All of the amounts disclosed in this press release are in U.S. dollars unless otherwise noted

TEL AVIV, Israel, May 11, 2023 (GLOBE NEWSWIRE) -- Enlight Renewable Energy Ltd. (NASDAQ: ENLT, TASE: ENLT) today reported financial results for the first quarter ended March 31, 2023.

The Company’s quarterly earnings materials and a link to the earnings webcast, which will be held today at 8:00 AM ET, may be found on the investor relations section of Enlight’s website at https://enlightenergy.co.il/data/financial-reports/

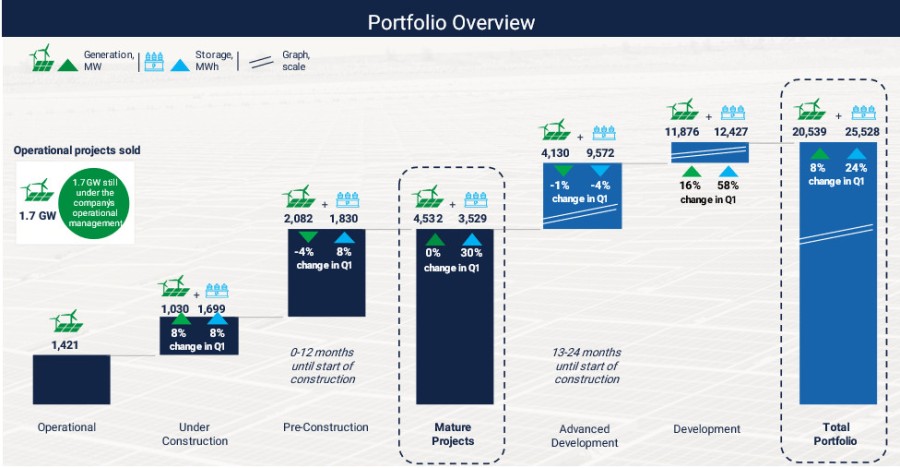

“We delivered record results in the first quarter of 2023, with Revenue up 103%, Net Income up 275% and Adjusted EBITDA* up 118%, driven by the 810 MW of projects that went into operation over the past year. Moreover, we believe that we have strong visibility on future growth. With a further 1 GW and 1.7 GWh of projects under construction and an additional 2.1 GW and 1.8 GWh of projects in pre-construction, all of which are projected to reach commercial operation by the end of 2025, we believe our growth is poised to continue apace over the coming years”, said Gilad Yavetz, CEO of Enlight Renewable Energy.

“In addition, we believe our projects can earn above-market returns due to our expertise in greenfield development, coupled with the positive regulatory backdrop of the Inflation Reduction Act. During the quarter we secured 480 MW of power purchase agreement (“PPA”) amendments with an average price increase of 30% and signed 475 MW of new PPAs at attractive prices. This demonstrates our ability to maintain above-market returns, despite the higher interest rate environment,” Yavetz added.

“We are also pleased to provide color on our funding capabilities post our U.S. initial public offering. With existing resources, we believe we can complete the entirety of our Mature Projects, with excess cash to spare. Moreover, we believe we have the financial flexibility to accelerate our growth thereafter, at our stated project deployment guidance of 1.5 GW per year, based on our current operating plan. We have several financing tools available to us to fund anticipated future growth, including distributions generated from our projects, proceeds from the sale of a minority ownership stake of some of our U.S. projects, issuance of unsecured bonds and project debt refinancings, without requiring additional equity financing. We believe that our successful development and execution efforts coupled with the U.S. IPO has created an autonomous machine that is in prime position to capture the massive opportunity we see ahead.”

First Quarter Highlights

Overview of Financial and Operating Results

Revenue

| ($ thousands) | For the Three Months Ended | |

| Segment | 3/31/23 | 3/31/22 |

| Israel | 13,838 | 4,689 |

| Central-Eastern Europe | 23,235 | 21,330 |

| Western Europe | 31,788 | 6,589 |

| Management and Construction | 2,133 | 2,452 |

| Total Revenues | 70,994 | 35,060 |

In the first quarter of 2023, the Company’s revenues increased to $71m, up from $35m last year, a growth rate of 103% year over year. Growth was mainly driven by the revenue contribution of new operational projects, as well as the inflation indexation embedded in PPAs for already-operating projects.

Since this period last year, 810 MW of projects started selling power, including Emek Habacha, Gecama and Björnberget. These projects collectively contributed $32m of revenue. Björnberget made its first substantial contribution in the first quarter, generating $3m of revenue as turbines were gradually commissioned during the quarter.

The Company also benefited from inflation indexation embedded in its PPAs, which contributed an additional $2m of revenue during the quarter. This reflected an average indexation of 6.3% across 483 MW of PPAs for projects that have been operational for a full year. 42% of the Company’s operational projects include PPAs with annual inflation indexation, which we believe is an advantage in today’s inflationary environment.

