Ballard Power Systems (NASDAQ: BLDP) (TSX: BLDP) today announced consolidated financial results for the fourth quarter and full year ended December 31, 2020. All amounts are in U.S. dollars unless otherwise noted and have been prepared in accordance with International Financial Reporting Standards (IFRS).

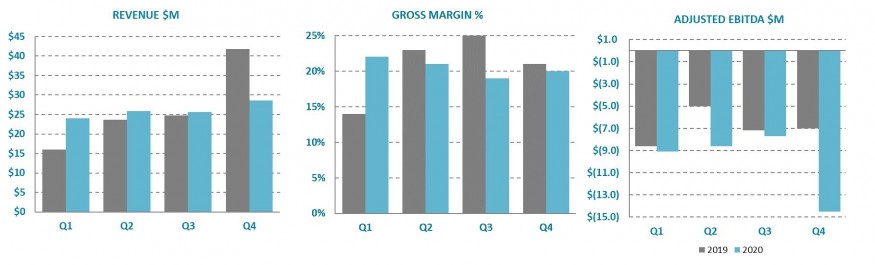

Randy MacEwen, President and CEO said, "Our Q4 and full year 2020 results were consistent with management's internal projections based on expected impacts from COVID-19. In Q4 and throughout 2020, COVID-19 created uncertainty and adversely impacted operations for certain customers along with order intake, although we saw higher than expected activity levels in our sales pipeline. Revenue was $28.6 million in Q4, and full year revenue was $103.9 million. Gross margin for the full year was 20%, Adjusted EBITDA was ($38.9) million and year-end cash reserves were $763.4 million."

Mr. MacEwen added, "Continued progress in the execution of our growth strategy in 2020 was reflected in a number of notable achievements: the Weichai-Ballard joint venture operation in China was commissioned; we announced a key strategic partnership with MAHLE to develop advanced fuel cell engines for the European commercial truck market; we made continued progress with bus OEM customers; we launched a new high power density stack; we completed our Marine Center of Excellence in Denmark and launched our new FCwaveTM 200 kilowatt engine for marine applications; we invested to expand our Vancouver MEA production capacity by 6-times; we announced our plan to reduce fuel cell stack costs by 70% by 2024; we detailed our estimate of the multi-billion dollar market opportunity for Ballard by 2030; Ballard products powered vehicles for cumulative on-road mileage in excess of 70 million kilometers; and we further fortified our balance sheet."

Mr. MacEwen concluded, "Notwithstanding a challenging year due to COVID-19, the hydrogen and fuel cell industry enjoyed unprecedented progress with strong policy support, sizeable corporate investments and broadened investor interest. With about 50 countries announcing CO2 pricing initiatives, 75 countries with net zero targets, and over 30 countries with hydrogen strategies, we believe Ballard is well positioned to realize significant growth in the coming decade. As a result, we are increasing and accelerating our investment to drive high growth, high market adoption and high market share for the benefit of long-term shareholder value. In 2021, we will increase our investment in competencies, technology innovation, product development and customer experience related to our key markets of bus, truck, rail and marine. We will continue to invest in our strategic partnerships with Weichai in China and MAHLE in Europe. We will also consider investments in further production capacity expansion and localization in key geographies, as well as strategic acquisitions and partnerships."

Q4 2020 Financial Highlights

(all comparisons are to Q4 2019 unless otherwise noted)

Full Year 2020 Financial Highlights

(all comparisons are to full year 2019 unless otherwise noted)

2021 Outlook

Ballard intends to maintain focus throughout 2021 on Heavy-and Medium-Duty Motive applications – including bus, commercial truck, train and marine markets – to increase penetration in the key markets of China, Europe and California. The Company also sees opportunities in additional geographic markets and therefore anticipates projects that will begin expanding reach beyond these initial key markets.

In 2021 Ballard will invest in additional technology and product innovation and development across bus, truck, rail and marine markets, including next-generation MEAs, plates, stacks, and modules. The Company expects this to include collaboration with MAHLE on the design of fuel cell engines for commercial trucks in Europe. Ballard will also continue to invest in customer experience in these markets.

Ballard will continue to work to expand MEA production capacity 6-times at its Vancouver headquarter facility. The Company will also review options for further localization of production capacity in China and Europe.

Furthermore, corporate development work will be an important priority this year, including potential acquisitions to help scale the business and simplify the customer experience.

During 2021 the Company has a commitment to make contributions totaling approximately $11.4 million towards its pro rata ownership share of the Weichai-Ballard joint venture in China. This is in addition to $57.7 million contributed cumulatively through 2020, as part of Ballard's total capital commitment of approximately $79.5 million.

In Europe, Ballard expects to deliver a significant number of modules to support deployments of Fuel Cell Electric Buses (FCEBs) in various countries. The Company anticipates increased market activity for FCEBs during the year, which can be expected to result in additional module purchase orders for delivery in future years. In addition, the shipment of backup power systems is expected to be flat as compared to 2020. Ballard also plans to continue execution of its automotive program with Audi.

Within North America, Ballard expects continued market activity for FCEBs and fuel cell-powered trucks, which can be expected to result in additional module purchase orders in 2021 for delivery in future years. In addition, the Company expects the volume of fuel cell stack shipments for material handling applications to be flat as compared to 2020.

Consistent with the Company's practice in this early stage of hydrogen fuel cell market development and adoption, and in view of the ongoing uncertainties resulting from COVID-19, Ballard is not providing specific financial performance guidance for the coming year.

Q4 & Full Year 2020 Financial Summary

(Millions of U.S. dollars) | Three months ended December 31, | Twelve months ended December 31, | ||||

2020 | 2019 | % Change | 2020 | 2019 | % Change | |

REVENUE | ||||||

Fuel Cell Products & Services:1,2 | ||||||

Heavy Duty Motive | $11.9 | $21.4 | -44% | $47.7 | $35.4 | 35% |

Material Handling | $0.9 | $1.9 | -51% | $5.3 | $10.8 | -51% |

Backup Power | $2.1 | $2.0 | 5% | $5.6 | $3.0 | 88% |

Sub-Total | $15.0 | $25.4 | -41% | $58.6 | $49.1 | 19% |

Technology Solutions | $13.6 | $16.4 | -17% | $45.3 | $56.6 | -20% |

Total Fuel Cell Products & Services Revenue | $28.6 | $41.8 | -32% | $103.9 | $105.7 | -2% |

PROFITABILITY Gross Margin $ | $5.6 | $8.6 | -34% | $21.0 | $22.3 | -6% |

Gross Margin % | 20% | 21% | -1-points | 20% | 21% | -1-point |

Operating Expenses | $19.6 | $15.6 | 26% | $60.7 | $47.8 | 27% |

Cash Operating Costs3 | $16.4 | $13.1 | 25% | $50.0 | $38.8 | 29% |

Equity gain (loss) in JV & Associates | ($4.3) | ($3.0) | -43% | ($12.6) | ($11.1) | -14% |

Adjusted EBITDA3 | ($14.5) | ($7.0) | -105% | ($38.9) | ($26.6) | -46% |

Net Income (Loss) from continuing operations | ($14.4) | ($9.8) | -47% | ($49.5) | ($35.3) | -40% |

Earnings Per Share from continuing operations | ($0.05) | ($0.04) | -28% | ($0.20) | ($0.15) | -31% |

CASH | ||||||

Cash provided by (used in) Operating | ||||||

Cash Operating Income (Loss) | ($6.7) | ($3.9) | -72% | ($25.8) | ($14.1) | -83% |

Working Capital Changes | $0 | $8.0 | -100% | ($17.1) | ($0.1) | -17,000% |

Cash provided by (used in) | ($6.7) | $4.1 | -262% | ($42.9) | ($14.2) | -202% |

Cash Reserves | $763.4 | $147.8 | 417% | |||

For a more detailed discussion of Ballard Power Systems Q4 and full year 2020 results, please see the Company's financial statements and management's discussion & analysis, which are available at www.ballard.com/investors, www.sedar.com and www.sec.gov/edgar.shtml.

Conference Call

Ballard will hold a conference call on Thursday, March 11, 2021 at 8:00 a.m. PT (11:00 a.m. ET) to review Q4 and full year 2020 operating results and Outlook for 2021. The live call can be accessed by dialing +1.604.638.5340. Alternatively, a live audio and PowerPoint slide webcast can be accessed through a link on Ballard's homepage (www.ballard.com). Following the call, the audio webcast will be archived in the 'Earnings, Interviews and Presentations' area of the 'Investors' section of Ballard's website (www.ballard.com/investors).

About Ballard Power Systems

Ballard Power Systems' (NASDAQ: BLDP; TSX: BLDP) vision is to deliver fuel cell power for a sustainable planet. Ballard zero-emission PEM fuel cells are enabling electrification of mobility, including buses, commercial trucks, trains, marine vessels, passenger cars and forklift trucks. To learn more about Ballard, please visit www.ballard.com.

Important Cautions Regarding Forward-Looking Statements

This release contains forward-looking statements concerning projected revenue growth, product shipments, gross margin, Adjusted EBITDA, cash operating expenses product sales and market adoption of fuel cell electric vehicles. These forward-looking statements reflect Ballard's current expectations as contemplated under section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any such statements are based on Ballard's assumptions relating to its financial forecasts and expectations regarding its product development efforts, manufacturing capacity, and market demand. For a detailed discussion of the factors and assumptions that these statements are based upon, and factors that could cause our actual results or outcomes to differ materially, please refer to Ballard's most recent management discussion & analysis. Other risks and uncertainties that may cause Ballard's actual results to be materially different include general economic and regulatory changes, detrimental reliance on third parties, successfully achieving our business plans and achieving and sustaining profitability. For a detailed discussion of these and other risk factors that could affect Ballard's future performance, please refer to Ballard's most recent Annual Information Form. These forward-looking statements are provided to enable external stakeholders to understand Ballard's expectations as at the date of this release and may not be appropriate for other purposes. Readers should not place undue reliance on these statements and Ballard assumes no obligation to update or release any revisions to them, other than as required under applicable legislation.

Endnotes: |

1 We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segment consists of the sale and service of PEM fuel cell products for our power product markets of Heavy Duty Motive (consisting of bus, truck, rail and marine applications), Material Handling and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of fuel cell applications. |

2 The UAV market has been classified as a discontinued operation in our third quarter of 2020 consolidated condensed financial statements. As such, the assets of the UAV market have been classified as assets held for sale as of September 30, 2020. Furthermore, the historic operating results of the UAV market for both 2020 and 2019 have been removed from continuing operating results and are instead presented separately in the statement of comprehensive income as income from discontinued operations. |

3 Note that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss), are non-GAAP measures. Non-GAAP measures do not have any standardized meaning prescribed by GAAP and therefore are unlikely to be comparable to similar measures presented by other companies. Ballard believes that Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) assist investors in assessing Ballard's operating performance. These measures should be used in addition to, and not as a substitute for, net income (loss), cash flows and other measures of financial performance and liquidity reported in accordance with GAAP. For a reconciliation of Cash Operating Costs, EBITDA, Adjusted EBITDA and Adjusted Net Income (Loss) to the Consolidated Financial Statements, please refer to Ballard's Management's Discussion & Analysis. |

Cash Operating Costs measures operating expenses excluding stock-based compensation expense, depreciation and amortization, impairment losses or recoveries on trade receivables, restructuring charges, acquisition costs, the impact of unrealized gains or losses on foreign exchange contracts, and financing charges. EBITDA measures net loss from continuing operations excluding finance expense, income taxes, depreciation of property, plant and equipment, and amortization of intangible assets. Adjusted EBITDA adjusts EBITDA for stock-based compensation expense, transactional gains and losses, asset impairment charges, finance and other income, the impact of unrealized gains or losses on foreign exchange contracts, and acquisition costs. Adjusted Net Income (Loss) measures net income (loss) from continuing operations excluding transactional gains and losses, asset impairment charges, and acquisition costs. |

| Last Trade: | US$2.74 |

| Daily Change: | 0.005 0.18 |

| Daily Volume: | 448,497 |

| Market Cap: | US$822.520M |

November 13, 2025 September 17, 2025 August 11, 2025 June 05, 2025 | |

COPYRIGHT ©2025 GREEN STOCK NEWS