Tritium DCFC Limited (Nasdaq: DCFC) (“Tritium” or the “Company”), a global developer and manufacturer of direct current (“DC”) fast chargers for electric vehicles (“EVs”), today announced record sales orders, revenue, and backlog for any calendar year or fiscal year in its history.

Tritium today announced financial results for its fiscal year ended June 30, 2022:

“Over $200 million of sales orders in a twelve-month period is an incredible validation of Tritium’s technology and category leadership, and significantly outpaces total sales orders in prior fiscal years. This is a testament to remarkable work from our employees, and a signal of the velocity now emerging across the global fast charger category as we look to 2023 and 2024,” said Tritium CEO Jane Hunter. “Our customers are now implementing multi-year investment strategies to build networks of fast charging infrastructure in our primary target geographies of the United States, Europe, Australia, and New Zealand. We are pleased to begin the 2023 fiscal year with a record contracted backlog that is currently in the process of being fulfilled as our Tennessee facility ramps-up its production capacity, in-line with our operating plan.”

Fiscal year 2022 saw an escalating level of sales activity across all of Tritium’s geographies, with strong demand from existing and new customers. Tritium is actively expanding factory capacity, bolstering supply chain, and improving production yields. For the fiscal year ended June 30, 2022, Tritium’s footprint grew to more than 11,000 fast charger connectors around the world.

1 Tritium reports sales and backlog based only on executed and contracted purchase orders; does not include anticipated, expected, or potential volumes from memorandums of understanding (MOUs) or customer indications

In support of this accelerating growth, the Company officially opened its new Tennessee factory on August 23, 2022. The factory, which came online in approximately five months, is planned to increase production capacity over the course of calendar year 2023, with an ultimate target capacity of up to 30,000 fast charger units per year, for delivery throughout the Americas and Europe. Tritium expects the Tennessee factory to reach a production capacity of 6,000 charger units per year by December 2022 and plans to scale to 28,000 units of production capacity by December 2023.

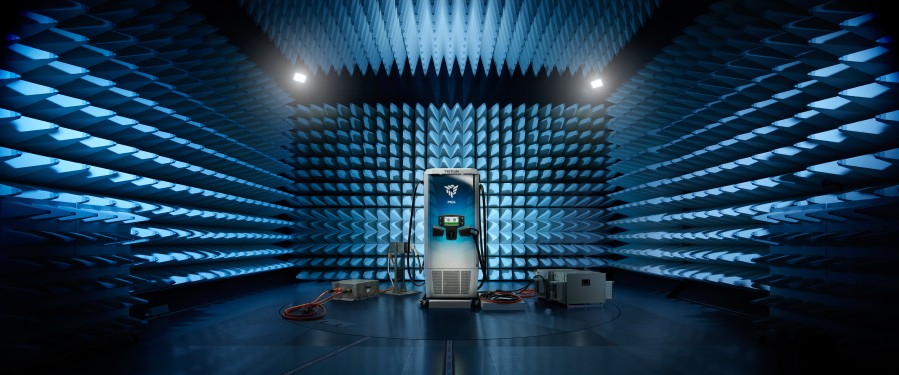

Tritium is now producing its modular fast chargers at the Tennessee factory. These DC fast chargers are compatible with all EVs, compact, reliable, IP65-rated, and cost effective, and are expected to be eligible for EV charging tax credits offered under the Inflation Reduction Act (“IRA”). Tritium’s modular fast chargers are also expected to meet Federal Highway Administration (“FHWA”) Buy America Act standards in 2023, making them eligible for the $5 billion in National Electric Vehicle Infrastructure (“NEVI”) Formula Program funding, including the first wave of $900 million recently approved by President Biden. Tritium is already in discussions with several customers who are targeting NEVI Program disbursements. In addition to NEVI, the Bipartisan Infrastructure Law provides $2.5 billion in discretionary grant programs for which Tritium expects its products will be eligible.

