Tuesday - June 10, 2025

Quarterly revenue increases 50% year-over-year

Electrovaya Inc. ("Electrovaya" or the "Company") (TSX:EFL)(OTCQB:EFLVF), a lithium ion battery manufacturer with industry-leading performance and substantial intellectual property, today reported its financial results for the fiscal second quarter ended March 31, 2021 ("Q2 FY2021"). All dollar amounts are in U.S. dollars unless otherwise noted.

Q2 FY2021 Financial Highlights:

Q2 FY2021 Business Highlights:

FY2021 Financial Outlook & Impact of COVID-19:

Electrovaya is experiencing strong year-over-year sales growth. Revenue in Q2 FY2021 and YTD FY2021 grew by 50% and 96%, respectively, compared to the prior-year periods. The Company's customer base is expanding through both of its key sales channels: direct sales to end customers and OEM distribution.

Management is pleased with the progress to date and the business performance thus far in FY2021. However, due to the continued uncertainty surrounding the duration and potential outcomes of the COVID-19 pandemic, management is currently unable to predict the future impacts of the pandemic on the Company's operations and financial results. Management is therefore withdrawing the financial outlook for FY 2021 originally issued on November 30, 2020.

At the time that the financial outlook for FY2021 was issued, there were certain positive indications about the resolution of the COVID-19 outbreak, and a key assumption underlying the guidance was that the impact of the pandemic would decline through the fiscal year and not materially affect customer sales or operations.

There are indications that the COVID-19 outbreak is declining, however, its impact on our customers, suppliers and employees still continues. While the Company's year-to-date revenue is generally as anticipated, based on current ordering patterns, management is uncertain as to the timing of future customer purchase orders and deliveries, which is expected to have an effect on FY 2021 revenue as compared to the Company's announced financial outlook. A revised financial outlook for FY2021 will not be provided unless and until such a time as it is possible to make a reasonable estimate of the Company's financial results for FY2021. See "Forward-Looking Statements".

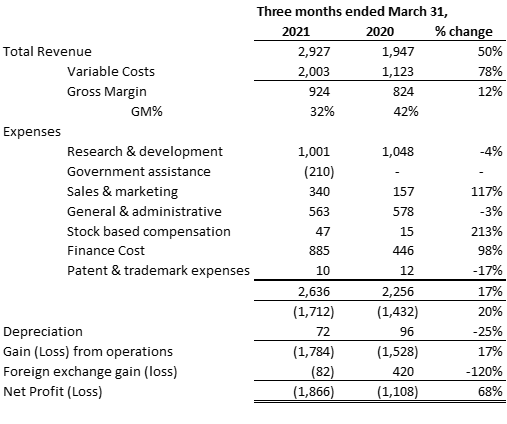

Summary Financial Results

(Expressed in thousands of U.S. dollars)

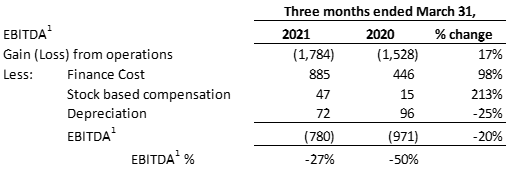

Key performance indicators

In addition to operating results and financial information described above, management reviews the following measures (which are not measures defined under IFRS):

(Expressed in thousands of U.S. dollars)

1 Non-IFRS Measure: EBITDA is defined as gain (loss) from operations, plus finance costs, stock-based compensation costs and depreciation. Management believes EBITDA is a useful measure in providing investors with information regarding financial performance and is an accepted measure in our industry. It is not a measure of financial performance under IFRS, and may not be defined and calculated in the same manner by other companies and should not be considered in isolation or as an alternative to Income (loss) from operations.

The Company's complete Financial Statements and Management Discussion and Analysis for the second quarter ended March 31, 2021 are available at www.sedar.com or on the Company's website at www.electrovaya.com.

Conference Call Details:

The Company will hold a conference call on Wednesday, May 12, 2021 at 8:00 a.m. Eastern

Time (ET) to discuss the March 31, 2021 quarter end financial results and to provide a business update.

US and Canada toll free: (877) 407-8291

International: + 1(201) 689-8345

To help ensure that the conference begins in a timely manner, please dial in 10 minutes prior to the start of the call.

For those unable to participate in the conference call, a replay will be available for two weeks beginning on May 12, 2021 through May 26, 2021. To access the replay, the U.S. dial-in number is (877) 660-6853 and the non-U.S. dial-in number is +1 (201) 612-7415. The replay conference ID is 13719673#.

For more information, please contact:

Investor Contact:

Jason Roy

Electrovaya Inc.

Telephone: 905-855-4618

Email: jroy@electrovaya.com

About Electrovaya Inc.

Electrovaya Inc. (TSX:EFL) (OTCQB:EFLVF) designs, develops and manufactures proprietary Lithium Ion batteries, battery systems, and battery-related products for energy storage, clean electric transportation and other specialized applications. Electrovaya is a technology focused company with extensive IP. Headquartered in Ontario, Canada, Electrovaya has production facilities in Canada with customers around the globe.

To learn more about how Electrovaya is powering mobility and energy storage, please explore www.electrovaya.com.

Forward-Looking Statements

This press release contains forward-looking statements, including statements that relate to, among other things, the effect of the ongoing global COVID-19 public health emergency on the Company's operations, its employees and other stake holders, including on customer demand, supply chain, and delivery schedule, the size of the Company's sales pipeline and the ability to satisfy orders thereunder, the Company's ability to satisfy its ongoing debt obligations, anticipated increased collaboration with OEMs and OEM channels constituting a source of sales growth for the Company, anticipated continued increase in sales momentum in fiscal 2021 through OEMs and directly to large global companies, including Fortune 500 companies, the future direction of the Company's business and products, including E-bus applications and additional intellectual property protection, the Company's ability to source supply to satisfy demand for its products and satisfy current order volume, technology development progress, the Company's application for a listing on NASDAQ and its ability to be listed thereon, pre-launch plans, plans for product development, plans for shipment using the Company's technology, production plans, the Company's markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates, and can generally be identified by the use of words such as "may", "will", "could", "should", "would", "likely", "possible", "expect", "intend", "estimate", "anticipate", "believe", "plan", "objective" and "continue" (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from expectations include but are not limited to: the COVID-19 outbreak will not have significant further effects on the Company's supply chain or operations; that current customers will continue to make and increase orders for the Company's products, and in accordance with communicated intentions, that the Company's alternate supply chain will be adequate to replace material supply and manufacturing, that the Company's interpretation of the effect of any comfort given to Litarion's auditors of the Company's financial support for Litarion's operations is correct, that Litarion's insolvency process will proceed in an orderly fashion that will satisfy Litarion's debt without a significant negative effect on the Company or its assets, actions taken by creditors and remedies granted by German courts in the Litarion insolvency proceedings and their effect on the Company's business and assets, negative reactions of the Company's existing customers to Litarion's insolvency process, general business and economic conditions (including but not limited to currency rates and creditworthiness of customers), Company liquidity and capital resources, including the availability of additional capital resources to fund its activities, level of competition, changes in laws and regulations, legal and regulatory proceedings, the ability to adapt products and services to the changing market, the ability to attract and retain key executives, the granting of additional intellectual property protection, and the ability to execute strategic plans. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company's Annual Information Form for the year ended September 30, 2020 under "Risk Factors", and in the Company's most recent annual Management's Discussion and Analysis under "Qualitative And Quantitative Disclosures about Risk and Uncertainties" as well as in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

| Last Trade: | US$3.59 |

| Daily Change: | 0.29 8.79 |

| Daily Volume: | 355,250 |

| Market Cap: | US$143.920M |

May 14, 2025 April 17, 2025 April 01, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS