Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

American Lithium Intersects Highest Grade Lithium and Cesium Samples Encountered to Date at Falchani - Up to 5,645 ppm Lithium and up to 12,610 ppm Cesium

VANCOUVER, British Columbia, July 12, 2023 (GLOBE NEWSWIRE) -- American Lithium Corp. (“American Lithium” or the “Company”) (TSX-V:LI | NASDAQ:AMLI | Frankfurt:5LA1) is pleased to provide details of assay results from three diamond drill holes recently drilled at the Falchani Lithium project in Puno, southeastern Peru (“Falchani”). These 3 holes were drilled under the ten-hole Environmental Impact Assessment (“EIA”) hydrology drilling program launched at Falchani last fall as part of the EIA hydrology study designed by EDASI SAC and SRK Peru with field work overseen by EDASI. This program has successfully demonstrated that there are no water table issues within proposed development areas across Falchani and the program has also enabled the drilling and analysis of core down to a depth of 120 metres (“m”). Once full results from this program are complete all data and assays will be incorporated into an updated resource report on Falchani to be prepared by Stantec Consulting, Inc (“Stantec”).

Core logging and assay results from these three diamond holes intersected intervals of typical Falchani volcanic tuff as well as large sections of breccias with highlights including Lithium up to 5,645 ppm and Cesium up to 1.22%, the highest grades of both metals encountered to date from 1 m drill core interval samples at Falchani. These holes were drilled in key areas both within and outside the current Falchani resource footprint and will add additional information to the planned mineral resource estimate update with a focus on expanding the overall resource and reclassifying the existing resource. Full details of the results from these three holes are set out below:

EIA Drill Program and Initial Results

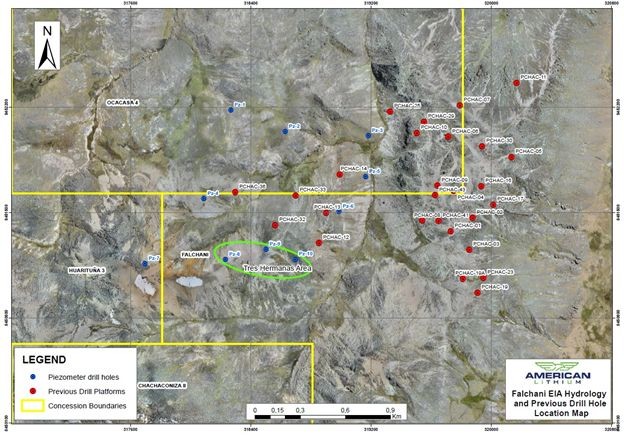

Link to: Figure 1 – Falchani EIA Hydrology and Previous Drill Hole Location Map (also see below)

- EIA diamond drill hole Pz04-TV (vertical) intersected lithium mineralization over the entire vertical drill hole; 0-120 m averaged 2,186 ppm Lithium (Li); 841 ppm Cesium (Cs); 1,215 ppm Rubidium (Rb); and 2.62% Potassium (K) - (see Table 1 – Drill Hole Pz04-TV results, below):

- Several substantial sub-intervals of +3,000 ppm Li intersected;

- Maximum Li of 5,645 ppm Li over 1 m at 54 m downhole; and

- This drill hole is the westernmost drill hole reported at Falchani and extends the drilled mineralization approximately 250 m further west. Mineralization remains open at depth (>120 m).

- EIA diamond drill hole Pz03-TV (vertical) intersected the strongest Cesium mineralization to date with associated moderate lithium mineralization over the upper 63 m downhole averaging 1,428 ppm Li; 4,770 ppm Cs; 1,188 ppm Rb; and 2.67% K (see Table 2 – Drill Hole Pz03-TV results, below):

- The upper interval (0-23 m) is richer in Li with the lower interval (23-63 m) much richer in Cs, including the highest 1 m Cs interval sample encountered at Falchani of 12,160 ppm Cs (1.2% Cs);

- Cs mineralization is associated with more intense brecciation and hydrothermal overprint observed in this hole, drilled from within the natural valley separating the east and western parts of the Falchani resource. This hole establishes the deposit thickness/bottom within the valley.

- EIA diamond drill hole Pz06-TV (vertical) intersected typical Falchani tuff over the entire 86 m drilled and analyzed to date averaging 2,739 ppm Li; 338 ppm Cs; 1,292 ppm Rb; and 2.87% K (see Table 3 – Drill Hole Pz06-TV results, below); drilling at this location continues in Li mineralization.

- Ground water has yet to be encountered in any holes within the 120 m reporting drill depth, so EDASI and the Company is requesting permission from ANA, the National Water Authority, to drill deeper:

- 10 diamond drill holes were approved for EIA drilling, including installation of downhole piezometers to monitor water table and local groundwater parameters where water is encountered;

- Every 5m EDASI collects drill hole wall-rock measurements of moisture content, water, etc. resulting in very slow drill advancement, but essential data and information for feasibility study;

- Drill core chemical analysis is required under the EIA, and reporting mineralization is allowed; and

- EIA Program is close to completion and additional results will be reported when available.

Simon Clarke, CEO of American Lithium states, “We are excited to have intersected thick, high grade lithium mineralization west of the current Falchani resource footprint, which should allow for resource expansion. The strong cesium and lithium mineralization encountered in the central valley bisecting Falchani is also very interesting from a strategic perspective with higher than previously recorded cesium grades. The entire EIA program will provide valuable additional data to the existing drill results from Falchani.

We are also very pleased to be back working constructively and successfully in Peru. We received the first new permits for the new Quelcaya targets several weeks ago and have also launched a new drill program on some of our best targets across the Macusani Plateau. We anticipate receiving our next drill permits for additional infill and expansion drilling at both the Falchani Deposit and the Macusani Uranium Project shortly. Expanding and reclassifying the resource is a key piece of the updated PEA we are targeting for the end of Q3.”

Figure 1 – Falchani EIA Hydrology and Previous Drill Hole Location Map

Figure 1 – Falchani EIA Hydrology and Previous Drill Hole Location Map

Hole Pz04-TV was drilled approximately 250 m west of Platform 36 (Falchani West – 2020 drilling), the westernmost holes from the 2020 resource drill program. Thick Li, Cs and Rb mineralization was intersected in rhyolite tuff, structural-hydrothermal breccia and subvolcanic rhyolitic intrusive rocks directly at surface to 120 m downhole depth. This expands the Falchani mineralization to the west, where the deposit remains open. The drill hole ended in mineralization and remains open at depth at this location.

Hole Pz03-TV was drilled in the northern portion of the intervening erosional valley that essentially bisects the Falchani deposit into eastern and western sides. It was collared 300 m southwest of Platform 25 (Falchani East – 2020 drilling) and 450 m northeast of Platform 14 (Falchani West – 2020 drilling). This drill hole intersected 63 m of Li, Cs and Rb mineralization in intensely brecciated rhyolite tuff lithologies, including the strongest Cs mineralization to date on the project (1 m interval >1.2% Cs at 34 m downhole). This establishes the base of mineralization definitively at this location where previously, resource modelers interpreted it as much thinner, due to lack of previous drilling. The remainder of the drill hole from 63 m to 115 m intersected older porphyritic rhyolite flow units with much lower Li, Cs and Rb contents.

Hole Pz06-TV was drilled approximately 100 m east of Platform 13 (Falchani West – 2020 drilling) towards the intervening valley and has intersected typical Falchani tuff mineralization over the entire drilled and reported thickness of 86 m. This drill hole encountered adverse ground conditions and had to be abandoned while still in mineralization. The hole was subsequently restarted from surface and drilling continues in mineralized tuff units.

Table 1 – Drill Hole Pz04-TV results

| Pz04-TV – 120.0 m total depth - Vertical | From (m) | To (m) | Thickness (m) | Li (ppm) | Cs (ppm) | Rb (ppm) | K (%) |

| 0.0 | 120.0 | 120.0 | 2,186 | 841 | 1,215 | 2.62 | |

| including | 1.5 | 11.0 | 9.5 | 3,090 | 503 | 1,506 | 3.03 |

| including | 50.0 | 90.0 | 40.0 | 3,001 | 746 | 1,156 | 2.50 |

| including | 50.0 | 68.0 | 18.0 | 4,108 | 610 | 1,461 | 2.23 |

| Maximum Li interval | 54.0 | 55.0 | 1.0 | 5,645 | |||

| Maximum Cs interval | 19.0 | 20.0 | 1.0 | 1,400 | |||

| Maximum Rb interval | 6.5 | 8.0 | 1.5 | 1,564 |

Table 2 – Drill Hole Pz03-TV results

| Pz03-TV – 115.0 m total depth - Vertical | From (m) | To (m) | Thickness (m) | Li (ppm) | Cs (ppm) | Rb (ppm) | K (%) |

| 0.0 | 63.0 | 63.0 | 1,428 | 4,770 | 1,082 | 2.55 | |

| including | 0.0 | 23.0 | 23.0 | 2,222 | 594 | 1,401 | 3.94 |

| including | 23.0 | 63.0 | 40.0 | 972 | 7,171 | 899 | 1.93 |

| Maximum Li interval | 20.0 | 21.0 | 1.0 | 3,543 | |||

| Maximum Cs interval | 34.0 | 35.0 | 1.0 | 12,160 | |||

| Maximum Rb interval | 21.0 | 22.0 | 1.0 | 1,830 |

Table 3 – Drill Hole Pz06-TV results

| Pz06-TV – 86.0 m total depth – Vertical; drilling continues | From (m) | To (m) | Thickness (m) | Li (ppm) | Cs (ppm) | Rb (ppm) | K (%) |

| 0.0 | 86.0 | 86.0 | 2,739 | 338 | 1,292 | 2.87 | |

| Maximum Li interval | 85.0 | 86.0 | 1.0 | 3,381 | |||

| Maximum Cs interval | 80.0 | 81.0 | 1.0 | 699 | |||

| Maximum Rb interval | 83.0 | 84.0 | 1.0 | 1,458 |

Quality Assurance, Quality Control and Data Verification

Diamond drilling is being conducted using Company-owned drill rigs with local contract personnel. Drill core samples are cut longitudinally with a diamond saw with one-half of the core placed in sealed bags and shipped to Certimin’s sample analytical laboratory in Lima for sample preparation, processing and ICP-MS/OES multi-element analysis. Certimin is an ISO 9000 certified assay laboratory. The Company’s Qualified Person for the drill program, Mr. Ted O’Connor, has verified the data disclosed, including drill core, sampling and analytical data in the field and laboratory. The program is designed to include a comprehensive analytical quality assurance and control routine comprising the systematic use of Company inserted standards, blanks and field duplicate samples, internal laboratory standards and has also included check analyses at other accredited laboratories. Downhole thicknesses for vertical drill holes are considered accurate true thickness intersections.

Qualified Person

Mr. Ted O’Connor, P.Geo., Executive Vice President of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About American Lithium

American Lithium is actively engaged in the development of large-scale lithium projects within mining-friendly jurisdictions throughout the Americas. The Company is currently focused on the continued development of its strategically located TLC Lithium Claystone Project in the richly mineralized Esmeralda lithium district in Nevada, as well as continuing to advance its Falchani Hard-rock Lithium Project and Macusani Uranium Project in southeastern Peru. All three projects, TLC, Falchani and Macusani have been through robust preliminary economic assessments, exhibit strong significant expansion potential and enjoy strong community support. Pre-feasibility work is well advanced at Falchani and has commenced at TLC.

For more information, please contact the Company at This email address is being protected from spambots. You need JavaScript enabled to view it. or visit our website at www.americanlithiumcorp.com for project update videos and related background information.

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

“Simon Clarke”

CEO & Director

Tel: 604 428 6128

For Media Inquiries:

Nancy Thompson

Vorticom, Inc.

212-532-2208

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the ability to appeal the judicial ruling, the anticipated completion of pre-feasibility work, and any other statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium’s ability to achieve its stated goals; which could have a material adverse impact on many aspects of American Lithium’s businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium’s ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium’s potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the judicial appeal process in Peru, and any and all future remedies pursued by American Lithium and its subsidiary Macusani to resolve the title for 32 of its concessions; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium’s shares and could negatively affect American Lithium’s ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the “Risk Factors” section of American Lithium’s Management’s Discussion and Analysis filed on May 29, 2023, and in recent securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Cautionary Note Regarding Macusani Concessions

Thirty-two of the 169 concessions held by American Lithium’s subsidiary Macusani, are currently subject to Administrative and Judicial processes (together, the “Processes”) in Peru to overturn resolutions issued by INGEMMET and the Mining Council of MINEM in February 2019 and July 2019, respectively, which declared Macusani’s title to 32 of the concessions invalid due to late receipt of the annual validity payments. In November 2019, Macusani applied for injunctive relief on 32 concessions in a Court in Lima, Peru and was successful in obtaining such an injunction on 17 of the concessions including three of the four concessions included in the Macusani Uranium Project PEA. The grant of the Precautionary Measure (Medida Cautelar) has restored the title, rights and validity of those 17 concessions to Macusani until a final decision is obtained at the last stage of the judicial process. A Precautionary Measure application was made at the same time for the remaining 15 concessions and was ultimately granted by a Court in Lima, Peru on March 2, 2021 which has also restored the title, rights and validity of those 15 remaining concessions to Macusani, with the result being that all 32 concessions are now protected by Precautionary Measure (Medida Cautelar) until a final decision on this matter is obtained at the last stage of the judicial process. The favourable judge’s ruling confirming title to all 32 concessions from November 3, 2021 represents the final stage of the current judicial process. However, this ruling has recently been appealed by MINEM and INGEMMET. American Lithium has no assurance that the outcome of these appeals will be in the Company’s favour.

Plug Into More Green Stock News

Tap into the pulse of emerging green sectors every morning. Top daily headlines from clean energy, cleantech, cannabis, and sustainable transport stocks:

More Green Stock News

More Green Stock News

| Last Trade: | US$0.33 |

| Daily Volume: | 0 |

| Market Cap: | US$71.670M |

October 16, 2024 July 16, 2024 May 30, 2024 February 26, 2024 | |