“Tritium’s Tennessee factory will create a step change in throughput for the Company. The facility, which spans 120,000 square feet, was designed to be capable of producing up to six times more product than Tritium’s prior global manufacturing footprint, and is one of the largest EV fast charger factories in the United States,” said Rob Topol, who will be transitioning into the role of CFO following the filing of the Company’s Form 20-F. “Of particular importance, the Tennessee facility is expected to provide the Company with significant economies of scale in 2023. This scale — combined with improved manufacturing processes, reduced freight costs through a combination of delivery via truck instead of sea freight for North American customers and significantly shorter shipping routes to Europe, as well as onboarding local suppliers closer to the manufacturing process, component volume discounts, the expected easing of component shortages over the course of 2023, and faster to assemble modular chargers — is key in our plans to further increase gross margin above the 300 basis point improvement achieved year-over-year.”

Despite the Company’s Tennessee factory being completed in just five months from lease commencement, its production volumes are approximately six weeks behind schedule due to the challenges experienced by electronics manufacturing businesses globally, principally related to supply chain and recruitment delays. This delay in production is expected to shift approximately six weeks of projected 2022 revenue, or approximately $45 million, into calendar year 2023, resulting in expected calendar year 2022 revenue of approximately $125 million. Importantly, this revenue is expected to be realized in the first quarter of calendar year 2023.

As previously announced, Tritium refinanced its existing $90 million credit facility with a three-year $150 million facility led by its longstanding lenders, Cigna Investments, Inc. and Barings LLC. Further, the Company entered into a committed equity facility of up to $75 million with B. Riley Financial, Inc., which the Company expects to access depending on market conditions. These financings will be used for general corporate purposes and working capital investments principally tied to the inventory ramp-up required to meet significantly increased sales orders, and the expansion of the Tennessee factory.

Earnings Conference Call Information

The Tritium management team will host a conference call to discuss the Company’s full fiscal year 2022 results on Thursday, September 22, 2022, at 4:30 p.m. Eastern time. The call can be accessed via a live webcast accessible on the Events page in the Investor Relations section of Tritium’s website at investors.tritiumcharging.com. An archive of the webcast will be available on the website after the call.

About Tritium

Founded in 2001, Tritium (NASDAQ: DCFC) designs and manufactures proprietary hardware and software to create advanced and reliable DC fast chargers for electric vehicles. Tritium’s compact and robust chargers are designed to look great on Main Street and thrive in harsh conditions, through technology engineered to be easy to install, own, and use. Tritium is focused on continuous innovation in support of our customers around the world.

Tritium continues to qualify as a Foreign Private Issuer (“FPI”) as defined by Rule 405 of Regulation C under the Securities Act and Rule 3b-4 under the Exchange Act. As such, the Company will file its next period financial results via its Form 6-K for the six-month period ending December 31, 2022, in early 2023.

For more information, visit tritiumcharging.com

Presentation of Information

Unless otherwise indicated, references to a particular “fiscal year” are to our fiscal year ended June 30 of that year. References to a year other than a “fiscal” or “fiscal year” are to the calendar year ended December 31.

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, also known as the Private Securities Litigation Reform Act of 1995. Any express or implied statements contained in this press release that are not statements of historical fact and generally relate to future events, hopes, intentions, strategies, or performance may be deemed to be forward-looking statements. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “might,” “possible,” “believe,” “predict,” “potential,” “continue,” “aim,” “strive,” and similar expressions may identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expressed or implied forwarding-looking statements, including, but not limited to: our history of losses; the ability to successfully manage our growth; the adoption and demand for electronic vehicles including the success of alternative fuels, changes to rebates, tax credits and the impact of government incentives; the accuracy of our forecasts and projections including those regarding our market opportunity; competition; our ability to secure financing; delays in our manufacturing plans; losses or disruptions in supply or manufacturing partners; risks related to our technology, intellectual property and infrastructure; exemptions to certain U.S. securities laws as a result of our status as a foreign private issuer; and other important factors discussed under the caption “Risk Factors” in the Company’s prospectus filed pursuant to Rule 424(b)(3) filed with the Securities and Exchange Commission (the “SEC”) on August 30, 2022, as such factors may be updated from time to time in the Company’s other filings with the SEC, accessible on the SEC’s website at www.sec.gov and the Investors Relations section of Company’s website at https://investors.tritiumcharging.com/. Any investors should carefully consider the risks and uncertainties described in the documents filed by the Company from time to time with the SEC as most of the factors are outside the Company’s control and are difficult to predict. As a result, the Company’s actual results may differ from its expectations, estimates and projections and consequently, such forward-looking statements should not be relied upon as predictions of future events. The Company cautions not to place undue reliance upon any forward-looking statements, including projections, which speak only as to management expectations and beliefs as of the date they are made. The Company disclaims any obligation or undertaking to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law.