Finally, growth was also partly driven by the recognition of all proceeds from the sale of electricity by the Halutziot project as revenue. Halutziot was reclassified out of Financial Assets in the second quarter of 2022 and contributed an additional $2m to revenue in the first quarter of 2023.

These positive impacts totaling $36m were offset by weaker currency exchange rates (“FX”), which had a $2m impact during the first quarter.

Financial performance was well-balanced between Western Europe, Central-Eastern Europe (“CEE”) and Israel, with 76% of revenues in the first quarter of 2023 denominated in Euros, 2% in another European currency and 22% denominated in Israeli shekel. In the second half of 2023, revenue is expected to include a substantial contribution denominated in U.S. dollars, following the planned completion of Apex Solar, the Company’s first project in the United States. Apex Solar is expected to come online by the end of the second quarter of 2023.

In addition to the above, the Company sold $3m of electricity in projects treated as financial assets in the quarter. Under IFRS this revenue is accounted for as financing income or other non-P&L metrics.

Net Income

In the first quarter of 2023, the Company’s net income increased to $33m, up from $9m year over year, a growth rate of 275%. $14m of the growth was driven by new projects. The residual growth of $11m was driven by interest income on deposits as well as foreign exchange impacts (strengthening USD relative to the NIS) on our cash and cash equivalents.

Adjusted EBITDA*

In the first quarter of 2023, the Company’s Adjusted EBITDA more than doubled to $54m compared to $25m for the same period in 2022.

The increase was driven by the same factors which affected our revenue increase in the same period, offset by a $3m increase in overhead as the team scales to accommodate rapid growth.

Portfolio Overview2

Key changes to the Company’s projects portfolio during the first quarter of 2023:

Anticipated Funding Capabilities

Supported by the strong financial position resulting from its U.S. IPO, the Company is pleased to present its anticipated funding capabilities. Utilizing existing resources, including cash on hand and distributions generated from its operational projects, the Company believes that it has sufficient equity capital to complete the entirety of the Mature Project portfolio of 4.5 GW generation and 3.5 GWh storage, all based on the current operating plan and its current assumptions.

Moreover, we believe the Company is well positioned to construct an additional 1.5 GW of capacity per annum as per its project deployment guidance from 2026 onward based on the current operating plan - without requiring additional equity. The Company expects this can be financed through the distributions generated from the Company’s Mature Portfolio of 4.5 GW and 3.5 GWh, together with a wide array of financing tools, including the sale of a minority ownership stake of some of the Company’s projects in the U.S., where it holds 100% effective ownership, the issuance of unsecured bonds where the Company benefits from an A2 local credit rating in Israel, and the refinancing of some of the Company’s project level debt.

Additional detail is provided in the investor presentation posted to the investor relations section of the Company’s website.

Market Updates: United States

The Company delivered meaningful progress on its large U.S. portfolio during the first quarter of 2023.

The Company’s Apex Solar project located in southwestern Montana is nearing completion. Module and other equipment deliveries are on schedule and related construction timelines are on track. We expect to finalize commissioning and reach commercial operation at the end of June. Our US asset management team is prepared to support commercial operations for Apex Solar beginning in the second half of 2023.

In New Mexico, our 360 MW / 1,200 MWh Atrisco Solar project is advancing steadily. Solar module deliveries commenced in April and continue at a steady pace. Site work is on schedule. Commercial operation is expected by the end of the second quarter 2024.

The Atrisco project financing is also advancing steadily. The Company is negotiating arrangements with several lenders to provide a construction facility exceeding $800m, permanent back leverage of $380m and tax equity of $450m. The banks include some of the largest financial institutions in the renewable sector, highlighting the strength of the project. We are on target to reach financial close before the end of the second quarter and expect to announce further details upon closing. With Atrisco, the Company is demonstrating its ability to maintain strong project economics and predictable execution.

In Arizona, the Company is making big strides on the CO Bar project. At 1,200 MW solar and 824 MWh storage, CO Bar is the first of the Company’s gigawatt sized projects to mature. In the first quarter, the Company contracted an incremental 475 MW on the project, bringing the total contracted solar at CO Bar to nearly 1 GW. A PPA on the remaining 200 MW is presently under negotiations and that PPA would add the first 824 MWh of storage on the project. More details are anticipated to be announced in Q3. We are pleased with our utility partners on the project, and we plan to announce their details in the second half of 2023.

On the development front, the CO Bar project has primary land control and permitting in place. The system impact study (SIS) for the interconnection is also complete, and the facilities study is nearing finalization. By signing and funding an E&P (Engineering and Procurement) agreement with the interconnecting utility, the project is on an accelerated pace to complete engineering for the interconnection and order any long lead-time equipment in advance of finalizing and signing the interconnection agreement (the LGIA). CO Bar is expected to start construction in the fourth quarter of 2023 and achieve COD in phases through 2025. The project stands to benefit from the IRA, including the production tax credit (PTC) and the possibility of a domestic content adder. There is also potential to contract an additional 3.2 GWh of storage at the project.

