Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Atlas Lithium Intersects Wide, High-Grade Lithium Mineralization, Continues Expansion of "Anitta 3" and "Anitta 4" Pegmatites

- Several recent drill holes in Anitta 3 and Anitta 4 pegmatites intersected further high-grade lithium mineralization:

- Drill hole DHAB-345 intersected 1.44% Li2O over 47.00m from 59m depth

- DHAB-347 intersected 1.32% Li2O over 42.88m from 133m depth and 1.20% Li2O over 9.65m from 223m depth

- DHAB-354 intersected 1.06% Li2O over 11.60m from 153m depth

- DHAB-356 intersected 0.96% Li2O over 12.55m from 29m depth and 1.96% Li2O over 3.40m from 127m depth

- Drill hole DHAB-339 intersected 1.52% Li2O over 20.90m from 82m depth and 1.70% Li2O over 9.00m from 162m depth

- At Anitta 4, DHAB-353 intersected 1.41% Li2O over 7.63m from 79m depth and DHAB-362 intersected 1.41% Li2O over 6.30m from 102m depth

- Drone magnetics geophysics surveys have now started and are planned to cover the entire Neves Project

Boca Raton, Florida--(Newsfile Corp. - January 8, 2024) - Atlas Lithium Corporation (NASDAQ: ATLX) ("Atlas Lithium" or "Company"), a leading lithium exploration and development company, is pleased to announce additional strong geochemical lithium assay results from the ongoing drilling campaign at its Neves Project in Brazil's Lithium Valley. The Neves Project consists of four mineral rights totaling 2,684 hectares in this proven lithium mining district. With these latest promising results, the Company continues to uncover the potential across its strategically positioned holdings of lithium claims spanning over 24,000 hectares.

The latest round of drilling into the Anitta 3 and Anitta 4 mineralized pegmatite swarms has yielded additional high-grade lithium intersections, further expanding the known mineralized dike strike and depth extents. Key Anitta 3 highlights include drill hole DHAB-339, which returned a robust 20.90-meter interval of 1.52% Li2O from only 82 meters depth, as well as 1.70% Li2O over 9.00 meters at 162 meters depth. Drill hole DHAB-345 delivered 47.00 meters of 1.44% Li2O beginning at 59 meters depth. Step-out drilling also delivered strong mineralized widths, including 42.88 meters at 1.32% Li2O in DHAB-347 from 133 meters depth, plus 9.65 meters of 1.20% Li2O starting at 223 meters depth. DHAB-354 intersected 11.60 meters of 1.06% Li2O from 153 meters downhole. DHAB-356 returned 12.55 meters grading 0.96% Li2O from shallow depths of 29 meters and had a second interval of 1.96% Li2O over 3.40 meters beginning at 127 meters depth.

At Anitta 4, located to the East of Anittas 2 and 3, recent highlights include drill hole DHAB-353 which intersected 1.41% Li2O over 7.63 meters from 79 meters depth, and DHAB-362 which returned 6.30 meters grading 1.41% Li2O from 102 meters depth.

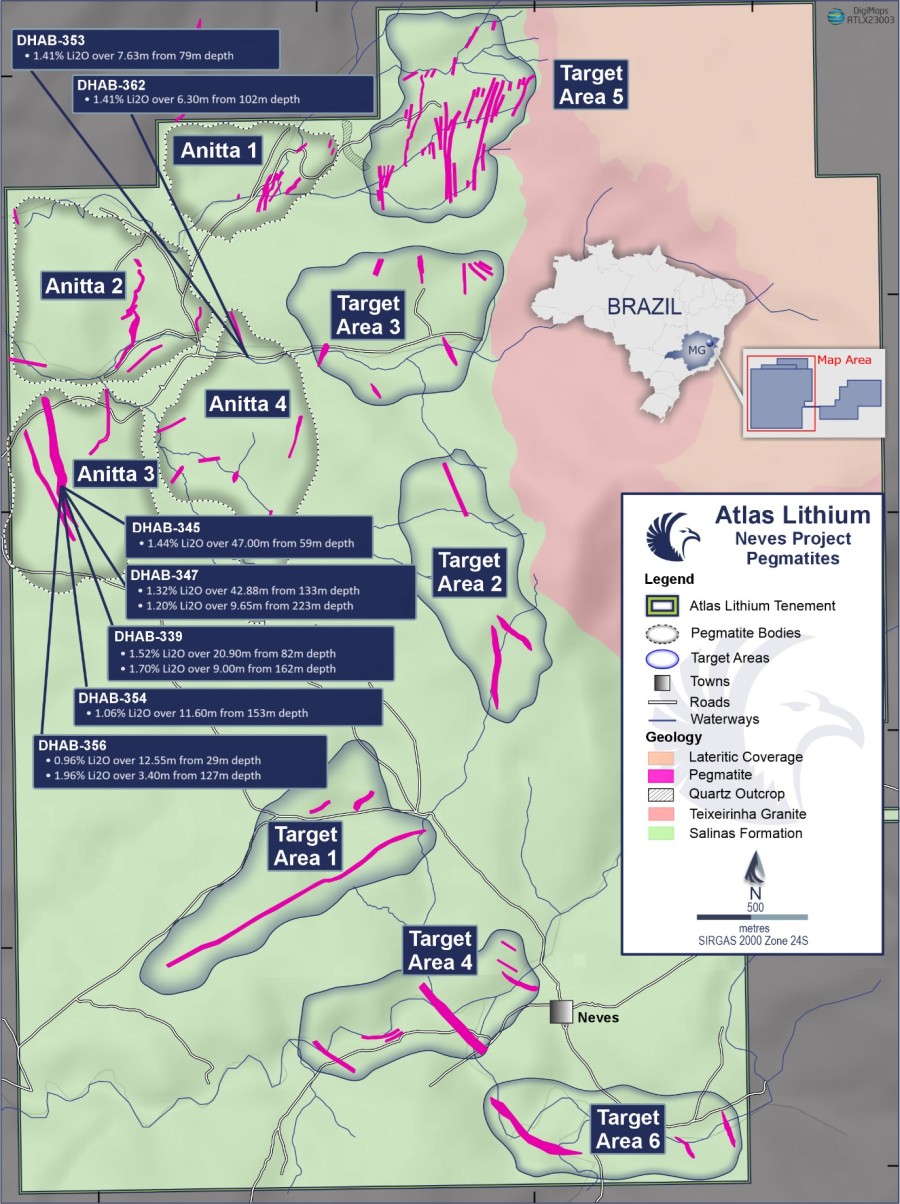

These latest results showcase the potential for significant lithium mineralized zones close to surface with attractive widths for open pit mining. It must be noted that the intercepts listed above are downhole intercept lengths. The true widths will be calculated once topographical location, azimuth angles, and other specifications from these holes are incorporated into their respective 3D geological models. A map of the Neves Project showing six new and promising target areas as well as the four confirmed pegmatite bodies with spodumene mineralization is shown in Figure 1.

Figure 1 - Six new and promising target areas (designated as Target Areas 1 through 6) within the Neves Project, complementing the four confirmed pegmatite bodies with spodumene mineralization (designated as Anitta 1 through 4).

Two high-resolution drone- and ground-magnetics geophysics surveys were recently commissioned, with the former already underway. The resulting structural and geological interpretation products will greatly assist in the identification of larger pegmatites and/or key structures that may control the mineralized pegmatites emplacement or their offset.

James Abson, the Company's Chief Geology Officer, commented, "We remain very encouraged by both the widths and grades coming out of our latest drilling campaign results. The recently discovered Anitta 4 mineralized pegmatite cluster is also starting to become more cohesive, with at least two parallel mineralized dikes now being delineated within the swarm. These latest intersects continue to expand the pegmatite body in both down-dip and along-strike orientations."

Mr. Abson continued, "Additionally, our understanding of the relationship between surface soil anomalies and the underlying mineralized pegmatite swarms and clusters has increased. The recently commissioned magnetics geophysics surveys will further enhance this understanding, as we look to uncover further extensions of the high-grade structures of both Anitta 3 and Anitta 4, as well as other promising lithium anomalies at the Neves Project and within our regional mineral rights."

About Atlas Lithium Corporation

Atlas Lithium Corporation (NASDAQ: ATLX) is focused on advancing and developing its 100%-owned hard-rock lithium project in Brazil's Lithium Valley, a well-known lithium district in the state of Minas Gerais. In addition, Atlas Lithium has 100% ownership of mineral rights for other battery and critical metals including nickel, rare earths, titanium, and graphite. The Company also owns equity stakes in Apollo Resources Corp. (private company; iron) and Jupiter Gold Corp. (OTCQB: JUPGF) (gold and quartzite).

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based upon the current plans, estimates and projections of Atlas Lithium and its subsidiaries and are subject to inherent risks and uncertainties which could cause actual results to differ from the forward- looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of production, reserves, sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in Brazil, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: results from ongoing geotechnical analysis of projects; business conditions in Brazil; general economic conditions, geopolitical events, and regulatory changes; availability of capital; Atlas Lithium's ability to maintain its competitive position; manipulative attempts by short sellers to drive down our stock price; and dependence on key management.

Additional risks related to the Company and its subsidiaries are more fully discussed in the section entitled "Risk Factors" in the Company's Annual Report and in Form 10-Q filed with the SEC on October 20, 2023. Please also refer to the Company's other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements represent the Company's views only as of today and should not be relied upon as representing its views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements.

Investor Relations:

Brian Bernier

Vice President, Investor Relations

+1 (833) 661-7900

This email address is being protected from spambots. You need JavaScript enabled to view it.

https://www.atlas-lithium.com/

@Atlas_Lithium

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$5.44 |

| Daily Change: | 0.18 3.42 |

| Daily Volume: | 1,192,470 |

| Market Cap: | US$144.430M |

December 22, 2025 November 14, 2025 September 22, 2025 August 25, 2025 | |