No Offer

This press release is for informational purposes only and it does not represent an offer to sell or the solicitation of an offer to buy any of the Company’s securities. There will be no sale of the Company’s securities in any jurisdiction in which one would be unlawful.

Consolidated Statements of Operations and Comprehensive Loss

For the years ended June 30, 2022, 2021, and 2020

| Year Ended June 30, 2022 $’000 | Year Ended June 30, 2021 $’000 | Year Ended June 30, 2020 $’000 | |||||||

| Revenue | |||||||||

| Service and maintenance revenue – external parties | 4,989 | 2,594 | 5,489 | ||||||

| Service and maintenance revenue – related parties | - | 1 | 2 | ||||||

| Hardware revenue – external parties | 69,243 | 32,299 | 34,095 | ||||||

| Hardware revenue – related parties | 11,589 | 21,263 | 7,383 | ||||||

| Total revenue | 85,821 | 56,157 | 46,969 | ||||||

| Cost of goods sold | |||||||||

| Service and maintenance - costs of goods sold | (3,778 | ) | (2,873 | ) | (2,138 | ) | |||

| Hardware – cost of goods sold | (82,383 | ) | (55,188 | ) | (45,805 | ) | |||

| Total cost of goods sold | (86,161 | ) | (58,061 | ) | (47,943 | ) | |||

| Selling, general and administration expense | (74,323 | ) | (31,624 | ) | (23,615 | ) | |||

| Product development expense | (14,031 | ) | (10,521 | ) | (9,548 | ) | |||

| Foreign exchange gain/(loss) | (4,208 | ) | (1,436 | ) | (231 | ) | |||

| Total operating costs and expenses | (92,562 | ) | (43,581 | ) | (33,394 | ) | |||

| Loss from operations | (92,902 | ) | (45,485 | ) | (34,368 | ) | |||

| Other income (expense), net | |||||||||

| Finance costs | (18,136 | ) | (8,795 | ) | (1,509 | ) | |||

| Transaction and offering related fees | (6,783 | ) | (4,794 | ) | - | ||||

| Fair value movements - derivatives and warrants | (9,782 | ) | (5,947 | ) | - | ||||

| Other income | 61 | 1,940 | 1,433 | ||||||

| Total other expenses and other income | (34,640 | ) | (17,596 | ) | (76 | ) | |||

| (Loss) before income taxes | (127,542 | ) | (63,081 | ) | (34,444 | ) | |||

| Income tax expense | (20 | ) | (11 | ) | - | ||||

| Net (loss) | (127,562 | ) | (63,092 | ) | (34,444 | ) | |||

| Net (loss) per common share | |||||||||

| Net (loss) per common share attributable to common shareholders | (127,562 | ) | (63,092 | ) | (34,444 | ) | |||

| Basic and diluted – common shares | (1.01 | ) | (0.58 | ) | (0.33 | ) | |||

| Basic and diluted – C shares | - | (0.58 | ) | (0.33 | ) | ||||

| Weighted average shares outstanding | |||||||||

| Basic and diluted – common shares | 126,814,171 | 99,915,563 | 97,565,239 | ||||||

| Basic and diluted – C shares | 8,047,417 | 8,047,417 | |||||||

| Comprehensive Loss | |||||||||

| Net (loss) | (127,562 | ) | (63,092 | ) | (34,444 | ) | |||

| Other comprehensive (loss) (net of tax) | |||||||||

| Change in foreign currency translation adjustment | 7,336 | (136 | ) | (600 | ) | ||||

| Total other comprehensive (loss) (net of tax) | 7,336 | (136 | ) | (600 | ) | ||||

| Total comprehensive (loss) | (120,226 | ) | (63,228 | ) | (35,044 | ) | |||

Consolidated Statements of Financial Position

As of June 30, 2022 and 2021

| As of June 30, 2022 $’000 | As of June 30, 2021 $’000 | ||||

| Assets | |||||

| Cash and cash equivalents | 70,753 | 6,157 | |||

| Accounts receivable - related parties | 16 | 2,991 | |||

| Accounts receivable - external parties | 30,816 | 11,318 | |||

| Accounts receivable - allowance for expected credit losses | (275 | ) | (227 | ) | |

| Inventory | 55,706 | 36,430 | |||

| Prepaid expenses | 4,873 | 918 | |||

| Deposits | 15,675 | 4,912 | |||

| Total current assets | 177,564 | 62,499 | |||

| Property, plant and equipment, net | 11,151 | 5,689 | |||

| Operating lease right of use assets, net | 24,640 | 18,312 | |||

| Deposits | - | 1,350 | |||

| Total non-current assets | 35,791 | 25,351 | |||

| Total assets | 213,355 | 87,850 | |||

| Liabilities and Shareholders’ Deficit | |||||

| Accounts Payable | 47,603 | 17,135 | |||

| Borrowings | 74 | 36,571 | |||

| Contract liabilities | 37,727 | 9,198 | |||

| Employee benefits | 2,653 | 2,037 | |||

| Other provisions | 27,623 | 5,349 | |||

| Obligations under operating leases | 4,020 | 2,941 | |||

| Financial instruments – derivative | - | 874 | |||

| Other current liabilities | 2,939 | 6,101 | |||

| Warrants | 12,340 | - | |||

| Total current liabilities | 134,979 | 80,206 | |||

| Obligations under operating leases | 25,556 | 17,660 | |||

| Contract liabilities | 2,231 | 1,618 | |||

| Employee benefits | 217 | 125 | |||

| Borrowings net of unamortized issuance costs | 88,269 | 37,369 | |||

| Related party borrowings | - | 6,392 | |||

| Other provisions | 2,652 | 2,541 | |||

| Financial instruments - derivative | - | 5,947 | |||

| Other non-current liabilities | - | - | |||

| Total non-current liabilities | 118,925 | 71,652 | |||

| Total liabilities | 253,904 | 151,858 | |||

| Commitments and Contingent liabilities | |||||

| Shareholders’ Deficit | |||||

| Common stock, no par value, unlimited stock authorized at June 2022, 153,094,269 shares issued (107,806,361 legacy Tritium common shares as of June 2021); 148,893,898 shares outstanding as of June 2022 (99,915,561 legacy Tritium common shares as of June 2021) | 227,268 | 92,809 | |||

| Treasury shares, 4,200,371 as of June 30, 2022 (7,890,800 as of June 2021) | - | - | |||

| Legacy Tritium Class C shares, no par value, unlimited shares authorized at June 2021, 8,052,499 shares issued and outstanding as of June 2021 (Nil as of June 2022) | - | 4,383 | |||

| Additional paid in capital | 19,210 | 5,601 | |||

| Accumulated other comprehensive income (loss) | 3,640 | -3,696 | |||

| Accumulated deficit | (290,667 | ) | (163,105 | ) | |

| Total Shareholders’ deficit | (40,549 | ) | (64,008 | ) | |

| Total Liabilities, and Shareholders’ deficit | 213,355 | 87,850 | |||

Consolidated Statements of Cash Flows

For the years ended June 30, 2022, 2021, and 2020

| Year Ended June 30, 2022 $’000 | Year Ended June 30, 2021 $’000 | Year Ended June 30, 2020 $’000 | |||||||

| Cash flows from operating activities | |||||||||

| Net loss | (127,562 | ) | (63,092 | ) | (34,444 | ) | |||

| Reconciliation of net loss to net cash used in operating activities | |||||||||

| Share-based compensation expense | 28,188 | 8,371 | - | ||||||

| Foreign exchange gains or losses | - | 1,436 | 213 | ||||||

| Depreciation expense | 2,198 | 2,312 | 1,309 | ||||||

| Borrowing costs | 1,518 | - | 725 | ||||||

| Fair value movements – derivatives and warrants | 9,782 | 5,947 | - | ||||||

| Adjustment for capitalized interest | 12,761 | 8,559 | - | ||||||

| Changes in operating assets and liabilities | |||||||||

| Accounts receivable | (16,475 | ) | (1,063 | ) | (4,755 | ) | |||

| Inventory | (19,276 | ) | (8,771 | ) | (2,455 | ) | |||

| Accounts payable | 3,263 | 6,619 | (1,085 | ) | |||||

| Employee benefits | 708 | 720 | 507 | ||||||

| Other liabilities | 37,020 | 9,069 | 1,800 | ||||||

| Other assets | (18,965 | ) | (2,567 | ) | (2,269 | ) | |||

| Net cash used in operating activities | (86,840 | ) | (32,460 | ) | (40,436 | ) | |||

| Cash flows from investing activities | |||||||||

| Payments for property, plant and equipment | (7,023 | ) | (2,572 | ) | (1,309 | ) | |||

| Net cash used in investing activities | (7,023 | ) | (2,572 | ) | (1,309 | ) | |||

| Cash flows from financing activities | |||||||||

| Proceeds from issuance of Common Stock in the Business Combination | 53,182 | - | - | ||||||

| Transaction costs paid | (3,808 | ) | - | - | |||||

| Proceeds from the exercise of warrants | 26,572 | - | - | ||||||

| Proceeds from issuance of Common Stock pursuant to the PIPE Financing | 15,000 | - | - | ||||||

| Proceeds from issuance of Common Stock pursuant to the Option Agreements | 45,000 | - | - | ||||||

| Proceeds from issuance of legacy Tritium ordinary shares | - | - | 23,677 | ||||||

| Proceeds from borrowings – external parties | 117,527 | - | 33,029 | ||||||

| Proceeds from borrowings – related parties | - | - | 5,150 | ||||||

| Proceeds from convertible notes including derivative | - | 33,367 | - | ||||||

| Transaction costs for borrowings | (3,888 | ) | - | (1,162 | ) | ||||

| Repayment of borrowings - external parties | (77,351 | ) | - | (12,392 | ) | ||||

| Repayment of borrowings - related parties | (6,414 | ) | - | - | |||||

| Waiver of related party’s option to acquire Tritium | (6,816 | ) | - | - | |||||

| Net cash provided by financing activities | 159,004 | 33,367 | 48,302 | ||||||

| Effects of exchange rate changes on cash and cash equivalents | (545 | ) | 120 | (60 | ) | ||||

| Net increase / (decrease) in cash and cash equivalents | 65,141 | (1,665 | ) | 6,557 | |||||

| Cash and cash equivalents at the beginning of the period | 6,157 | 7,702 | 1,205 | ||||||

| Cash and cash equivalents end of the period | 70,753 | 6,157 | 7,702 | ||||||

Tritium Media Contact

Jack Ulrich

This email address is being protected from spambots. You need JavaScript enabled to view it.

Tritium Investors Contact

Caldwell Bailey

ICR, Inc.

This email address is being protected from spambots. You need JavaScript enabled to view it.

| Last Trade: | US$3.64 |

| Daily Volume: | 0 |

| Market Cap: | US$3.890M |

January 09, 2024 November 29, 2023 October 04, 2023 | |

UGE International develops, owns, and operates commercial and community solar projects in the United States and strategic markets abroad. Our distributed energy solutions deliver cheaper, cleaner energy to businesses and consumers...

CLICK TO LEARN MORE

Surf Air Mobility is a regional air mobility platform expanding the category of regional air travel to reinvent flying through the power of electrification. In an effort to substantially reduce the cost and environmental impact of...

CLICK TO LEARN MORECOPYRIGHT ©2022 GREEN STOCK NEWS