Based on its interpretation of the published U.S. Treasury guidance, the Company can now estimate the percentage of its U.S. portfolio which may benefit from the energy community tax credit adder under the Inflation Reduction Act. The energy community adder gives a 10% multiplier to the project’s PTC value and a 10% addition to the ITC rate. The Company estimates that at least 25% of its portfolio in the U.S. may qualify based on the guidance. Note that the 25% estimate does not include any projects that may qualify as energy zones based on the brownfield criteria. We are reviewing the brownfield possibilities in detail and will have a more informed view on which projects potentially qualify in the next several months.

| Project Classification (MW) | Potential Qualification Under Closed Coal Mine | Potential Qualification Under Both Fossil Fuel & Current Unemployment Figures | Total Potential Qualification |

| Mature Projects | 256 | - | 256 |

| Advanced Development | 1,320 | 375 | 1,695 |

| Development | 1,058 | 670 | 1,728 |

| Total | 2,634 | 1,045 | 3,679 |

| % of Total Portfolio | 17% | 7% | 25% |

The Company’s diversified supply chain is designed to meet its growing module supply needs. We have supply commitments for up to 2 GW of modules from India through 2025, and access to additional volume out of Southeast Asia during the waiver period.

Finally, the Company’s advanced portfolio and market specific knowledge is enabling it to avoid the increasing interconnection queue congestion across the United States. With more than 8.7 GW of projects (+240 MW versus Q4 2022) past system impact study--the critical phase of the interconnection study process--the Company believes it is well positioned to continue and even accelerate its growth in the United States.

Europe

The Company is benefiting from strong power pricing in Europe. For example, in the first quarter of 2023, Gecama (Spain) benefited from an average net price of 85 EUR/MWh, 85% of which was hedged. Electricity demand is high, and competing sources still suffer from high input costs. Notably, natural gas prices remain significantly above historical levels.

Project Björnberget (Sweden), at 372 MW is one of the largest onshore wind farms in Europe. The commissioning of the turbines continues according to plan. In Sweden, the Company can generate revenues from the sale of electricity for operational turbines even before the project reaches full COD. In the first quarter, Björnberget generated $3m of revenues. We expect the project to ramp up to full production by the beginning of the third quarter 2023.

On the development front, Gecama Solar (Spain), a 250 MW solar and 200 MWh storage project advanced as planned. With real estate and interconnection already secured, the project awaits its environmental and construction permit. We have received indications from the regulator that the project is feasible from an environmental perspective, reducing the risk of project delays. Construction is expected to commence by the end of 2023 with COD expected by year end 2024.

Israel

Genesis Wind, the largest renewable energy project in Israel, which has now been expanded to 207 MW (from 189 MW), completed erection of all its wind turbines. Commissioning tests are in full swing with COD on schedule by the end of the third quarter 2023.

The Company continues to progress construction on Solar + Storage 1 & 2 project clusters, totaling 252 MW and 483 MWh of storage. Projects are expected to be commercialized ahead of the schedule presented in the fourth quarter of 2022, with Solar + Storage 1 expected to reach full COD by end of 2023 and Solar + Storage 2 by end of the first half of 2024. Corporate PPA negotiations are ongoing with several major offtakers.

In May 2023, the Company signed an agreement to sell two small projects totaling 25 MW at a valuation of $465,000 per MW. This is expected to contribute $5.8m of net proceeds and $4.7m of pre-tax income, as capital is recycled to fund future growth.

Balance Sheet

The Company benefits from a strong and diversified liquidity position, with 82% of cash and cash equivalents held in U.S. dollars or Euros, with minimal exposure to the Israeli shekel.

| ($ thousands) | 03/31/2023 | ||

| Cash and Cash Equivalents: | |||

| Enlight Renewable Energy Ltd ,Enlight EU Energies Kft and Enlight Renewable LLC, excluding subsidiaries (“Topco”) | 353,859 | ||

| Subsidiaries | 188,608 | ||

| Deposits: | |||

| Short term deposits | 2,719 | ||

| Restricted Cash: | |||

| Projects under construction | 72,319 | ||

| Reserves, including debt service, performance obligations and others | 38,831 | ||

| Total Cash | 656,336 | ||

| Financial assets at fair value through profit or loss* | 32,328 | ||

| Total Liquidity | 686,664 | ||

* Securities, largely government fixed income securities

2023 Financial Outlook

Commenting on the outlook, Enlight Chief Financial Officer Nir Yehuda noted, “We are pleased to affirm our Revenue and Adjusted EBITDA guidance for 2023. This guidance is based on our current operational portfolio and planned CODs over the course of the year. Our Revenue and Adjusted EBITDA guidance does not include certain proceeds from the sale of electricity for our projects treated as Financial Assets. Similarly, our Adjusted EBITDA outlook does not include tax credits expected to be recognized upon COD of Apex Solar.”

Details of the 2023 outlook include:

* The section titled “Non-IFRS Financial Measures” below contains a description of Adjusted EBITDA, a non-IFRS financial measure discussed in this press release. A reconciliation between Adjusted EBITDA and Net Income, its most directly comparable IFRS financial measure, is contained in the tables below. The Company is unable to provide a reconciliation of Adjusted EBITDA to Net Income on a forward-looking basis without unreasonable effort because items that impact this IFRS financial measure are not within the Company’s control and/or cannot be reasonably predicted. These items may include, but are not limited to, forward-looking depreciation and amortization, share based compensation, other income, finance income, finance expenses, share of losses of equity accounted investees and taxes on income. Such information may have a significant, and potentially unpredictable, impact on the Company’s future financial results. We note that “Adjusted EBITDA” measures that we disclosed in previous filings in Israel were not comparable to “Adjusted EBITDA” disclosed in the release and in our future filings.

Conference Call Information

Enlight plans to hold its First Quarter 2023 Conference Call and Webcast on Thursday, May 11, 2023 at 8:00 a.m. ET to review its financial results and business outlook. Management will deliver prepared remarks followed by a question-and-answer session. Participants can join by conference call or webcast:

The press release with the financial results as well as the investor presentation materials will be accessible from the Company’s website prior to the conference call. Approximately one hour after completion of the live call, an archived version of the webcast will be available on the Company’s investor relations website at https://enlightenergy.co.il/info/investors/.

Supplemental Financial and Other Information

We intend to announce material information to the public through the Enlight investor relations website at https://enlightenergy.co.il/info/investors, SEC filings, press releases, public conference calls, and public webcasts. We use these channels to communicate with our investors, customers, and the public about our company, our offerings, and other issues. As such, we encourage investors, the media, and others to follow the channels listed above, and to review the information disclosed through such channels.

Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page of our website.

Non-IFRS Financial Measures

This release presents Adjusted EBITDA, a financial metric, which is provided as a complement to the results provided in accordance with the International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). A reconciliation of the non-IFRS financial information to the most directly comparable IFRS financial measure is provided in the accompanying tables found at the end of this release.

We define Adjusted EBITDA as Net Income adjusted for depreciation and amortization, share based compensation, other income, finance income, finance expenses, share of losses of equity accounted investees and taxes on income. Our management believes Adjusted EBITDA is indicative of operational performance and ongoing profitability and uses Adjusted EBITDA to evaluate the operating performance and for planning and forecasting purposes.

Non-IFRS financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for financial information presented under IFRS. There are a number of limitations related to the use of non-IFRS financial measures versus comparable financial measures determined under IFRS. For example, other companies in our industry may calculate the non-IFRS financial measures that we use differently or may use other measures to evaluate their performance. All of these limitations could reduce the usefulness of our non-IFRS financial measures as analytical tools. Investors are encouraged to review the related IFRS financial measure, Net Income, and the reconciliations of Adjusted EBITDA provided below to Net Income and to not rely on any single financial measure to evaluate our business.

Special Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding the Company’s business strategy and plans, capabilities of the Company’s project portfolio and achievement of operational objectives, market opportunity and potential growth, discussions with commercial counterparties and financing sources, progress of Company projects, including anticipated timing of related approvals, the Company’s future financial results, expected impact from various regulatory developments, including the IRA, and Revenue, EBITDA, Adjusted EBITDA and proceeds from sale of electricity guidance, the expected timing of completion of our ongoing projects, and the Company’s anticipated cash requirements and financing plans, are forward-looking statements. The words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “target,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible,” “forecasts,” “aims” or the negative of these terms and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions.

These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: our ability to site suitable land for, and otherwise source, renewable energy projects and to successfully develop and convert them into Operational Projects; availability of, and access to, interconnection facilities and transmission systems; our ability to obtain and maintain governmental and other regulatory approvals and permits, including environmental approvals and permits; construction delays, operational delays and supply chain disruptions leading to increased cost of materials required for the construction of our projects, as well as cost overruns and delays related to disputes with contractors; our suppliers’ ability and willingness to perform both existing and future obligations; competition from traditional and renewable energy companies in developing renewable energy projects; potential slowed demand for renewable energy projects and our ability to enter into new offtake contracts on acceptable terms and prices as current offtake contracts expire; offtakers’ ability to terminate contracts or seek other remedies resulting from failure of our projects to meet development, operational or performance benchmarks; various technical and operational challenges leading to unplanned outages, reduced output, interconnection or termination issues; the dependence of our production and revenue on suitable meteorological and environmental conditions, and our ability to accurately predict such conditions; our ability to enforce warranties provided by our counterparties in the event that our projects do not perform as expected; government curtailment, energy price caps and other government actions that restrict or reduce the profitability of renewable energy production; electricity price volatility, unusual weather conditions (including the effects of climate change, could adversely affect wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission system constraints and the possibility that we may not have adequate insurance to cover losses as a result of such hazards; our dependence on certain operational projects for a substantial portion of our cash flows; our ability to continue to grow our portfolio of projects through successful acquisitions; changes and advances in technology that impair or eliminate the competitive advantage of our projects or upsets the expectations underlying investments in our technologies; our ability to effectively anticipate and manage cost inflation, interest rate risk, currency exchange fluctuations and other macroeconomic conditions that impact our business; our ability to retain and attract key personnel; our ability to manage legal and regulatory compliance and litigation risk across our global corporate structure; our ability to protect our business from, and manage the impact of, cyber-attacks, disruptions and security incidents, as well as acts of terrorism or war; changes to existing renewable energy industry policies and regulations that present technical, regulatory and economic barriers to renewable energy projects; the reduction, elimination or expiration of government incentives for, or regulations mandating the use of, renewable energy; our ability to effectively manage our supply chain and comply with applicable regulations with respect to international trade relations, tariffs, sanctions, export controls and anti-bribery and anti-corruption laws; our ability to effectively comply with Environmental Health and Safety and other laws and regulations and receive and maintain all necessary licenses, permits and authorizations; our performance of various obligations under the terms of our indebtedness (and the indebtedness of our subsidiaries that we guarantee) and our ability to continue to secure project financing on attractive terms for our projects; limitations on our management rights and operational flexibility due to our use of tax equity arrangements; potential claims and disagreements with partners, investors and other counterparties that could reduce our right to cash flows generated by our projects; our ability to comply with tax laws of various jurisdictions in which we currently operate as well as the tax laws in jurisdictions in which we intend to operate in the future; the unknown effect of the dual listing of our ordinary shares on the price of our ordinary shares; various risks related to our incorporation and location in Israel; the costs and requirements of being a public company, including the diversion of management’s attention with respect to such requirements; certain provisions in our Articles of Association and certain applicable regulations that may delay or prevent a change of control; and; and the other risk factors set forth in the section titled “Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission (the “SEC”) and our other documents filed with or furnished to the SEC.

These statements reflect management’s current expectations regarding future events and operating performance and speak only as of the date of this press release. You should not put undue reliance on any forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by applicable law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

About Enlight

Founded in 2008, Enlight develops, finances, constructs, owns, and operates utility-scale renewable energy projects. Enlight operates across the three largest renewable segments today: solar, wind and energy storage. A global platform, Enlight operates in the United States, Israel and 9 European countries. Enlight has been traded on the Tel Aviv Stock Exchange since 2010 (TASE: ENLT) and completed its US IPO (Nasdaq: ENLT) in 2023.

| Appendix 1 - Consolidated statements | ||||||

| Consolidated Statements of Financial Position as of | ||||||

| March 31 | December 31 | |||||

| 2023 | 2022 | |||||

| USD in | USD in | |||||

| thousands | thousands | |||||

| Assets | (Unaudited) | (Audited) | ||||

| Current assets | ||||||

| Cash and cash equivalents | 542,467 | 193,869 | ||||

| Deposits in banks | 2,719 | 4,054 | ||||

| Restricted cash | 72,319 | 92,103 | ||||

| Financial assets at fair value through profit or loss | 32,328 | 33,895 | ||||

| Trade receivables | 42,640 | 39,822 | ||||

| Other receivables | 20,949 | 36,953 | ||||

| Current maturities of contract assets | 7,518 | 7,622 | ||||

| Current maturities of loans to investee entities | - | 13,893 | ||||

| Other financial assets | 16 | 1,493 | ||||

| Total current assets | 720,956 | 423,704 | ||||

| Non-current assets | ||||||

| Restricted cash | 38,831 | 38,728 | ||||

| Other long term receivables | 6,512 | 6,542 | ||||

| Deferred costs in respect of projects | 221,437 | 205,575 | ||||

| Deferred borrowing costs | 4,429 | 6,519 | ||||

| Loans to investee entities | 14,205 | 14,184 | ||||

| Contract assets | 96,650 | 99,152 | ||||

| Fixed assets, net | 2,365,020 | 2,220,734 | ||||

| Intangible assets, net | 280,762 | 279,717 | ||||

| Deferred taxes | 5,228 | 4,683 | ||||

| Right-of-use asset, net | 116,235 | 96,515 | ||||

| Financial assets at fair value through profit or loss | 48,725 | 42,918 | ||||

| Other financial assets | 89,988 | 94,396 | ||||

| Total non-current assets | 3,288,022 | 3,109,663 | ||||

| Total assets | 4,008,978 | 3,533,367 | ||||

| Consolidated Statements of Financial Position as of (Cont.) | ||||||

| March 31 | December 31 | |||||

| 2023 | 2022 | |||||

| USD in | USD in | |||||

| thousands | thousands | |||||

| Liabilities and equity | (Unaudited) | (Audited) | ||||

| Current liabilities | ||||||

| Credit and current maturities of loans from | ||||||

| banks and other financial institutions | 209,147 | 165,627 | ||||

| Trade payables | 39,118 | 34,638 | ||||

| Other payables | 64,569 | 77,864 | ||||

| Current maturities of debentures | 15,412 | 15,832 | ||||

| Current maturities of lease liability | 5,915 | 5,850 | ||||

| Financial liabilities through profit or loss | 37,872 | 35,283 | ||||

| Other financial liabilities | 17,654 | 50,255 | ||||

| Total current liabilities | 389,687 | 385,349 | ||||

| Non-current liabilities | ||||||

| Debentures | 231,132 | 238,520 | ||||

| Convertible debentures | 128,655 | 131,385 | ||||

| Loans from banks and other financial institutions | 1,538,263 | 1,419,057 | ||||

| Loans from non-controlling interests | 91,644 | 90,908 | ||||

| Financial liabilities through profit or loss | 45,936 | 48,068 | ||||

| Deferred taxes | 28,481 | 14,133 | ||||

| Employee benefits | 13,454 | 12,238 | ||||

| Lease liability | 112,998 | 93,773 | ||||

| Asset retirement obligation | 50,632 | 49,902 | ||||

| Total non-current liabilities | 2,241,195 | 2,097,984 | ||||

| Total liabilities | 2,630,882 | 2,483,333 | ||||

| Equity | ||||||

| Ordinary share capital | 3,171 | 2,827 | ||||

| Share premium | 1,029,095 | 762,516 | ||||

| Capital reserves | 52,209 | 30,469 | ||||

| Proceeds on account of convertible options | 15,496 | 15,496 | ||||

| Accumulated profit (loss) | 16,780 | (7,214 | ) | |||

| Equity attributable to shareholders of the Company | 1,116,751 | 804,094 | ||||

| Non-controlling interests | 261,345 | 245,940 | ||||

| Total equity | 1,378,096 | 1,050,034 | ||||

| Total liabilities and equity | 4,008,978 | 3,533,367 | ||||

| Consolidated Statements of Income | ||||||

| For the three months ended March 31 | ||||||

| 2023 | 2022 | |||||

| USD in | USD in | |||||

| thousands | thousands | |||||

| (Unaudited) | (Unaudited) | |||||

Revenues | 70,994 | 35,060 | ||||

| Cost of sales | (10,253 | ) | (6,357 | ) | ||

| Depreciation and amortization | (12,750 | ) | (6,601 | ) | ||

| Gross profit | 47,991 | 22,102 | ||||

| General and administrative expenses | (8,073 | ) | (6,040 | ) | ||

| Development expenses | (1,375 | ) | (1,307 | ) | ||

| Other income | 505 | 331 | ||||

| (8,943 | ) | (7,016 | ) | |||

| Operating profit | 39,048 | 15,086 | ||||

| Finance income | 20,377 | 8,241 | ||||

| Finance expenses | (16,363 | ) | (12,089 | ) | ||

| Total finance income (expenses), net | 4,014 | (3,848 | ) | |||

| Profit before tax and equity loss | 43,062 | 11,238 | ||||

| Share of loss of equity accounted investees | (205 | ) | (59 | ) | ||

| Profit before income taxes | 42,857 | 11,179 | ||||

| Taxes on income | (9,581 | ) | (2,308 | ) | ||

| Profit for the year | 33,276 | 8,871 | ||||

| Profit for the year attributed to: | ||||||

| Owners of the Company | 23,994 | 4,791 | ||||

| Non-controlling interests | 9,282 | 4,080 | ||||

| 33,276 | 8,871 | |||||

| Earnings per ordinary share (in USD) with a par | ||||||

| value of NIS 0.1, attributable to owners of the | ||||||

| parent Company: | ||||||

| Basic earnings per share | 0.22 | 0.06 | ||||

| Diluted earnings per share | 0.20 | 0.06 | ||||

| Weighted average of share capital used in the | ||||||

| calculation of earnings: | ||||||

| Basic per share | 109,445,475 | 93,460,873 | ||||

| Diluted per share | 117,820,495 | 96,246,320 | ||||

| Consolidated Statements of Cash Flows | ||||||

| For the three months ended March 31 | ||||||

| 2023 | 2022 | |||||

| USD in | USD in | |||||

| Thousands | Thousands | |||||

| (Unaudited) | (Unaudited) | |||||

| Cash flows for operating activities | ||||||

| Profit for the year | 33,276 | 8,871 | ||||

| Adjustments required to present cash flows from operating | ||||||

| activities (Annex A) | 27,488 | 7,162 | ||||

| Cash from operating activities | 60,764 | 16,033 | ||||

| Interest receipts | 4,551 | 389 | ||||

| Interest paid | (12,064 | ) | (8,504 | ) | ||

| Income Tax paid | (448 | ) | (240 | ) | ||

| Repayment of contract assets | 2,640 | 5,714 | ||||

| Net cash from operating activities | 55,443 | 13,392 | ||||

| Cash flows for investing activities | ||||||

| Restricted cash, net | 18,690 | (15,998 | ) | |||

| Purchase, development and construction of fixed assets | (137,199 | ) | (141,974 | ) | ||

| Investment in deferred costs in respect of projects | (11,579 | ) | (9,092 | ) | ||

| Proceeds from sale (purchase) of short term financial assets | ||||||

| measured at fair value through profit or loss, net | 661 | (663 | ) | |||

| Changes in bank deposits | 1,396 | - | ||||

| Loans repaid from (provided to) investee, net | 12,258 | - | ||||

| Payments on account of acquisition of consolidated company | (1,073 | ) | - | |||

| Investment in investee | (12 | ) | - | |||

| Purchase of long term financial assets measured at fair value | ||||||

| through profit or loss | (3,204 | ) | - | |||

| Net cash used in investing activities | (120,062 | ) | (167,727 | ) | ||

| Consolidated Statements of Cash Flows (Cont.) | |||||

| For the three months ended March 31 | |||||

| 2023 | 2022 | ||||

| USD in | USD in | ||||

| Thousands | Thousands | ||||

| (Unaudited) | (Unaudited) | ||||

| Cash flows from financing activities | |||||

| Receipt of loans from banks and other financial institutions | 169,541 | 110,886 | |||

| Repayment of loans from banks and other financial institutions | (13,135 | ) | (11,484 | ) | |

| Issuance of convertible debentures | - | 47,578 | |||

| Repayment of debentures | (1,300 | ) | (1,463 | ) | |

| Dividends and distributions by subsidiaries to non-controlling | |||||

| interests | (1,980 | ) | (131 | ) | |

| Deferred borrowing costs | (1,005 | ) | (1,591 | ) | |

| Receipt of loans from non-controlling interests | - | 19,278 | |||

| Repayment of loans from non-controlling interests | (663 | ) | (143 | ) | |

| Issuance of shares | 264,045 | 69,293 | |||

| Repayment of lease liability | (2,395 | ) | (2,013 | ) | |

| Proceeds from investment in entities by non-controlling | |||||

| interest | 2,679 | 162 | |||

| Net cash from financing activities | 415,787 | 230,372 | |||

| Increase in cash and cash equivalents | 351,168 | 76,037 | |||

| Balance of cash and cash equivalents at beginning of year | 193,869 | 260,407 | |||

| Effect of exchange rate fluctuations on cash and cash | |||||

| equivalents | (2,570 | ) | (13,626 | ) | |

| Cash and cash equivalents at end of year | 542,467 | 332,818 | |||

| Consolidated Statements of Cash Flows (Cont.) | ||||||

| For the three months ended March 31 | ||||||

| 2023 | 2022 | |||||

| USD in | USD in | |||||

| Thousands | Thousands | |||||

| (Unaudited) | (Unaudited) | |||||

| Annex A - Adjustments Required to Present Cash Flows From | ||||||

| operating activities: | ||||||

| Income and expenses not associated with cash flows: | ||||||

| Depreciation and amortization | 13,140 | 7,015 | ||||

| Finance expenses in respect of project finance loans | 14,736 | 9,771 | ||||

| Finance expenses in respect of loans from non-controlling | ||||||

| interests | 371 | 231 | ||||

| Finance expenses in respect of contingent consideration | 198 | 1,371 | ||||

| Interest income from deposits | (3,016 | ) | - | |||

| Fair value changes of financial instruments measured at fair | ||||||

| value through profit or loss | (1,965 | ) | (100 | ) | ||

| Share-based compensation | 1,389 | 2,481 | ||||

| Deferred taxes | 5,140 | 1,380 | ||||

| Finance expenses in respect of lease liability | 550 | 332 | ||||

| Finance income in respect of contract asset | (2,875 | ) | (7,482 | ) | ||

| Exchange rate differences and others | (1,147 | ) | 62 | |||

| Interest incomes from loans to investees | (207 | ) | (317 | ) | ||

| Company’s share in losses of investee partnerships | 205 | 59 | ||||

| Finance expenses (income) in respect of forward transaction | (299 | ) | 138 | |||

| 26,220 | 14,941 | |||||

| Changes in assets and liabilities items: | ||||||

| Change in other receivables | 1,817 | (516 | ) | |||

| Change in trade receivables | (2,384 | ) | (7,978 | ) | ||

| Change in other payables | 1,028 | 1,507 | ||||

| Change in trade payables | 807 | (792 | ) | |||

| 1,268 | (7,779 | ) | ||||

| 27,488 | 7,162 | |||||

| Segmental reporting | |||||||||||||||

| For the three months ended March 31, 2023 | |||||||||||||||

| Israel | Central- Eastern Europe | Western Europe | Management and construction | Total reportable segments | Adjustments | Total | |||||||||

| USD in thousands | |||||||||||||||

| (Unaudited) | |||||||||||||||

| External revenues | 13,838 | 23,235 | 31,788 | 2,133 | 70,994 | - | 70,994 | ||||||||

| Inter-segment revenues | - | - | - | 1,396 | 1,396 | (1,396 | ) | - | |||||||

| Total revenues | 13,838 | 23,235 | 31,788 | 3,529 | 72,390 | (1,396 | ) | 70,994 | |||||||

| Segment Adjusted | |||||||||||||||

| EBITDA | 13,463 | 19,747 | 27,907 | 751 | 61,868 | - | 61,868 | ||||||||

| Reconciliations of unallocated amounts: | |||||||||||||||

| Headquarter costs (*) | (6,055 | ) | |||||||||||||

| Intersegment profit | 404 | ||||||||||||||

| Repayment of contract asset under concession arrangements | (2,640 | ) | |||||||||||||

| Depreciation and amortization and share based compensation | (14,529 | ) | |||||||||||||

| Operating profit | 39,048 | ||||||||||||||

| Finance income | 20,377 | ||||||||||||||

| Finance expenses | (16,363 | ) | |||||||||||||

| Share in the losses of equity accounted investees | (205 | ) | |||||||||||||

| Profit before income taxes | 42,857 | ||||||||||||||

(*) Including general and administrative, development expenses and other income (excluding depreciation and amortization and share based compensation).

| Segmental reporting (Cont.) | |||||||||||||||

| For the three months ended March 31, 2022 | |||||||||||||||

| Israel | Central- Eastern Europe | Western Europe | Management and construction | Total reportable segments | Adjustments | Total | |||||||||

| USD in thousands | |||||||||||||||

| (Unaudited) | |||||||||||||||

| External revenues | 4,689 | 21,330 | 6,589 | 2,452 | 35,060 | - | 35,060 | ||||||||

| Inter-segment revenues | - | - | - | 1,594 | 1,594 | (1,594 | ) | - | |||||||

| Total revenues | 4,689 | 21,330 | 6,589 | 4,046 | 36,654 | (1,594 | ) | 35,060 | |||||||

| Segment Adjusted | |||||||||||||||

| EBITDA | 8,682 | 17,885 | 5,858 | 1,355 | 33,780 | - | 33,780 | ||||||||

| Reconciliations of unallocated amounts: | |||||||||||||||

| Headquarter costs (*) | (3,266 | ) | |||||||||||||

| Intersegment profit | (218 | ) | |||||||||||||

| Repayment of contract asset under concession arrangements | (5,714 | ) | |||||||||||||

| Depreciation and amortization and share based compensation | (9,496 | ) | |||||||||||||

| Operating profit | 15,086 | ||||||||||||||

| Finance income | 8,241 | ||||||||||||||

| Finance expenses | (12,089 | ) | |||||||||||||

| Share in the losses of equity accounted investees | (59 | ) | |||||||||||||

| Profit before income taxes | 11,179 | ||||||||||||||

(*) Including general and administrative, project promotion and development expenses (excluding depreciation and amortization and share based compensation).

| Appendix 2 - Reconciliations between Net income to Adjusted EBITDA | ||

| ($ thousands) | For the three months ended at | |

| 03/31/23 | 03/31/22 | |

| Net Income | 33,276 | 8,871 |

| Depreciation and amortization | 13,140 | 7,015 |

| Share based compensation | 1,389 | 2,481 |

| Finance income | (20,377) | (8,241) |

| Finance expenses | 16,363 | 12,089 |

| Share of losses of equity accounted investees | 205 | 59 |

| Taxes on income | 9,581 | 2,308 |

| Adjusted EBITDA | 53,577 | 24,582 |

For additional information:

Enlight Renewable Energy

Dan Politi

This email address is being protected from spambots. You need JavaScript enabled to view it.

The Blueshirt Group, for Enlight:

Alex Wellins

This email address is being protected from spambots. You need JavaScript enabled to view it.

____________________

1 Pursuant to IFRS, if the government controls and regulates the licensing arrangements for a renewable energy facility and the license term is similar to the facility’s useful life, the facility is viewed as if it has been transferred to the government’s ownership. Although when evaluating our performance, such a project is like any other renewable energy project, from an accounting perspective, it is treated as “Financial Asset”, whereby we are considered strictly as a contractor.

2 As of May 11, 2023 (“Approval Date”).

| Last Trade: | US$51.77 |

| Daily Change: | 1.42 2.82 |

| Daily Volume: | 19,826 |

| Market Cap: | US$6.840B |

November 12, 2025 June 03, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS