest paid | (33,793) | (22,695) | (18,169) | (10,631) |

| Income Tax paid | (4,783) | (2,854) | (3,985) | (2,406) |

| Repayment of contract assets | - | 7,447 | - | 4,807 |

| Net cash from operating activities | 91,069 | 94,801 | 55,840 | 39,358 |

| Cash flows for investing activities | ||||

| Acquisition of consolidated entities | (1,388) | - | - | - |

| Changes in restricted cash and bank deposits, net | (15,370) | 2,456 | (10,382) | (17,630) |

| Purchase, development, and construction in respect of projects | (461,801) | (359,622) | (262,068) | (210,844) |

| Loans provided and Investment in investees | (14,216) | (21,523) | (2,932) | (21,214) |

| Repayment of loans to investees | - | 12,555 | - | - |

| Payments on account of acquisition of consolidated company | (10,851) | (1,073) | - | - |

| Proceeds from sale (purchase) of long-term financial assets measured at fair value through profit or loss, net | (11,340) | (5,837) | (2,931) | (3,294) |

| Net cash used in investing activities | (514,966) | (373,044) | (278,313) | (252,982) |

| Consolidated Statements of Cash Flows (Cont.) | ||||

| For the six months period ended June 30 | For the three months period ended June 30 | |||

| 2024 | 2023 | 2024 | 2023 | |

| USD in | USD in | USD in | USD in | |

| Thousands | Thousands | Thousands | Thousands | |

| Cash flows from financing activities | ||||

| Receipt of loans from banks and other financial institutions | 330,449 | 202,542 | 259,078 | 33,001 |

| Repayment of loans from banks and other financial institutions | (77,197) | (42,748) | (66,749) | (29,613) |

| Repayment of debentures | (1,284) | (1,300) | - | - |

| Dividends and distributions by subsidiaries to non-controlling interests | (3,450) | (5,227) | (3,342) | (3,247) |

| Deferred borrowing costs | (5,378) | (1,041) | (2,696) | (36) |

| Receipt of loans from non-controlling interests | - | 274 | - | 274 |

| Repayment of loans from non-controlling interests | (1,000) | (663) | (45) | - |

| Increase in holding rights of consolidated entity | (167) | - | (167) | - |

| Issuance of shares | - | 266,635 | - | 2,590 |

| Exercise of share options | 13 | - | 13 | - |

| Repayment of lease liability | (4,117) | (2,931) | (446) | (536) |

| Proceeds from investment in entities by non- controlling interest | 179 | 2,679 | 27 | - |

| Net cash from financing activities | 238,048 | 418,220 | 185,673 | 2,433 |

| Increase (Decrease) in cash and cash equivalents | (185,849) | 139,977 | (36,800) | (211,191) |

| Balance of cash and cash equivalents at beginning of period | 403,805 | 193,869 | 249,851 | 542,467 |

| Effect of exchange rate fluctuations on cash and cash equivalents | (9,165) | (13,128) | (4,260) | (10,558) |

| Cash and cash equivalents at end of period | 208,791 | 320,718 | 208,791 | 320,718 |

Segmental Reporting

| For the six months ended June 30, 2024 | |||||||||||||

| MENA(**) | Europe(**) | USA | Management and Construction | Total reportable segments | Adjustments | Total | |||||||

| USD in thousands | |||||||||||||

| External revenues | 66,041 | 101,123 | 3,431 | 4,500 | 175,095 | - | 175,095 | ||||||

| Inter-segment revenues | - | - | - | 2,851 | 2,851 | (2,851) | - | ||||||

| Total revenues | 66,041 | 101,123 | 3,431 | 7,351 | 177,946 | (2,851) | 175,095 | ||||||

| Segment Adjusted | |||||||||||||

| EBITDA | 54,873 | 83,253 | 1,305 | 2,291 | 141,722 | - | 141,722 | ||||||

| Reconciliations of unallocated amounts: | |||||||||||||

| Headquarter costs (*) | (15,629) | ||||||||||||

| Intersegment profit | 121 | ||||||||||||

| Depreciation and amortization and share-based compensation | (54,971) | ||||||||||||

