Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

Atlas Lithium Hits a Record Milestone with High Grade 5.23% Lithium Oxide Intersect at Only Nine Meters Depth in Its Lithium Project

Boca Raton, Florida--(Newsfile Corp. - July 13, 2023) - Atlas Lithium Corporation (NASDAQ: ATLX) ("Atlas Lithium" or "Company"), a leading mineral exploration company, is pleased to announce its new geochemical high mark for lithium mineralization from its ongoing exploration campaign at its Neves Project in Brazil's Lithium Valley. Drill hole DHAB-185 yielded an intersect with 5.23% Li2O mineralization extending from 9.20 to 10.30 meters. According to the Company's technical experts at SGS Canada Inc. ("SGS"), a world leader in mineral resource evaluation, such high grade close to the surface is not common. In aggregate, DHAB-185 showed 21.75 meters at an average grade of 2.12% Li2O. DHAB-185 is located at the new frontier of the ongoing exploration drilling campaign, approximately 650 meters southwest of its Anitta pegmatite trend. This new area is being provisionally referred to as "Anitta 2."

Marc Fogassa, Atlas Lithium's CEO and Chairman, commented, "This result places our Neves Project into the select category of those with encountered lithium mineralization of greater than 5% Li2O. It is rewarding to see the promising results of our exploration campaign such as the discovery of this new ore body."

The Company's exploration program is supervised by a Qualified Person as defined by Subpart 1300 of Regulation S-K promulgated by the U.S. Securities and Exchange Commission ("Regulation S-K 1300"). Atlas Lithium has engaged SGS, and in particular, their geologist Marc-Antoine Laporte, a Qualified Person under Regulation S-K 1300, to produce its initial mineral resource estimate report under Regulation SK-1300 for the Company's Neves Project. Mr. Laporte has worked on lithium properties in Brazil's Lithium Valley since 2017.

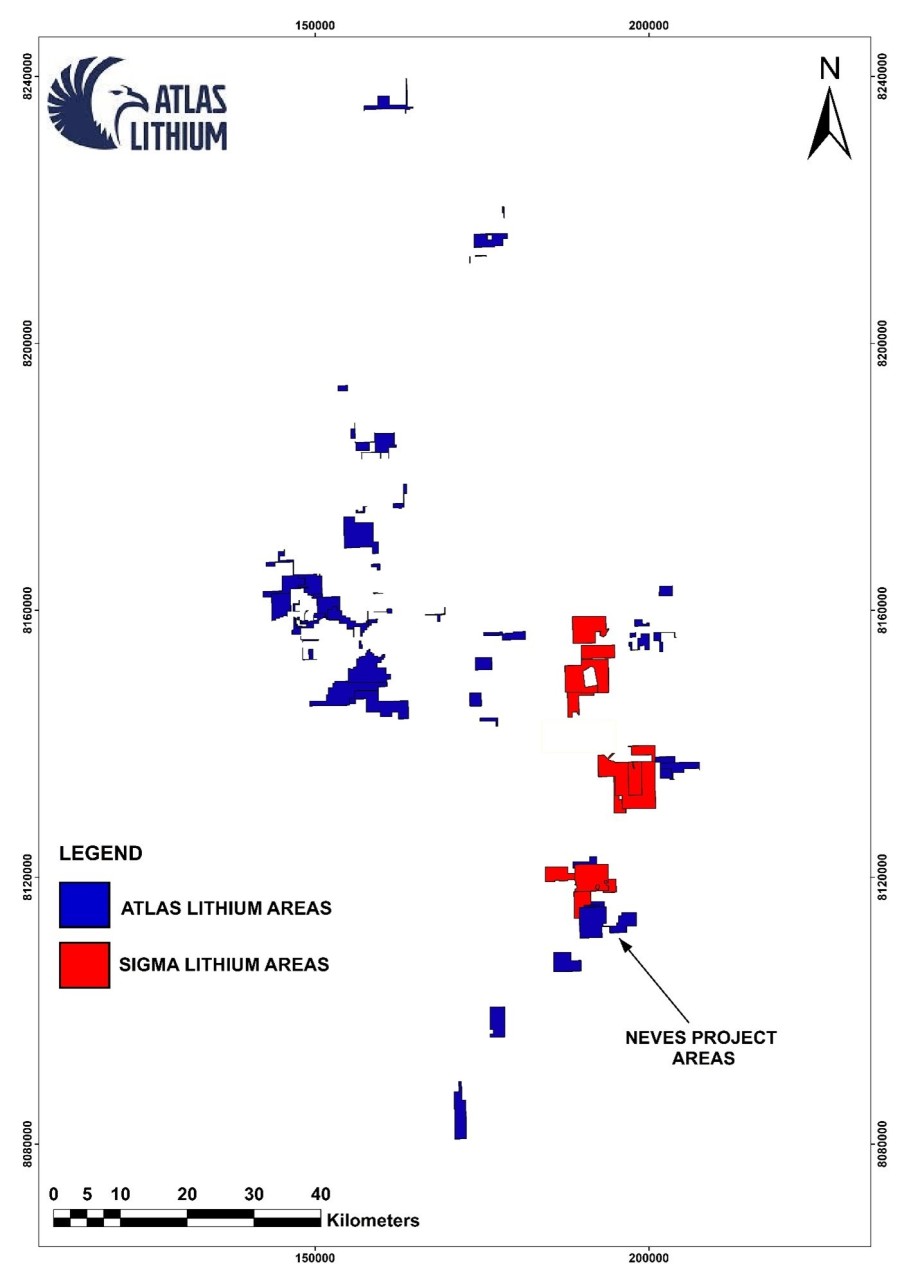

Figure 1 - Atlas Lithium's Neves Project and additional mineral rights in relation to the areas of Sigma Lithium Corporation, a nearby lithium producer in Brazil's Lithium Valley.

Figure 1 - Atlas Lithium's Neves Project and additional mineral rights in relation to the areas of Sigma Lithium Corporation, a nearby lithium producer in Brazil's Lithium Valley.

Figure 2: DHAB-185 spodumene intersect with lithium mineralization of up to 5.23% Li2O

Figure 2: DHAB-185 spodumene intersect with lithium mineralization of up to 5.23% Li2O

Figure 3: DHAB-185 spodumene intersects with lithium mineralization of up to 5.23% Li2O

Figure 3: DHAB-185 spodumene intersects with lithium mineralization of up to 5.23% Li2O

About Atlas Lithium Corporation

Atlas Lithium Corporation (NASDAQ: ATLX) is focused on advancing and developing its 100%-owned hard-rock lithium project in Brazil's Lithium Valley, a well-known lithium district in the state of Minas Gerais. The Company's exploration mineral rights for lithium cover approximately 308 km2 and are located primarily in Brazil's Lithium Valley. In addition, Atlas Lithium has 100% ownership of mineral rights for other battery and critical metals including nickel (222 km2), rare earths (122 km2), titanium (89 km2), and graphite (56 km2). The Company also owns approximately 45% of Apollo Resources Corp. (private company; iron) and approximately 28% of Jupiter Gold Corp. (OTCQB: JUPGF) (gold and quartzite).

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are based upon the current plans, estimates and projections of Atlas Lithium Corporation and its subsidiaries (collectively, "Atlas Lithium" or "Company") and are subject to inherent risks and uncertainties which could cause actual results to differ from the forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of production, reserves, sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in Brazil, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. Therefore, you should not place undue reliance on these forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: results from ongoing geotechnical analysis of projects; business conditions in Brazil; general economic conditions, geopolitical events and regulatory changes; availability of capital; Atlas Lithium's ability to maintain its competitive position; manipulative attempts by short sellers to drive down our stock price; and dependence on key management.

Additional risks related to the Company and its subsidiaries are more fully discussed in the section entitled "Risk Factors" in the Company's Annual Report on Form 10-Q filed with the SEC on May 15, 2023. Please also refer to the Company's other filings with the SEC, all of which are available at www.sec.gov. In addition, any forward-looking statements represent the Company's views only as of today and should not be relied upon as representing its views as of any subsequent date. The Company explicitly disclaims any obligation to update any forward-looking statements.

Investor Relations:

Michael Kim or Brooks Hamilton

MZ Group - MZ North America

+1 (949) 546-6326

This email address is being protected from spambots. You need JavaScript enabled to view it.

https://www.atlas-lithium.com/

@Atlas_Lithium

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$5.85 |

| Daily Change: | 0.29 5.22 |

| Daily Volume: | 690,238 |

| Market Cap: | US$155.320M |

December 22, 2025 November 14, 2025 September 22, 2025 August 25, 2025 | |