| Other incomes not attributed to segments | 6,526 | ||||||||||||

| Operating profit | 77,769 | ||||||||||||

| Finance income | 15,065 | ||||||||||||

| Finance expenses | (49,311) | ||||||||||||

| Share in the losses of equity accounted investees | (449) | ||||||||||||

| Profit before income taxes | 43,074 | ||||||||||||

| (*) Including general and administrative and development expenses (excluding depreciation and amortization and share based compensation). | |||||||||||||

| (**) Due to the Company's organizational restructuring, the Chief Operation Decision Maker (CODM) now reviews the group’s results by segmenting them into four business units: MENA (Middle East and North Africa), Europe, the US, and Management and Construction. Consequently, the Central/Eastern Europe and Western Europe segments have been consolidated into the "Europe" segment, and the Israel segment has been incorporated into the MENA segment. The comparative figures for the six-month and three-month periods ending June 30, 2023, have been updated accordingly. | |||||||||||||

Segmental Reporting

| For the six months ended June 30, 2023 | |||||||||||

| MENA | Europe | Management and Construction | Total reportable segments | Adjustments | Total | ||||||

| USD in thousands | |||||||||||

| External revenues | 29,757 | 89,530 | 4,270 | 123,557 | - | 123,557 | |||||

| Inter-segment revenues | - | - | 2,642 | 2,642 | (2,642) | - | |||||

| Total revenues | 29,757 | 89,530 | 6,912 | 126,199 | (2,642) | 123,557 | |||||

| Segment Adjusted | |||||||||||

| EBITDA | 30,450 | 84,085 | 1,794 | 116,329 | - | 116,329 | |||||

| Reconciliations of unallocated amounts: | |||||||||||

| Headquarter costs (*) | (14,493) | ||||||||||

| Intersegment profit | 701 | ||||||||||

| Repayment of contract asset under concession arrangements | (7,447) | ||||||||||

| Depreciation and amortization and share-based compensation | (29,627) | ||||||||||

| Other incomes not attributed to segments | 7,075 | ||||||||||

| Operating profit | 72,538 | ||||||||||

| Finance income | 32,262 | ||||||||||

| Finance expenses | (33,431) | ||||||||||

| Share in the losses of equity accounted investees | (368) | ||||||||||

| Profit before income taxes | 71,001 | ||||||||||

| (*) Including general and administrative and development expenses (excluding depreciation and amortization and share based compensation). | |||||||||||

Segmental Reporting

| For the three months ended June 30, 2024 | ||||||||||||||

| MENA | Europe | USA | Management and Construction | Total reportable segments | Adjustments | Total | ||||||||

| USD in thousands | ||||||||||||||

| External revenues | 37,567 | 41,963 | 2,200 | 2,968 | 84,698 | - | 84,698 | |||||||

| Inter-segment revenues | - | - | - | 1,395 | 1,395 | (1,395) | - | |||||||

| Total revenues | 37,567 | 41,963 | 2,200 | 4,363 | 86,093 | (1,395) | 84,698 | |||||||

| Segment Adjusted | ||||||||||||||

| EBITDA | 30,345 | 32,546 | 1,447 | 1,623 | 65,961 | - | 65,961 | |||||||

| Reconciliations of unallocated amounts: | ||||||||||||||

| Headquarter costs (*) | (8,023) | |||||||||||||

| Intersegment profit | (69) | |||||||||||||

| Depreciation and amortization and share-based compensation | (26,250) | |||||||||||||

| Other incomes not attributed to segments | 3,262 | |||||||||||||

| Operating profit | 34,881 | |||||||||||||

| Finance income | 7,000 | |||||||||||||

| Finance expenses | (29,818) | |||||||||||||

| Share in the losses of equity accounted investees | (305) | |||||||||||||

| Profit before income taxes | 11,758 | |||||||||||||

| (*) Including general and administrative and development expenses (excluding depreciation and amortization and share based compensation). | ||||||||||||||

Segmental Reporting

| For the three months ended June 30, 2023 | |||||||||||

| MENA | Europe | Management and Construction | Total reportable segments | Adjustments | Total | ||||||

| USD in thousands | |||||||||||

| External revenues | 15,919 | 34,507 | 2,137 | 52,563 | - | 52,563 | |||||

| Inter-segment revenues | - | - | 1,246 | 1,246 | (1,246) | - | |||||

| Total revenues | 15,919 | 34,507 | 3,383 | 53,809 | (1,246) | 52,563 | |||||

| Segment Adjusted | |||||||||||

| EBITDA | 16,987 | 36,431 | 1,043 | 54,461 | - | 54,461 | |||||

| Reconciliations of unallocated amounts: | |||||||||||

| Headquarter costs (*) | (8,438) | ||||||||||

| Intersegment profit | 297 | ||||||||||

| Repayment of contract asset under concession arrangements | (4,807) | ||||||||||

| Depreciation and amortization and share-based compensation | (15,098) | ||||||||||

| Other incomes not attributed to segments | 7,075 | ||||||||||

| Operating profit | 33,490 | ||||||||||

| Finance income | 11,885 | ||||||||||

| Finance expenses | (17,068) | ||||||||||

| Share in the losses of equity accounted investees | (163) | ||||||||||

| Profit before income taxes | 28,144 | ||||||||||

| (*) Including general and administrative and development expenses (excluding depreciation and amortization and share based compensation). | |||||||||||

| Appendix 2 - Reconciliations between Net Income to Adjusted EBITDA | |||||||||

| ($ thousands) | For the six months | For the three months | |||||||

| ended June 30 | ended June 30 | ||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||

| Net Income (loss) | 33,944 | 55,707 | 9,459 | 22,431 | |||||

| Depreciation and amortization | 50,886 | 26,777 | 25,282 | 13,637 | |||||

| Share based compensation | 4,085 | 2,850 | 968 | 1,461 | |||||

| Finance income | (15,065) | (32,262) | (7,000) | (11,885) | |||||

| Finance expenses | 49,311 | 33,431 | 29,818 | 17,068 | |||||

| Non-recurring other income (*) | (6,526) | (7,075) | (3,262) | (7,075) | |||||

| Share of losses of equity accounted investees | 449 | 368 | 305 | 163 | |||||

| Taxes on income | 9,130 | 15,294 | 2,299 | 5,713 | |||||

| Adjusted EBITDA | 126,214 | 95,090 | 57,869 | 41,513 | |||||

| * Non-recurring other income comprised the recognition of income related to other income recognized in relation to tax credits for projects in the United States | |||||||||

Appendix 3 – Debentures Covenants

Debentures Covenants

As of June 30, 2024, the Company was in compliance with all of its financial covenants under the indenture for the Series C-F Debentures, based on having achieved the following in its consolidated financial results:

Minimum equity

The company's equity shall be maintained at no less than NIS 200 million so long as debentures E remain outstanding, no less than NIS 375 million so long as debentures F remain outstanding, and NIS 1,250 million so long as debentures C and D remain outstanding.

As of June 30, 2024, the company’s equity amounted to NIS 5,480 million.

Net financial debt to net CAP

The ratio of standalone net financial debt to net CAP shall not exceed 70% for two consecutive financial periods so long as debentures E and F remain outstanding, and shall not exceed 65% for two consecutive financial periods so long as debentures C and D remain outstanding.

As of June 30, 2024, the net financial debt to net CAP ratio, as defined above, stands at 36%.

Net financial debt to EBITDA

So long as debentures E and F remain outstanding, standalone financial debt shall not exceed NIS 10 million, and the consolidated financial debt to EBITDA ratio shall not exceed 18 for more than two consecutive financial periods.

For as long as debentures C and D remain outstanding, the consolidated financial debt to EBITDA ratio shall not exceed 15 for more than two consecutive financial periods.

As of June 30, 2024, the net financial debt to EBITDA ratio, as defined above, stands at 10.

Equity to balance sheet

The standalone equity to total balance sheet ratio shall be maintained at no less than 20% and 25%, respectively, for two consecutive financial periods for as long as debentures E and F, and debentures C and D remain outstanding.

As of June 30, 2024, the equity to balance sheet ratio, as defined above, stands at 60%.

| Last Trade: | US$51.77 |

| Daily Change: | 1.42 2.82 |

| Daily Volume: | 19,826 |

| Market Cap: | US$6.840B |

November 12, 2025 June 03, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS